You’re expecting a baby. Congratulations!

When it comes to parenthood, there’s a lot to look forward to. Because having a child is expensive, there’s also a lot to think about.

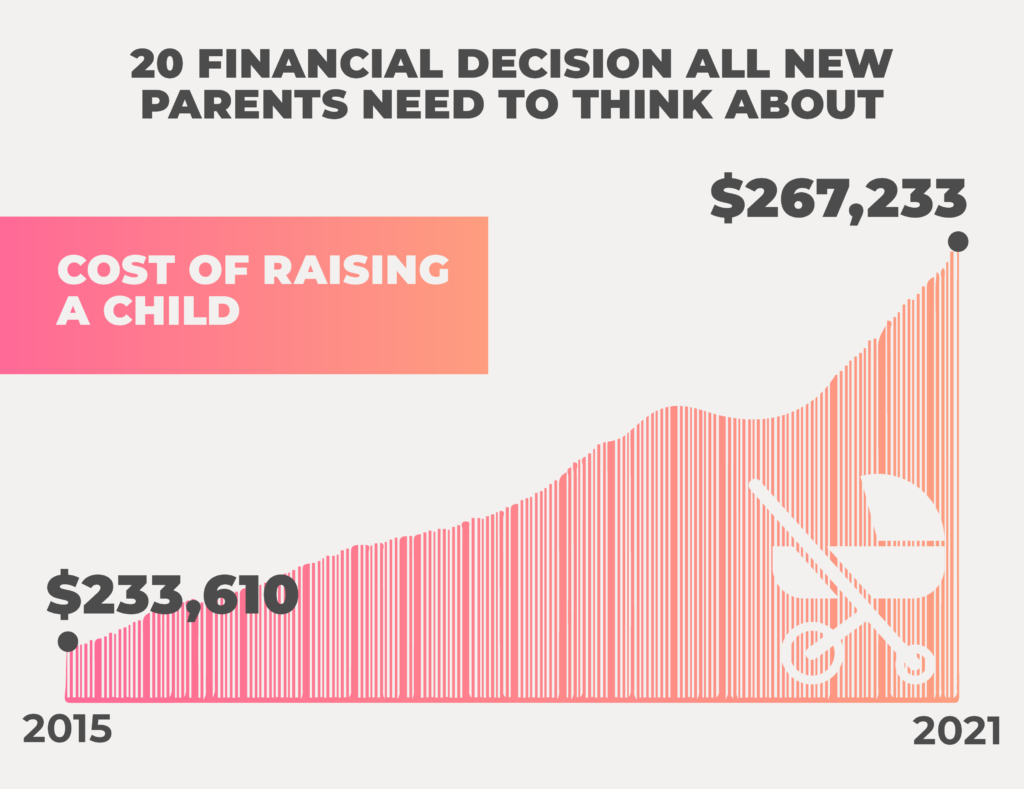

In fact, the cost of raising a child ballooned from $233,610 in 2015 to $267,233 in 2021, according to recent data from the Bureau of Labor Statistics.

That’s likely more than any of us have in our piggy bank.

It’s impossible for new parents to prepare for everything. To lighten the load, though, we present the 20 financial decisions all new parents need to think about.

Nothing will make those turbulent teen years any easier, but nevertheless, check any or all these off your to-do list once that bouncing bundle of joy finally arrives, and you’ll be one step ahead

Being a parent is one of the most rewarding and most difficult things to do in life. Let this list of the 20 financial decisions all new parents need to think about help you get started.

20 Financial Decisions All New Parents Need To Think About

1. Plan for Maternity/Paternity Leave

The first financial decision all new parents should think about is how much if any, maternity or paternity leave you’ll take.

The typical maternity leave is as long as 10 weeks for many new mothers, while others take as little as few as five weeks off following the birth of their child. Fathers, on the other hand, typically take only one week after their baby is born. That’s generally agreed to be not enough time, however, and many new fathers wish they had more.

The first step to plan for maternity or paternity leave is whether or not the company or business you work for offers any paid time-off, and if not, how much they will allow after having a baby, paid or unpaid.

Some unpaid paternity and maternity leave is required by law, however, under the Family and Medical Leave Act (FMLA). Keep this in mind when speaking with your employer’s human resources department or human resources representative.

