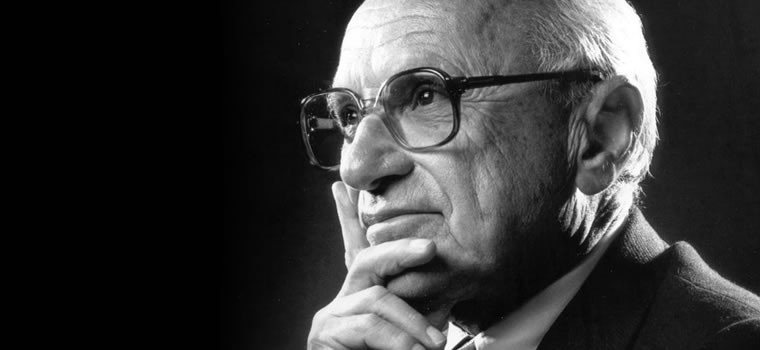

I grew up with an interest in economics because my father was an economics professor. One of the lights in his intellectual firmament was Milton Friedman (1912-2006), who won the Nobel Prize in economics in 1976 for his work “in the fields of consumption analysis, monetary history and theory, and for his demonstration of the complexity of stabilization policy.”

Friedman is an icon for free-market capitalists searching for an alternative to Keynesian economics. One of America’s most prominent 20th century statisticians and economists, he is the father of monetarism. He believed that monetary policy played an influential role in determining a country’s likelihood to experience an economic crisis. Two of Friedman’s most well-known publications are A Monetary History of the United States, 1867-1960 and Capitalism and Freedom.

Milton Friedman’s Life

Friedman spent his early life on the East Coast. He was born in New York City in 1912. Friedman’s parents were Jewish immigrants from a region in Hungary that is now part of Ukraine, and they made a living selling dry goods. Friedman attended Rutgers University in New Jersey, where he graduated with a degree in economics and statistics. He then traveled to Chicago, where he got his master’s degree in economics from the University of Chicago. This was also where he met his wife, Rose, a fellow economist.

Milton Friedman’s first significant job was at the National Bureau of Economic Research, where he studied income distribution and inequality. Later, as the United States entered World War II, he transferred to the War Research Division, where he, in conjunction with the Treasury Department, advised the government on methods to reduce wartime inflation. Friedman proposed an income withholding tax.

Friedman earned his PhD from Columbia University in 1946 before accepting an offer to teach economic theory at the University of Chicago, where he would spend the rest of his career. Even after officially retiring, Friedman continued to research and write articles for publications like the Wall Street Journal. He also served on former President Ronald Reagan’s Economic Policy Advisory Board. Friedman died in California in 2006 from heart failure when he was 94 years old.

Milton Friedman’s Theories

Friedman’s experiences during the Great Depression strongly influenced his economic theories. He believed that the government’s response to the market was just as important as the performance of the market itself. Although Friedman was a lauded academic, he was renowned for ensuring that his theories were accessible to ordinary people. He was convinced of the superiority of the free market and did not believe in government restrictions on the free market unless exceptional circumstances required them. Friedman emphasized the value of results-oriented policies instead of those based solely on theory.

Permanent Income Hypothesis

Friedman’s permanent income hypothesis was derived from his analysis of Keynes’s consumption function. Keynes had postulated that there was a direct correlation between a country’s gross national income and the levels of aggregate consumption and aggregate savings. In other words, the more money people had to spend, the more likely they were to buy consumer goods or put money away for a rainy day. In 1957, Friedman identified a key idea missing from Keynes’s consumption function, namely that temporary income fluctuations didn’t incentivize consumers to adjust their behavior. Instead, only permanent income changes, or income changes perceived by the consumer to be permanent, affected consumer spending patterns. Friedman’s hypothesis was proven right by evidence indicating that temporary tax increases didn’t substantially affect consumption or savings.

Monetarism

Monetarism was Friedman’s biggest contribution to the field of economics. In a time dominated by adherence to the Keynesian school of thought, which advocated fiscal policies to influence macroeconomic variables, Friedman argued that changes in monetary policy could spur both short-term and long-term economic changes. Government spending was not the only way to change the course of a nation’s economic future. Instead, the money supply needed to increase at a slow, steady pace to stimulate economic growth. The government’s printing of currency could influence the market also. Monetarism discredited the Phillips Curve and the Keynesian Multiplier, which were fixtures of Keynesian theory. Friedman asserted that with very little government intervention, the collected effects of individual market players and interactions could actually correct negative market trends. In other words, in some situations, the market would be able to correct itself. In fact, government intervention in the form of stimulus programs could actually create a market disconnect, causing more harm than good.

Friedman’s insights remain timely in our current economic milieu.

Here are some Milton Friedman resources for further reading:

- Milton Friedman: Theories and Monetary Policy

- Milton Friedman’s Biography

- Milton Friedman’s Nobel Prize

- Monetarism vs. Keynesianism

- The Great Depression According to Milton Friedman

- How Would Friedman Attack Income Inequality?

- Monetarism Explained

- Monetary Policy After World War II

- Friedman’s Thoughts on Free Markets

- The Friedman Rule on Inflation

- The Permanent Income Hypothesis, Wealth Inequality, and Anti-Recessionary Stimulus

- Shortcomings of Keynesian Economics

- The Keynesian Multiplier in Monetary Policy

- How Free-Market Economists Got it Wrong

- Friedman vs. Mundell on Fixed Exchange Rates, Gold, and a World Currency

- Reagan’s Economic Policy Advisory Board

- Laissez-Faire Economic Policy

- Stabilization Policies and Their Effects

- The Phillips Curve