Buying life insurance is an important thing to do, and picking the right life insurance policy is a big decision.

If you’re young, it’s easy to think — I have time for that later. At my age, do I really need life insurance? And what is the best age to buy life insurance, anyway? Should a 21 year-old have life insurance? How much life insurance should a 25 year-old have? And what age is it too late to get life insurance?

Naturally, you have questions, and we have answers. In this guide, we’ll tell you the best age to buy life insurance, with some tips and pointers to get the most from your policy, no matter how old you are.

What is the Best Age to Buy Life Insurance: The Younger the Better

Ok, if you’re only 21 and you have no dependents and no debt, picking up a life insurance policy could be third or fourth on your to-do list, right after finishing college, finding adequate housing, or finally going on a date. Or maybe just backpacking through Europe!

But the fact of the matter is, you’ll never be as healthy as you are when you’re young. And how healthy you are relates directly to how affordable your life insurance policy will be. For this reason, buying a life insurance policy is cheaper when you’re younger.

If you wait until you’ve developed some health conditions — age-related or otherwise — you’ll only pay more for your coverage.

For example, a 25-year-old in otherwise good health could potentially get a 20-year, $100k life insurance policy for about $10 a month! That’s hard to beat. And with most policies, they can grow and change over time, adding or removing beneficiaries or increasing and decreasing coverage, matching whatever stage in life you are in.

So, when it comes to buying life insurance, the best time is when you’re young. But there’s more than one type of life insurance policy: term life and whole life, sometimes called permanent life insurance, or universal life insurance.

In our next section, we’ll explain the difference, and we’ll tell you how to know which type of policy is better for younger people buying a life insurance policy for the very first time.

What is Better: Term Life or Whole Life

There are primarily two different types of life insurance: term life, and whole life, sometimes called universal life insurance. Here’s how to know which type of policy is best for you when you’re young

- Term life insurance covers you for only a certain number of years. For example, just until your kid reaches the age of 18, or when they leave for college.

If you have a cosigner on a loan, like a mortgage for example, some people take out a term life insurance policy for the life of the loan. And sometimes, individuals with unsecured debt — like credit cards or private student loans — also take out a term life insurance policy.

- Whole life insurance, on the other hand, does just that: covers you for your whole life. For this reason, it’s also a whole lot more expensive. One benefit of a universal life insurance policy, though, is that the cash value grows over time on a tax-deferred basis.

Start young, and a whole life insurance policy will become quite valuable, and what’s best: The cost of the policy will stay the same. That value can also be used to buy a house or to even supplement retirement income. And the earlier you start, the more time that money will have to grow.

Since term life insurance premiums are generally more affordable, most young people start there, but some policies can be switched over time, adding and removing beneficiaries or adjusting the amount of coverage.

Some even let you switch from term to universal life, but not all. For this reason, if you do buy a term life insurance policy at a young age, make sure it offers this flexibility.

What Age is Too Late to Get Life Insurance?

As discussed, buying a life insurance policy when you’re young is cheaper. And in the instance of a permanent life policy, will give even more time for your tax-deferred contributions to grow. Although most life insurance companies won’t sell a policy to anyone over the age of 75 — but some companies do! — it’s really never too late to get life insurance.

