We adore our furry four-legged friends. They sleep with us. They sometimes eat with us. We take them on family vacations. But as any pet owner knows, when it comes to our beloved feline and canine companions, accidents happen and health issues arise.

You’d do anything to help them feel better or to alleviate their suffering, of course. But have you considered buying health insurance for your dog or cat?

Considering how expensive modern life — not to mention owning an animal — is, is it really worth adding pet insurance to your monthly tab of life insurance, car insurance, and health insurance costs?

Good question. We’re here to say, yes, there are 5 very good reasons to buy pet insurance for your dog or cat.

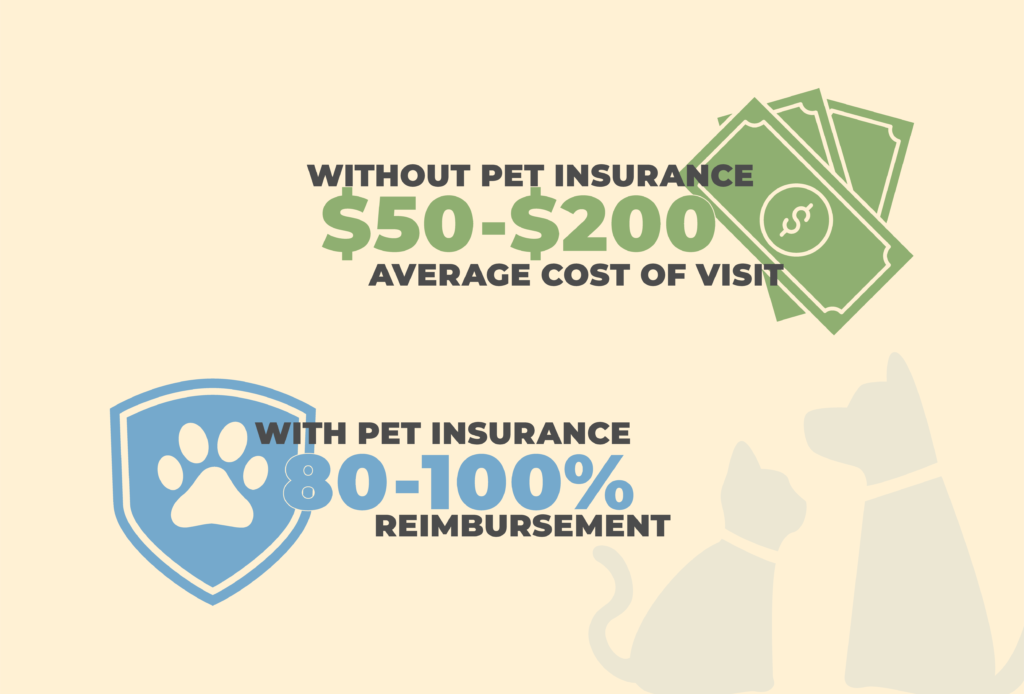

And consider the alternative. Without pet insurance, the average cost of a routine vet visit ranges from between $50 to $250. Sometimes more in the event of an accident or emergency. Not to mention, all the other pet-related expenses you pay for annually.

The best pet insurance policy could reimburse you anywhere from 80% to 100% of those healthcare costs! Why not take advantage of it?

In this article, we’ll tell you more about pet insurance, why you would need it, and what the benefits are.

Pet owners aren’t legally required to buy insurance for their pet, but after reading our article, you’ll be convinced: No dog or cat should be welcomed into your home without first purchasing a pet insurance policy.

5 Reasons to Buy Pet Insurance for Your Dog or Cat

1. For a Better Night’s Sleep

Does Mittens like to explore the neighborhood in the dark? Does Rover have a tendency to get into too much human food accidentally left out on the counter? There are any number of ways our pets can get themselves into trouble — sometimes serious, sometimes less so, but always expensive.

Should an accident occur, or a health issue arise, here’s what pet insurance will do:

- Cover prescription medication costs. Pet medication is expensive. Preventative medication for fleas and heartworm alone can run $20 a month, not to mention emergency medication. Pet insurance will help pay the bill.

