Healthy living is important for all of us for a variety of reasons. What you might not know is that a healthy life can actually improve your personal finances.

The next time you’re debating whether to prioritize your side hustle or your workout—or weighing the cost of gym memberships, at-home exercise equipment, or fees for participating in your favorite sports league—remember that the impact of a healthy lifestyle on your personal finances goes beyond its financial costs in the moment. Long-term, staying healthy really can save you money.

How Much Money Does Being Healthy Save You?

There are many benefits of a healthy lifestyle. People in good health are less likely to develop cardiovascular disease, high blood pressure, diabetes, and other chronic diseases. They typically have a stronger immune system and better overall health. They even tend to have a longer life.

When it comes to how much money you could save (or make) as a result of healthy living, you could be looking at a lot. All told, healthy people can save thousands of dollars per year compared to those in poor health based on factors like their increased potential for lifetime earnings and their reductions in healthcare spending.

A Healthy Lifestyle Means More Time to Earn Money

The time available to you to earn money by working or to accumulate wealth through investments is finite. Although you may not know how much time you have, you know that this time is limited by the length of both your lifespan and your work lifetime.

A healthy lifestyle can help you live, and earn money, longer. Without being forced into early retirement because of your poor health (or dying prematurely), you can keep accumulating wealth for a longer period of time. Over the course of your lifetime, this naturally means your good physical and mental health allows you to achieve better financial health.

That’s not to say, necessarily, that you have to spend the longer lifespan that accompanies good health working. By all means, retire early if you can afford to. Even so, continuing to invest your money wisely offers more time for your money to grow compared to if you had to stop working due to health problems or your poor health cut your life short.

The Benefits of Needing Fewer Sick Days

The impact of your health on your work and ability to earn an income isn’t limited to your long-term savings. More immediate effects of prioritizing a healthier lifestyle include using fewer sick days.

This reduction in the number of sick days you take is a particularly big deal if your paid time off is limited. For example, you might benefit most from not having to take as many sick days if you:

- Are a part-time worker

- Work for a small business

- Are self-employed

- Have to use your paid sick days to take care of children or ill family members instead of saving them for when you need to focus on your own health

Everyone gets sick some of the time, even if you’re in the best of health. An illness or injury that happens at an inconvenient time of the year may force you to blow through your paid time off and leave you without any sick days left. Whatever the reason, running out of paid sick days means that you may need to use up much-needed vacation time to recuperate from an illness. Employees who run out of PTO completely may even need to take unpaid time off of work—which obviously affects your financial situation.

Even if you get plenty of paid sick days, being absent from work frequently can pose significant opportunity costs. It’s hard to build a reputation as a reliable worker with leadership potential if you’re missing work often, even if the reasons for your absence are completely legitimate. This can make it a lot harder to qualify for promotions or lead the kinds of efforts that are likely to secure you good bonuses.

From the perspective of improving your job security and, in turn, your financial security, it’s definitely better to reduce the need to take extra sick days where possible by living a healthier lifestyle.

Making Money by Getting Into Better Shape

It’s too bad you’ll never get paid for all the hard work you’re putting into getting and staying healthy… or will you? If you’re confident enough in your fitness plan (and your dedication to it) to bet money on your future weight loss, you may be able to turn your healthy lifestyle journey into cash.

Ways to Get Paid for Being in Good Health

How can your healthy habits earn you money? Boosting your household finances through weight loss and other fitness goals can take numerous forms.

In-Person Weight Loss Challenges

Workplaces, community groups, and even friend groups may hold team or individual challenges. Typically, all participants pay an entry fee. The team or individual that reports the most weight loss at the end of the challenge period wins a cash prize.