How much FMLA you get for pregnancy depends on the state you live in, but a minimum of 12 weeks of unpaid time off from work is guaranteed for both mothers and fathers.

2. Pick an In-Network Pediatrician

It’s important for new parents to make this next financial decision as soon as possible before your baby even arrives, and as early as three months before your due date.

Picking an in-network primary care physician is important because newborn babies need regular checkups. The American Academy of Pediatrics, in fact, recommends newborn babies see the doctor for a checkup nine times in the first three years! And that’s just for standard wellness visits and vaccinations.

If you have healthcare coverage, picking an in-network pediatrician is as simple as checking with your insurance provider. You may also want to ask around with friends and family for recommendations.

To find a pediatrician before a baby is born, consider the following, among other factors

- Where the office is located.

- What are the hours of the clinic or medical office, and what are the pediatrician’s preferred methods of communication.

If any or all of those points won’t work for you or your family, then that pediatrician is not the right fit for you and your needs.

If you aren’t covered by insurance, you can and should see a pediatrician. Typical pediatrician appointments cost about $100 per visit. To help save some money, consider a community health clinic, a walk-in clinic or a direct care provider.

3. Save for a Down Payment on a Home

Based on recent data from the USDA, housing is responsible for 29% of the overall cost of raising a child, and stable housing is a crucial part of a child’s healthy development, according to the Center on Budget and Policy Priorities.

For these reasons and more, it’s vitally important for expecting parents to begin planning for adequate housing as soon as possible. If for no other reason than, with a new arrival, your one-bedroom apartment simply one won’t cut it any longer.

But that’s easier said than done, with housing costs up in almost every corner of the U.S.

While saving up for a down payment, though, it’s important to remember that conventional home loans, a VA loan, or loans through the USDA can sometimes be secured with no money down, or with as little as 3% down.

Otherwise, you may need 20% down at closing with private mortgage insurance.

Already living somewhere that can comfortably accommodate your new family? Then by no means should you rush to take on the expense of new housing. Stay put until the time is right.

4. Pick the Best Life Insurance Policy

Once you take care of a savings account and healthcare coverage, the next financial decision to check off your to-do list is purchasing the best life insurance policy for your circumstances.

No matter how old you are, life insurance policies are important, especially so after becoming a parent, or if you’re in a relationship. Having a life insurance policy will make sure all your affairs are in order, and they’re particularly important for small business owners.

There are primarily two types of life insurance: term life and whole life.

The biggest difference between the two is that term life covers a specific period of time, while a whole life policy, naturally, covers you for the rest of your life.

There’s more to know about these types of life insurance policies. Which one is better when you have a baby depends a lot on income and other factors. Consult a life insurance agent for further information.

When parents do choose term life insurance, however, it’s generally recommended that parents carry about 6X to 10X their annual income until the child reaches the age of 18. As far as when it’s better to buy a policy, before or after pregnancy: Life insurance premiums balloon at a rate of roughly 5% a year, so it’s best to buy a policy as soon as you can.

And as unthinkable as it might be, purchasing life insurance for your baby is also recommended — but at least the policies for newborns babies are affordable.

5. Find Healthcare Coverage, or Adjust Your Medical Insurance

How medical insurance works when you’re having a baby is after the newborn child arrives, babies are retroactively added to the plan for up to the first 60 days of life, depending on your policy.

But here’s the catch. Following that timeframe, you’ll have to inform your insurance company of the new arrival. Some insurance policies require you to provide notification within 24 hours after your child is born, so it’s best to get this straightened out with your coverage provider before the big day arrives!

The good news being, having a baby is considered a qualifying event, so you can add the child to your policy outside of the normal enrollment period.

How much does health insurance typically cover when you have a baby? Again, that depends on the policy, but typical health plans cover anywhere from 25% to 90% of medical costs for new parents.

If you’re expecting and you’re without employer-provided coverage, consider purchasing a policy from the Affordable Care Act (ACA) Marketplace, or Medicaid.

6. Create a Will or Trust

Another important thing for new parents to take care of is creating a will or trust.

Part of this process is assigning power of attorney. Should one or both parents die without a will, then your estate — everything you own at the time of your death — will go into probate. That means what happens to your property will be up to the courts and applicable state law.