- Help pay for unexpected illness or surgery. If only pets could tell us when and where it hurts, or for how long they’ve been feeling unwell. The fact of the matter is, pets get sick and sometimes they even need surgery. Pet insurance helps them get back up on (all four) feet in no time.

- Exams, tests, and emergency room visits. As previously mentioned, animals can’t talk. For this reason, it can take a battery of exams and tests to find out exactly what’s wrong. Those are expensive. And just like human hospitals, emergency vet visits cost a lot. Pet insurance helps cover the bill.

What’s more, some pet insurance policies even allow for alternative treatments like acupuncture.

What typically isn’t included in pet insurance: grooming, flea meds, spay and neutering, vaccinations and other forms of routine and preventative care. Specific policies vary.

2. Emergency Savings or Pet Insurance: The Choice is Yours

Responsible pet owners are well aware: animals are expensive, and veterinary costs are rising!

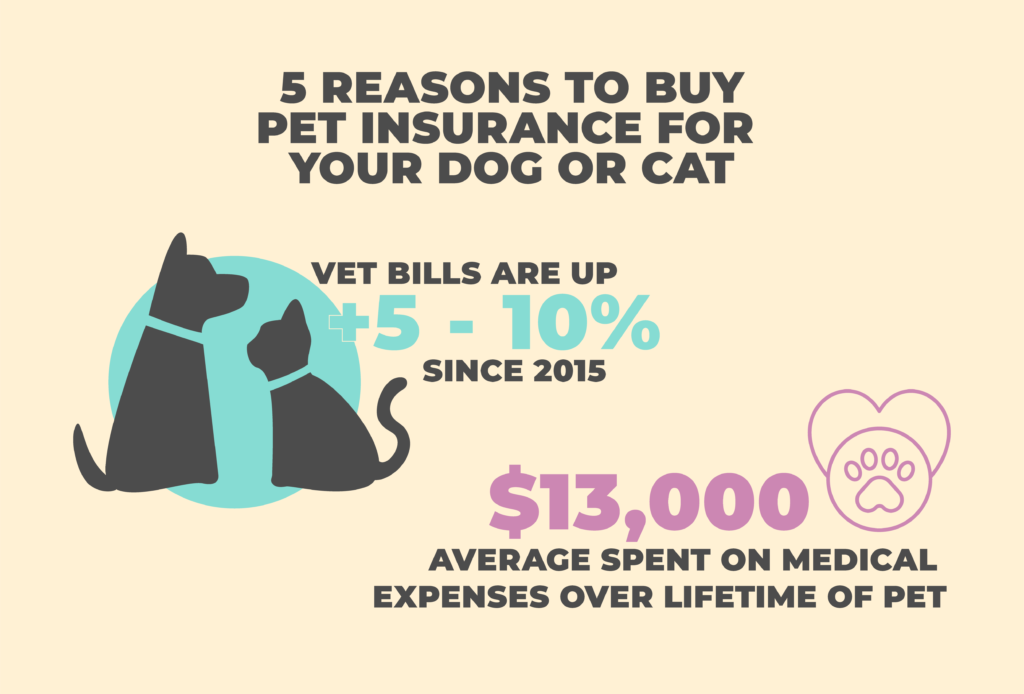

According to the Nationwide/Purdue University Veterinary Price Index, in fact, average vet bills have ballooned anywhere from 5% to 10% since 2015, and based on some estimates, pet owners spend as much as $13,000 on medical expenses over the lifetime of their animal.

If there’s anything you can do to help your pet feel better or to keep them around just a little bit longer, you’ll do it. But doing so costs money, and those funds will come from somewhere. Why dip into your rainy-day fund?

What pet insurance costs per month depends, but pet insurance monthly premiums range anywhere from about $10 a month for an accident-only policy to around $50 a month for accident and illness coverage. There are policies out there running for as much as $100 a month.

Other factors affecting how much money you’ll spend on pet insurance include:

- Whether it’s a dog or a cat.

- The size and breed of the animal.

- The age of the animal.

- Where you live.

- And the nature of the policy you choose.