Apps for Cashing in on Healthy Habits

In-person competitions aren’t the only way to make money for achieving your fitness goals. There are several apps available that facilitate financial gain from weight loss. The HealthyWage app allows you to place a wager on when you’ll reach your weight loss goals. If you achieve your goal within the intended timeframe, you win a prize worth more than your wager. The maximum prize is as high as $10,000, although to win this much, you would need to wager nearly $1,000 per month and be planning to lose well over 100 pounds.

If you would rather win money by competing against others than betting on your own weight loss, you could consider an app like Competish, which pairs you with a different competitor within your group each week. In any case, the possibility of ending up with more money than you wagered helps to motivate you to reach your fitness goals. So does the risk of losing the money that you already paid to place the wager or enter the competition.

(Editor’s note: The above are only examples of apps that can provide financial incentives for healthy living; we aren’t recommending or endorsing any specific apps or challenges. If you decide to participate in one of these programs or apps, do your research to make sure the platform is legitimate before providing your financial information.)

Other Methods for Adding Financial Incentives to Your Healthy Living Journey

Rewards don’t have to take the form of direct financial compensation to be good motivators. Some insurance companies, wellness companies, and even states offer programs that aim to encourage healthy living by rewarding participants for choices that range from walking and doing regular weigh-ins to seeing their primary care providers for annual checkups. These rewards may be redeemed for gift cards or money-saving offers. Using such a program to qualify for discounts at or gift cards to your local grocery store, for example, can help you save money by reducing your monthly food spending.

You might also implement a financial reward system the old-fashioned way. If cutting out fast food from your diet is part of your fitness plan, you might put aside the money you would normally be spending on eating lunch out or buying a soda from the vending machine. For every week you continue changing these unhealthy habits, your reward is to spend money you would otherwise have used on your guilty pleasure to buy something else you enjoy (preferably something that doesn’t undermine your fitness journey).

Behavioral Economics and Healthy Habits

If this notion of tying better health to cash prizes strikes you as far-fetched or too good to be true, you should know that the concept of earning money for getting into better health is backed by science. The field of behavioral economics, which brings together economics and psychology, seeks to understand the reasons behind the choices people make in the real world. Often, applications of behavioral economics focus on ways to help nudge people toward making better choices.

According to the principles of behavioral economics, there are a lot of factors that contribute to bad habits and unhealthy lifestyles. In today’s world, we’re constantly busy. The scarcity of time may impede your plans for exercising regularly and preparing healthy, homemade meals. It’s faster and easier to rely on fast food or processed foods, even when we know they’re less healthy for us. Similarly, when we’re tired (physically or mentally) from our hectic schedules, physical activity may seem too daunting to undertake. Speaking of being tired, for most of us, it’s easier to reach for an extra cup of coffee (often loaded up with sugar) or caffeinated fizzy drinks to boost our alertness than to actually work more time for sleep into our daily routine.

It’s not that we aren’t aware of the positive effects of exercise and healthy foods. Rather, the long-term positive impact associated with good habits seems far removed from our choices at the moment. If we eat right and exercise consistently, in theory, we will see health benefits… eventually. However, the immediate rewards of curling up on the couch with our preferred junk food and binge-watching our favorite show are a lot more compelling than this theoretical, eventual improvement in our well-being.

The bad news is that it’s human nature to choose the options that give us immediate rewards over those that are better for us in the long run. The good news? You can leverage the principles of behavioral economics to help motivate you to lead a healthier lifestyle.

The Trouble With Weight Loss Challenges

Doing a weight loss challenge isn’t for everyone. Activities like these can be triggering for those with a history of eating disorders, body image issues, and gambling problems. Despite the focus on losing the most weight, you should aim to lose weight in healthy, sustainable ways rather than taking drastic measures that are unsustainable and potentially dangerous. If weight loss challenges aren’t a good fit for you personally, regardless of the reason, you should know that participating in them isn’t crucial to seeing financial benefits from healthier living.

That said, if you’re interested in leveraging your focus on good health to improve your financial position, it may be worth exploring the possibility of turning your progress into a direct personal finance boost.