The difference between a will and a trust is that a will is nothing more than a document expressing in writing to whom you want your possessions to go in the event of your passing.

A trust, on the other hand, is a legal agreement that a piece of property is given to a person or entity to keep and use for the benefit of another entity, such as between siblings when a piece of rental property is put into a trust after the passing of a parent.

It is possible to take care of any one of these planning documents with the help of an attorney. A much cheaper and more streamlined option for setting up a will, trust, or assign power of attorney is available online through LegalZoom.

7. Create a Household Budget

No two ways about it: raising a child is expensive. To help cover costs, new parents should start a household budget.

Tracking the cost of raising a child since 1960, the USDA estimates the cost of raising a child at over $200K per year. Multiply that over 18 years, and, well…you better start saving as soon as that pregnancy test turns blue.

There are a lot of expenses associated with being a parent, some expected and some surprising. In additional postnatal and prenatal expenses there will be diapers, strollers, a car seat, and toys.

To start a household budget we recommend first sorting out the one-time costs associated with parenthood — will you buy more than one car seat, for example? — and the recurring costs, like food and diapers, among many others.

RELATED: What Do Americans Spend the Most Money On?

Next steps include calculating your monthly income and then applying what’s called the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and to pay off debt.

There are also many great budgeting tools and apps available online, and best of all, for free.

For starters, we recommend Mint or Personal Capital.

8. Save for College

But wait, we just had a baby — is it really time to start planning for college? The answer to that question is: yes. It’s never too soon, in fact, to start saving for a college education.

In 2021, the average cost of a college education in the U.S. was nearly $36K annually, and over the past two decades, that number has nearly tripled at a rate of 6.8% per year! Attend a private college, and that number could be even more substantial.

Clearly, college is quite an investment, and there are many ways for parents to begin saving for their child’s post-secondary education. To get some idea of where to start, we recommend Blackrock’s free college savings estimator tool. Then, consider, at the very least, starting a standard investment account so that your money can start to grow while your child is still in diapers.

Another great possibility to help make sure your child is financially ready for higher education is a tax-advantaged 529 plan. The advantage of a 529 plan is that all money contributed will grow on a tax-deferred basis. When it’s time to take distributions, those too will be tax-free, so long as they’re used on qualified educational expenses, such as the following:

- Tuition and fees

- Books and supplies

- Some room and board expenses

In certain instances, 529 plans may also cover K–12 tuition, and offer some support in student loan repayment to certain beneficiaries.

The primary disadvantages of a 529 plan include reduced needs-based eligibility for other forms of student aid when it comes to time for your child to attend school.

9. Start a Savings Account and Emergency Fund

Notice a pattern in this list? Savings are important for brand-new and expecting parents. With a long list of things to save for, it might seem impossible to save for a rainy day or an emergency.

But we’re here to say, finding a way to do just that is an important financial decision for new parents to think about. That’s because one thing’s for certain: With a child in your life, the unexpected will occur and more than likely, it won’t be cheap.

It’s generally recommended to have as much as three to six months of income saved and to keep those funds in a separate account from your everyday spending.

Automating a contribution to your savings account through your financial institution can also help build your rainy day fund.

1o. Plan for Childcare or a Nanny

Planning for childcare or a nanny is the next financial decision new parents need to consider, whether or not one of both parents return to work following their maternity or paternity leave.

Even if one parent stays home, some childcare or nanny service may still be required. Although child care costs vary from state to state, no matter where you live, it’s expensive — as much as $15K a year for full-time care in a childcare center!

Other potential child care solutions include in-home child care with groups of other children, sometimes called daycares, or a nanny, which is the most expensive option of all, costing anywhere from $20K to $50K a year. depending on where you live.

Daycare costs also vary greatly between states, but on average, expect to pay at least $200 a week.

Let’s hope granny, grandpa, aunts, uncles, or even a close trusted friend shoulder some of the burden!

11. Consider Buying Disability Insurance

Perhaps more important than life insurance, new parents should consider purchasing disability insurance covering some or all of the family’s income in case they need to be out of work for any length of time — or perhaps permanently due to an injury, accident, or medical condition.

There are two types of disability insurance. A short-term policy typically replaces between 60 to 70% of your income, paid out anywhere from a few months to a year, and beginning a few weeks after you become disabled.