Furthermore, pet insurance deductibles hover around $500, with a $5,000 maximum per year, according to recent estimates. The average plan pays you back about 80% of any costs incurred by treating your pet.

What’s clear, pet insurance helps keep your savings account intact. And they don’t cost much money in terms of monthly premiums. What’s not to like?

3. For Third-Party Liability Coverage

Many pet insurance policies also cover third-party liability — particularly relevant for dog owners. And although this is less often an issue for cats — especially indoor cats — it’s not outside the realm of possibility that a cat could potentially injure another person or animal, or even cause damage to someone else’s property.

Some homeowner’s and renters’ insurance policies cover personal liability, even for animals. But those policies typically have a limit, and should a claim exceed that number, pet owners will be on the hook for the remaining balance.

Based on recent data from the Insurance Information Institute, homeowners paid out $854 million in dog bite claims in 2020. Exactly how much it costs if your dog bites another person or animal depends a lot on where you live.

Why not add some third-party liability coverage to your pet insurance policy? That way you’ll be covered should an incident occur.

What is typically covered by third-party pet insurance:

- Injury to another person or pet

- Damage to another person’s property

Third-party pet insurance policies will also help cover medical and hospital costs, potential legal fees, and even property replacement or repair.

As previously mentioned, third-party pet insurance coverage is less common for cats, and typically only covers injuries caused between cats or by a cat to another pet or farm animal.

Either way, what’s best is that third-party liability is typically not an add-on to most pet insurance, coming standard with most policies.

4. To Cover Breed-Specific Health Conditions

Some potential bad news for anyone considering a pet insurance policy for their dog or cat: pet insurance does not cover pre-existing conditions or injuries, as determined by the animal’s medical record.

The good news, though, is that most pet insurance policies do cover breed-specific or genetic conditions, so long as those issues haven’t shown up prior to taking out the policy.

From respiratory issues to joint, skin, and bone problems, breed-specific, genetic, or hereditary health issues in your pets can be relatively minor. But inherited pet health problems can also be quite serious. That’s especially true for purebred dogs, ranging from aortic stenosis to gastric dilatation volvulus and dilated cardiomyopathy, among many others. Some cat breeds also have issues related to breeding and genetics.

For this reason, it’s important to carefully research the breed of your dog or cat before adoption. If you do adopt a dog known for particularly heritable health problems and should any issues arise, pick up a pet insurance policy to help cover the cost and relieve the animal’s suffering.

How much it will cost to address a breed-specific issue varies depends on the breed and the nature of the problem. According to some estimates though, pet owners spend nearly $1,400 a year to treat certain genetic medical conditions in dogs, among other medical expenses. And as far as healthcare alone, the least expensive dog breed is the American Foxhound.

5. To Help Find Your Lost or Stolen Pet

And finally, the last but certainly not least important reason to take out a life insurance policy is to reimburse costs related to a lost or stolen pet. Should your animal go missing for whatever reason, most pet insurance policies will cover costs of flyers and notices to spread the word, and even pony up for a reward.

Pet insurance might even cover the cost of a pet tracker to prevent this from happening in the first place. And pet insurance can help should your animal be stolen — certain breeds command a handsome price on the black market.

You can insure your dog against theft as a standard part of most policies, covering costs to search for your animal and potential legal fees.

5 Reasons to Buy Pet Insurance for Your Dog or Cat: Conclusion

Pets are expensive. But can you put a price on what they bring to our lives? Protect your pet — and your bottom line — with the best pet insurance for your dog or cat. These policies protect the animal in the event of an accident, illness, or injury — and all without forcing you to dip into a savings account or emergency fund.

Pet insurance policies are relatively affordable, and purchasing coverage helps protect pet owners from third-party liability should your pet injure another person or pet, or damage someone else’s property.

And although preexisting conditions aren’t covered by pet insurance policies, breed-specific health problems, genetic conditions, and other heritable traits are covered, so long as they haven’t become apparent prior to taking out the policy. They also cover some costs should your pet be lost or stolen.

Let a pet insurance policy give you peace of mind you need to truly experience the joy of having animal companionship in your life.