How Does Being Healthy Save You Money?

Being in good health doesn’t only put you in a better position to make more money. Your excellent health can also save you money by reducing or even eliminating some expenses that would otherwise eat into your savings. Off the bat, healthy lifestyles generally translate to better health overall, which can save you money on medical expenses and insurance premiums.

Spending Less Money on Medical Care

Getting sick is expensive. Avoiding extra medical costs can achieve significant savings. We’re talking thousands or even tens of thousands of dollars.

Expenses like doctor’s copayments, coinsurance costs, and the costs of medications add up quickly. That’s not even counting the impact of more major medical costs, like emergency room bills, hospitalization costs, and surgeries. The more chronic diseases or ongoing health issues you have, the greater the risk of complications that, once again, increase costs.

In a 2023 report, PETERSON-KFF Health System Tracker put the out-of-pocket healthcare expenditure amount in America at $1,315 per capita based on 2021 data, not counting health insurance premiums. Many households are spending thousands of dollars per year on healthcare costs.

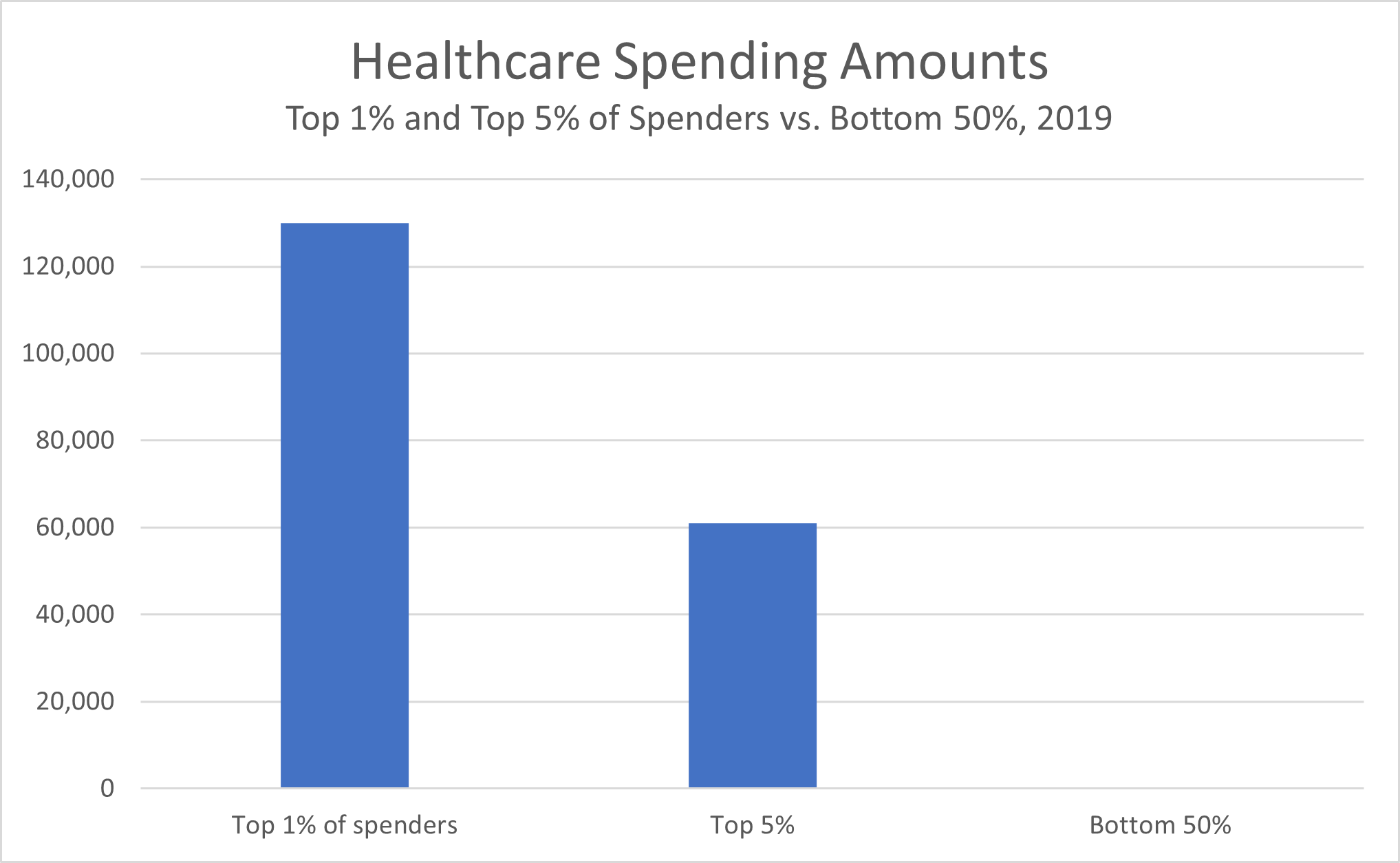

Let’s look beyond the average figures. An earlier article by PETERSON-KFF Health System Tracker—this one using 2019 data—found that a segment that amounted to 5% of the U.S. population accounted for almost half of the health spending that year. On average, the individuals in this group spent $61,000 on health care spending. Among those who accounted for the top 1% of spenders, healthcare expenditures for that single year added up to more than $130,000. (PETERSON-KFF Health System Tracker doesn’t clarify whether these figures include insurance premium contributions or out-of-pocket health spending exclusively.)