Otherwise, there’s long-term disability insurance, covering between 40 to 50% of your base salary, ending when the disability ends, after a certain number of years, or until retirement age is reached. The waiting period is typically 90 days after long-term coverage policies begin paying out.

Some employers offer disability insurance, as do some professional and trade organizations. It’s also possible to buy a disability insurance policy on your own.

12. Buy a Car or Create a Transportation Plan

From pediatrician’s appointments to daycare, or to simply get yourself to work, it’s important for new parents to have a reliable set of wheels. Or, if a new or new-to-you car simply isn’t in the works, to have a solid transportation plan in place before the big day arrives.

Even if you have a car of your own, putting a car seat in the back of that sporty 2-door coupe will prove impractical. Yep, the time has most certainly come to upgrade to a new or new-to-you, family-sized vehicle.

If paying for a vehicle from your own personal savings is not an option, then new or used car loans are offered from many financial institutions and dealerships. At the very least, expecting parents should familiarize themselves with the public transportation available in their area.

13. Pay off Debt

All the savings we have recommended won’t make much difference if brand-new parents are still underwater in debt. For this reason, it’s important for new parents to do their best to pay down debt as much as possible before having a baby.

That’s easier said than done, on top of everything else new parents need to think about. To make progress, though, we recommend the following:

- Consolidate debt

- Pay more than the minimum and pay more than once a month

- Pay off high interest debt first

Unfortunately paying off debt is often much less fun than building debt, but with diligence and hard work, it is possible to raise a child with a clean financial slate.

14. Take Advantage of Free Government Forms at the Hospital

Doing paperwork will likely be the farthest thing from your mind while in the hospital after giving birth to a child. But like everything these days: parenthood equals paperwork, from birth certificate applications to Social Security forms.

The fact of the matter is, all this can be taken care of for free at the hospital. Fail to take advantage of these free services at that time and you may have to pay the IRS for those forms. Fail to take care of these important steps entirely, and you just might find yourself with a costly fine.

15. Keep Saving for Your Own Retirement

Naturally, after having a baby everything becomes about the needs and wants of the child. But it’s also crucial, in matters financial and otherwise, for parents to not neglect their own needs.

Chief among them, the pressing concern of retirement savings. If you have a solid plan for retirement in place — keep it up! Don’t change a thing. If you still need to square away your retirement savings, then there’s no time like the present to begin planning for the future.

- Get Your Business Affairs in Order

This next tip for new parents is particularly important if you’re a small business owner, or have an ownership stake in a business. It’s even possible to start a business when you have a newborn! To help your fledgling enterprise be successful, or to help prioritize your time as an established business owner, consider the following:

- Plan to work at home as much as possible for at least the first year.

- Communicate what’s happening in your life to your clients and employees, and that you may be less available to them than you otherwise might be — chances are, they’ll understand!

- Reconsider your business’ org chart. Perhaps the most difficult thing a business owner and a new parent needs to come to terms with: They simply won’t be able to do what they used to be able to do. The time has come to pass off some responsibility to your trusted team.

Follow these guidelines and you truly can keep your business afloat while managing a parent’s busy schedule.

17. Adjust Your HSA Contribution

Instead of a traditional insurance policy, there are a few things new parents should bear in mind with an HSA, or Health Savings Account — which are typically part of a High Deductible Health Plan (HDHP).

Advantages of an HDHP or HSA in addition or instead of traditional health care coverage include tax-deductible contributions, and unused funds roll over from year to year.

Something to be aware of, however, is that deductibles start higher with HDHPs than non-HDHP, and plans of this sort are not available everywhere. Like a traditional healthcare policy, HDHPs have open enrollment periods.

The good news is, having a baby counts as a qualifying event under most HSA policies, allowing families to enroll outside that specific timeframe. Family budgets typically dictate what to contribute to an HSA, but for families, the IRS allows up to $7,200 in tax-free annual contributions to HSA.

18. Update Your Tax Forms

In addition to a Social Security Number, there is a long list of other tax-related to-dos for brand-new parents before tax time comes in April.

First off, consider your filing status. If you’re already married filing jointly when your new bundle of joy arrives, then you’re in luck! There’s no reason to change a thing.