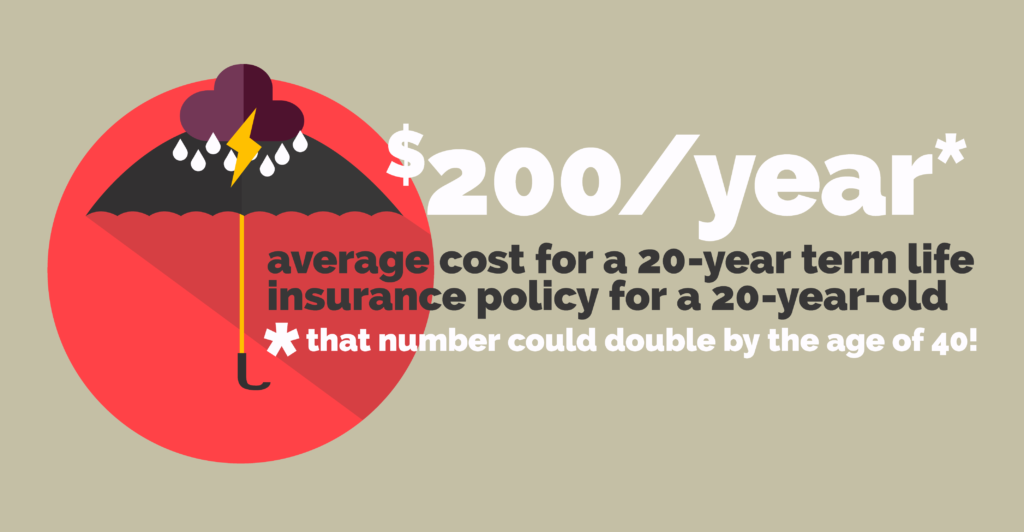

Wait too long to buy a policy, and the primary drawback will be the cost. Premiums for coverage aren’t just based on age, but also gender, medical history, and even the state you live in. But the average 20-year term life policy cost for a 20-year-old could be about $200 a year. That number could double by the time you’re 40!

Furthermore, the longer you wait to buy life insurance, the more likely it is that health issues will arise — naturally, or otherwise. This will also drive up your premiums! So again, although it’s never really too late to buy some form of a life insurance policy, for the reasons we’ve outlined here, the sooner you buy a policy the better.

But since age ain’t nothing but a number if you’ve reached any of the following milestones, it’s a good idea to consider buying a life insurance policy:

- When you get married. Young or old, marriage means you’re responsible for just your own wellbeing, but also the wellbeing of your partner. For this reason, it’s important to buy a life insurance policy before or after marriage, no matter your age.

- When you buy a house. Whenever you and a significant other go in together on a home, it’s also an important time to buy or increase your life insurance policy coverage. That way your partner or cosigner on the loan will be protected should one of you pass away.

- When you have a cosigner on a loan, or if you’re a cosigner on a loan. From student loans to car loans, should you happen to have a cosigner on any number of different kinds of loans then it may also be a good time to consider life insurance. That’s because your cosigner will be left responsible for the remaining balance on the loan if you pass away before the loan is paid in full.

Also, if you’re the cosigner on the loan itself it’s important to carry a life insurance policy. Should you die before the terms of the loan are complete then it’s possible the lender will require the balance be paid in full, depending on the terms of the contract. This could leave your child or grandchild stuck with a pretty hefty bill in addition to the shock and grief of your passing.

- When you start a business. Among all the important decisions that come along with starting a business, one of the most important of all is purchasing life insurance. Life insurance is particularly important if you’re in business with a partner, or if you plan on leaving the business to your children.

What’s more, permanent life insurance policies gain cash value over time, creating the potential for a quick infusion of cash into the bottom line of your business should the need ever arise.

- When you have a baby. More and more of us are choosing fur babies rather than human children, but nonetheless, whenever you have a kid, it’s a good idea to also pick up a life insurance policy. That way you’ll know your child is protected should the unthinkable happen to you, your partner, or your child.

When picking a life insurance policy for you and your children, take a moment to consider how you’d like the policy to benefit your child: would you like to help them with college, buy a house, or maybe even pay for their wedding? These questions can greatly affect the nature of the policy you take out.

And what about buying a life insurance policy not just because you have a kid, but for your kid. The age at which it’s appropriate to purchase life insurance for your child varies, of course, but there are many reasons why a child would need, or benefit from life insurance.

Should tragedy happen and your child should pass, a life insurance policy will pay out a death benefit, possibly covering the funeral expense or cover lost wages from missed work.

More pleasantly, though, a life insurance policy for your child will begin to build a record of insurability for them later on in life. Because again, you’re never as healthy as you are when you’re young, and a record of insurability through a life insurance policy reaching back to when they’re a baby will only help them get better deals and easier access to life insurance policies later on in life.

What is the Best Age to Buy Life Insurance: Conclusion

Purchasing a life insurance policy is a big decision. What’s almost universally true, however, is that the younger you can purchase a policy the better. To help you make your decision, meet with a trusted financial advisor, or see Expensivity’s Complete Guide to Life Insurance for more information.