The good news, for people in good health, is that those who spend the least money on medical expenses are spending significantly less than the average amount. Per the PETERSON-KFF Health System Tracker article drawing on 2019 data to compare healthcare expenditures across the population, the bottom 50% of healthcare spenders in America accounted for just 3% of the nation’s healthcare spending. On average, they spent just $374 on health care expenditures. A significant proportion of the population, 14%, reported $0 in healthcare expenditures.

Under many insurance plans today, annual wellness exams often require no copay. Even some preventive screenings, vaccinations, and other proactive measures for staying healthy may be fully covered by insurance. As such, if your healthy lifestyle allows you to avoid getting sick and you only have to see the doctor for a routine checkup, it’s feasible to be among the Americans who spend no money on out-of-pocket medical costs in a year (if we take the cost of insurance premiums out of the equation, that is).

Making the Most of Your Savings on Health Spending

Your healthy habits could be saving your family thousands of dollars every year. If you want to compound these savings, consider putting away an amount equal to the average healthcare expenditure in some sort of interest-bearing account or investment. This way, not only are you saving money in the short term, but the growth over time that results from interest contributes to long-term savings. (Just don’t tie up this money in an investment that you can’t access in case you need it. After all, even people with a healthier lifestyle still get sick or hurt on occasion.)

Saving Money on Your Life Insurance Policy

Direct costs of medical problems aren’t the only expenses associated with poor health. Healthy applicants also pay lower premiums when purchasing a life insurance policy.

The average monthly cost of life insurance in 2023, according to Business Insider, amounted to $40 for a variable life policy and $55 for a universal life policy. Generally, younger people pay less than older people, and women pay lower premiums than men. The longer life expectancies are the reason for this difference.

Your health, including unhealthy habits, also affects life insurance costs.