Single parents, however, can file as head of household for a bigger standard deduction. No matter what, don’t leave single filing status as it is. Otherwise, you’ll be missing out on any number of tax advantages offered to parents and families.

Additional tax-related considerations for brand-new parents include Itemizing medical expenses since many are tax-deductible. W-4 forms should also be updated with your employer to claim allowances for your children, bringing down the total amount withheld from your paycheck by the IRS.

19. Sign-Up for an FSA

This next financial decision is only relevant if your employer offers an FSA or flexible spending accounts.

FSAs are employer-sponsored spending account, allowing pre-tax contributions to be spent on qualifying medical expenses. Although similar to an HSA, one significant difference is unused FSA funds typically expire at the end of the year. By law, however, some employers do allow $500 to roll over from year to year.

Because FSA funds can be used on a wide variety of health and wellness-related products and services, they’re particularly useful tools for new parents stocking up on diapers, first aid supplies, or other baby-related expenses.

They also cover many medical services that may not be covered under traditional insurance policies such as eye care or certain dental procedures.

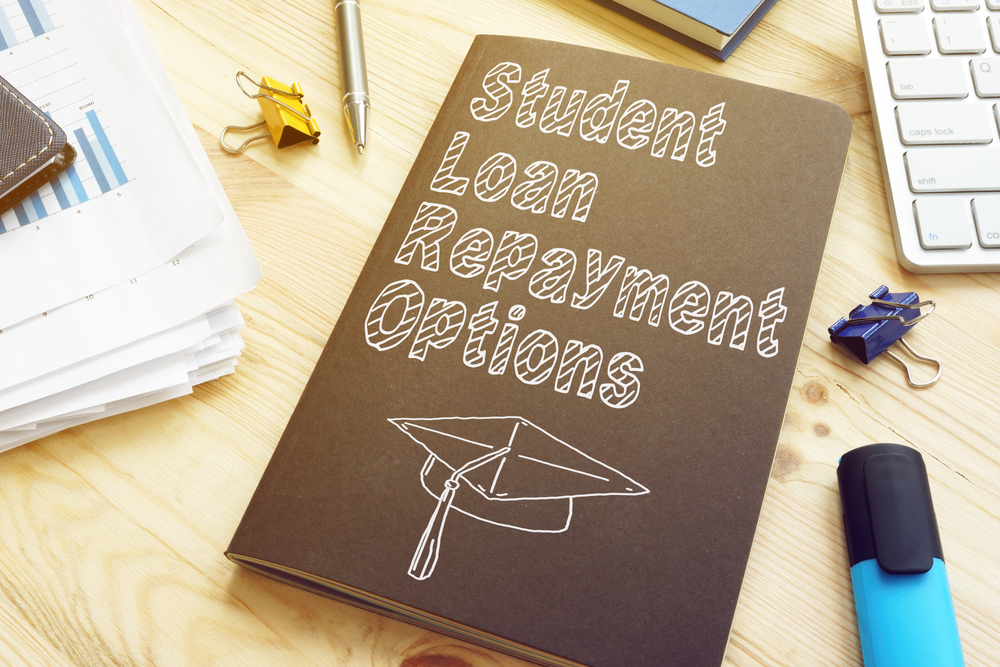

20. Change Your Student Loan Repayment Plan

Starting a family with student debt? Let’s face it, most new families have at least some student loan repayment to factor into their budget. And making your payment on time and in full can be difficult, especially during maternity or paternity leave.

For this reason, it’s important for new parents to consider updating or changing their student loan repayment plan, at least temporarily. Best of all, it’s free to do! Among the many different repayment plans that are useful to new families is the Revised Pay As You Earn Repayment Plan (REPAYE).

Under this plan, payments amount to 10% of discretionary income, and they are recalculated each year based on income and family size. However, it is the responsibility of the borrower to update this information.

And if married, both incomes will be considered, whether taxes are filed jointly or separately.

20 Financial Decisions All New Parents Need To Think About: Conclusion

There’s a lot to think about and even more to decide when families are just starting out. It’s natural to feel nervous and overwhelmed at the prospect of becoming a parent. Some things on this list might be more relevant to your financial situation than others, but nevertheless, follow this guide carefully and you’ll be well on your way to many happy, worry-free years ahead.