Everyone seems to be after a chunk of our money these days, including life insurance companies. For this reason, it’s natural to wonder: Is life insurance a good investment? Everyone says you need it, but is it really worth it?

Before signing on the dotted line with a life insurance company, those are good questions to ask.

We’ll break down our answers to those questions into two distinct but related responses that, when taken as a whole, will help make the best life insurance policy buying decision possible.

Let’s begin with whether or not life insurance is a good investment.

Is Life Insurance a Good Investment? It Depends on Your Policy

You’re wondering whether or not a life insurance policy could substitute for a 401(K) or IRA. Or maybe instead, if it’s a good place to put your wealth like gold, silver, crypto or real estate can sometimes be — a means for it to grow, or just a sensible choice to save for your old age.

The answer to that question is yes and no, but also, it depends.

Term life insurance is worth it, but should not be treated as an investment opportunity.

Term life insurance policies are generally taken out for a specific period of time, or term.

To offer just a few common examples: That could be just until your children are 18 and are out of the house, or over the life of a loan like a mortgage; or while you are a cosigner on someone else’s loan, like a privately-held student loan for your college-aged children.

Life insurance policies of this type are relatively affordable. The death benefit paid to your children is a way to substitute for lost income in the event of an unforeseen illness, should you die, or should an accident happen leaving you unable to work.

From this point of view, carrying a term life insurance policy is definitely worth it.

But should the term for which the policy is purchased elapse, and if you find yourself alive and well, then all that money spent on premiums during that period of time will be lost.

From this perspective, term life insurance is not a good investment, in the same sense that a retirement account like a 401(K) or an investment in a short-term rental property can be seen as a good investment.

If you’re simply looking for a way to grow your wealth, then no: term life insurance is not a good investment.

From an investment perspective, whole life insurance is a somewhat better option, if you can afford it.

That being said, purchasing a permanent life insurance policy, sometimes called a “cash value” policy, simply for investment purposes is also not generally recommended.

The premiums on these policies are relatively expensive, and it can take years — sometimes decades — before policyholders see a return.

- How whole life insurance works — or really any kind of cash value policy — is that part of the money paid goes toward premiums, some toward administrative costs and other fees, and some toward the cash value of the policy.

For the first few years, insurance coverage costs take up most of the money, but over time, the cash value of the policy will grow.

And there are some advantages to investing in a cash value or a whole life insurance policy, including the following:

- All Contributions are tax-deferred, similar to a 401(k) or IRA.

Unlike those accounts, however, money paid in premiums toward your whole life policy is not tax-deductible — a definite disadvantage.

Over time, though, and once the cash value has grown sufficiently, it is possible to receive dividends on your policy, distributed annually among all policyholders. Exactly how insurance companies pay out these dividends can vary, and dividends are not guaranteed.