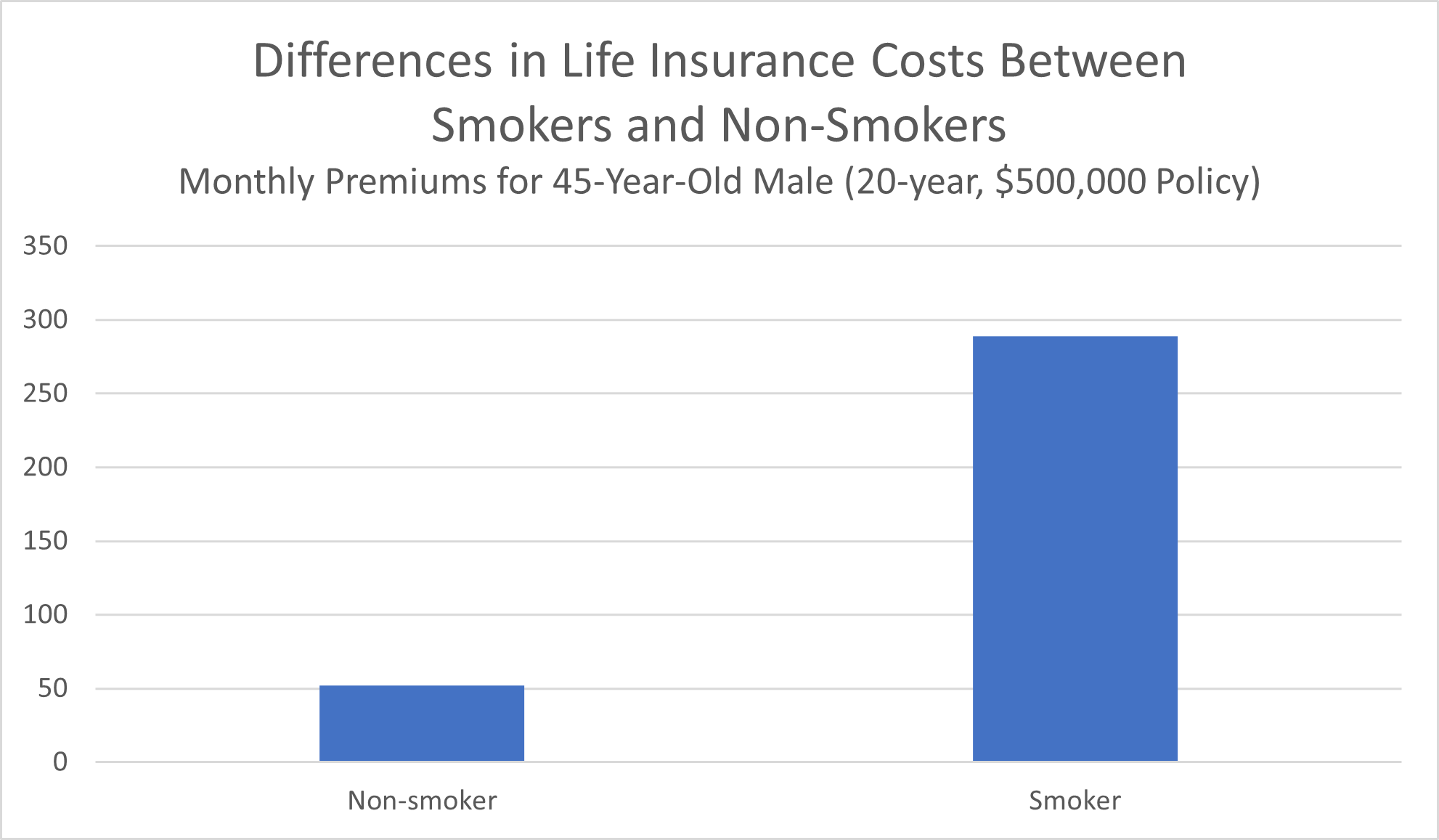

Smoking is the most obvious example. According to Business Insider, research has shown that smokers pay 100 to 300 times more money for life insurance than non-smokers. Just not smoking can save you hundreds of dollars per month on life insurance premium costs (not to mention the direct costs of this unhealthy habit itself).

Pre-existing health conditions, too, affect how much you pay for life insurance plans. Many life insurance companies require a medical exam. Even those that don’t will typically consider your health and medication history, as ascertained from a medical records database, in their calculations. Some of the pre-existing conditions that are most likely to raise life insurance premium rates include high blood pressure, diabetes, cancer, and asthma.

Life insurance companies assign applicants ratings based on quantitative measures of health status. These ratings typically include Standard, Preferred, and Substandard, although a small number of people may qualify for “Preferred Plus” or “Super Preferred.” The difference between premiums for applicants in these categories can be significant, especially later in life. At age 25, being in the Preferred category may only save you a dollar per month compared to applicants in the Standard category, and Preferred Plus policyholders may save around $5 per month. By age 50, being in the Preferred Plus category can save you up to $20 to $30 per month compared to premium costs for the Standard category.

Being in particularly poor health will cost you when you apply for life insurance. Depending on the severity of your poor health, you could end up paying anywhere from 25% to 250% more than your peers in the standard category, Policygenius reported.

Over the course of years, being in better health can save policyholders hundreds or even thousands of dollars on their life insurance policies.

Building Up Your Personal Finances While You Can

Looking at good health as a static factor—something you either have or don’t have— is an easy mistake to make. However, healthy people don’t always remain so, especially over time. As people age, they become more likely to develop health conditions and complications, even if they are generally in good health.

While that reality may sound discouraging, it’s a good reason to prioritize healthier living and the financial gains that go along with it as early in your life as possible. Doing so can support aging-in-place objectives from both a health and financial perspective.

Your starting point of good health can help compensate for the declines that can sometimes accompany aging. By using the cost savings that good health can bring to put you in a better financial position earlier in your life, you are more likely to have available the funds for supports that will allow you to age in place, from renovations to make your home easier to get around to outsourced help with chores.

Part of financial literacy is planning for your financial future, which includes the eventuality of aging.

A Note About Health and Healthy Lifestyles

The reality is that not all of the variables that affect our health are fully under our control.

Genetics is a great example. A strong family history of heart disease, for example, may put you at a greater risk of cardiovascular events compared to someone else with a similar diet and activity level. As a result, more frequent medical monitoring may be indicated for you, which increases your healthcare spending. You may also pay a higher premium for a life insurance policy.

Similarly, you might not be able to change variables like past environmental exposure to pollution or carcinogens or medical conditions that aren’t caused by lifestyle choices. You also can’t change your past lifestyle choices and the health risks they pose, although you can certainly embrace healthier habits going forward. The upshot of all of this is that, while a healthy lifestyle is (in large part) a choice, one’s overall health may not be.

Even if you have medical conditions or risk factors that you can’t change, though, living the most healthy life possible and making health-conscious choices can help you make significant gains in overall health. Healthier lifestyles can’t cure chronic health conditions or erase the reality of genetic and environmental influences, but they can help you manage and mitigate the risks. Even among those in sub-optimal health, making healthier choices as much as possible can produce financial benefits like saving or even making money.

The Health and Wealth Cycle

In all the ways we shared above, staying healthy can help you financially. The inverse is true, too. The better your financial situation, the more likely you are to be in better health.

The health-and-wealth cycle may serve in some ways to gatekeep those who aren’t in the best financial health from attaining optimal physical health. It’s certainly easier to achieve your best level of health when money is no object.

Still, it’s possible to break into this cycle by making relatively small but meaningful choices that impact your health in a positive way. Saving or making more money by being in good health isn’t a phenomenon that only exists for the top 1%. The average American can see financial benefits from prioritizing their health, too.

If the cost of eating exclusively healthy is too high, look for ways you can switch to healthier options for at least some of your diet. This can help you improve your health significantly enough to yield some financial savings. So can fitting free or low-cost physical activities into your routine. The more you’re able to improve your health, the more of the financial benefits of good health you can experience.

At the end of the day, it’s not a competition between you and someone else who may be in better or worse shape, physically or financially. It’s about putting in the effort and sacrifices to live a healthier lifestyle today than you did in the past, so you can enjoy the benefits—financial and otherwise—that arise from healthy living.