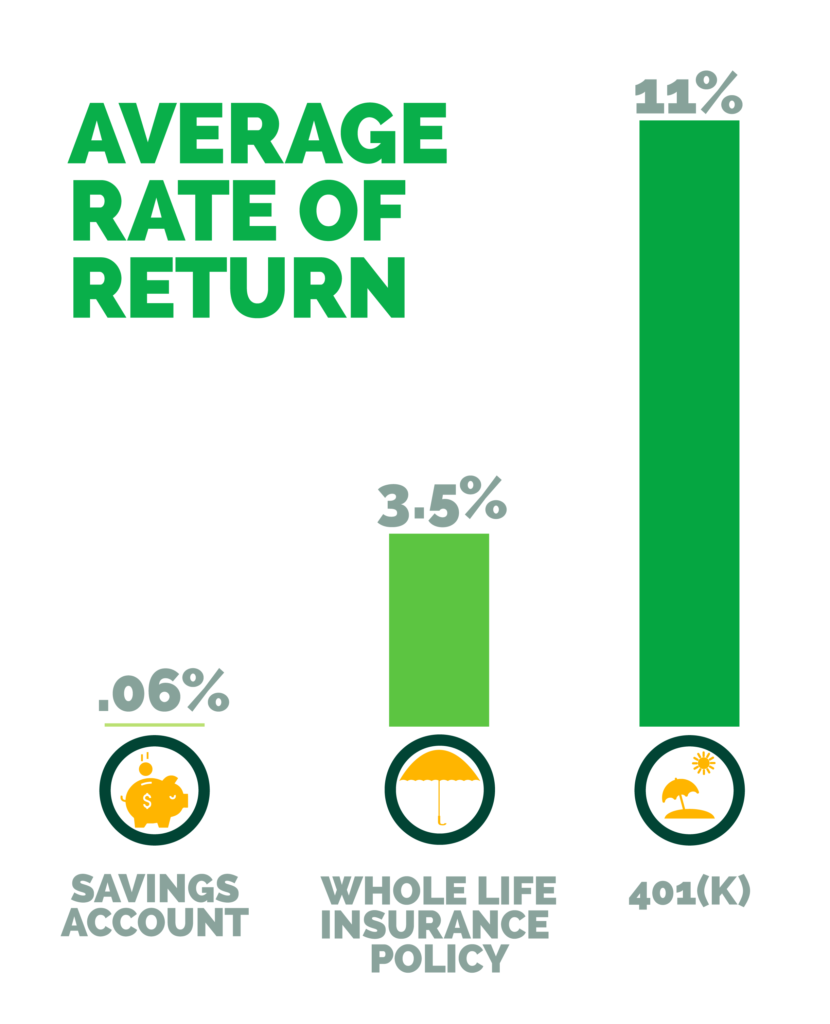

According to Consumer Reports, though, the average rate of return on a whole life policy is about 3.5% — a number that can be easily undercut by inflation, however.

Still, that’s not bad, certainly when compared to the interest rate on an average savings account — which is only about .06%, according to Bank Rate.

Compare that to the estimated average rate of return on a 401(k), however — which according to Business Insider is around 11% — and it’s plain to see:

- There are some investment advantages to a whole life insurance policy, but overall, there are much better avenues to pursue if investment returns are your primary motivator.

Furthermore, if you’re older, it’s unlikely that enough time will pass for you to see any dividends on a whole life policy.

When a policy does start to pay dividends, however, they can be paid in cash, put toward premiums, or they can be reinvested in the policy through what are called “paid-up” insurance additions, boosting both the cash value and the death benefit of your plan.

Other ways to access the investment gains on a whole life insurance policy include:

- Taking out a loan using the cash value of your policy as collateral. Should you pass away before the balance is repaid, the remainder will be deducted from the death benefit.

- Partial withdrawal. Depending on your insurance company, policyholders may be able to withdraw some of their policy’s cash value, including fees. That amount will also be deducted from the overall death benefit. What’s best: if you withdraw only up to what you have paid in premiums you’ll pay no income tax at all.

- Cash. The cash value on a whole life insurance policy is worth just what it sounds like: cash. What’s best, those cash withdrawals are free from income tax so long as the cash withdrawals don’t exceed what was paid into the policy in premiums.

- Selling or surrendering your policy. The last two ways to see some return on your life insurance policy investment is to either sell or surrender the policy. Life insurance policies can be sold for more than the cash value but less than the death benefit. Any profit you make on the policy will be taxed as either capital gains or income.

Surrendering — or simply giving up — your policy for the cash value, minus fees, may also be possible. Most insurance companies discourage surrendering a life insurance policy within the first decade or so by charging higher fees — so high in fact, it’s hardly worthwhile.

This is one primary reason why life insurance should never be treated as a short-term investment.

The Difference Between Whole Life and Universal Life: Which is a Good Investment?

Finally, whole life and universal life insurance policies are very, very, similar with some important differences, especially from the perspective of investment.

Here’s what you need to know:

- Universal life insurance policies offer more flexibility in how your money is invested and the premiums you pay.

- Once your policy earns cash value, a portion of that amount can be used to pay some or all of your policy premiums.

- Universal life insurance policies have a minimum and maximum premium, offering consumers the flexibility to pay somewhere in between.

Because of these extra investment opportunities and added flexibility offered through a universal life insurance policy, there is the risk for greater gains, but also the possibility of greater loss, just like any type of investment.

There is one more kind of life insurance policy: a variable universal life insurance policy.

Is Variable Life Insurance a Good Investment?

Variable universal life insurance is similar to any other kind of universal or whole life insurance policy. Policies like these offer a death benefit, consumers pay a premium and they also accrue a cash value.

What variable life insurance allows you to do is pick from a set of mutual funds, giving the consumer more control over how their money is invested. For this reason, returns can be greater on a variable life insurance policy.

The greatest investment risk in a variable life insurance policy, however, is that the cash value can also decrease, given the fact that variable life insurance policies are tied more closely to the market.

What’s more, fees are also higher which can burn through some of your gains more quickly. So, like any kind of investment, there’s risk, but there’s also reward.

Is Life Insurance a Good Investment: A Final Word

There are many good reasons to purchase a life insurance policy: to take care of your children after you pass away, to support your business and business partners when you die, or to make sure your debts and obligations become the obligation of your loved ones.

There are also many different types of life insurance policies, and even further customization may be possible with the help of a life insurance agent or certified financial planner.

Term life insurance policies offer very little investment incentive, while whole life or universal life insurance have somewhat more of an investment, though it does take some time for any policy of this type to accrue a significant cash value.

In conclusion, life insurance should never be used first and foremost as an investment tool.

Instead, investment benefits offered through life insurance should be seen as nothing more than icing on the cake, supplementing the peace of mind offered by the coverage.

Should the unthinkable come to pass your family, loved ones, business partners, employees, and colleagues will be well taken care of. For more information about your first life insurance policy, see Expensivity’s Complete Guide to Life Insurance.