The credit card landscape has evolved dramatically from its inception to today’s staggering numbers. With billions of cards in circulation and soaring debt levels, I’ve delved into the latest industry data to uncover insights into profitability, consumer debt, and more. Join me in exploring the state of credit cards.

How Big Is the U.S. Credit Card Industry?

The market size of the U.S. credit card issuing industry amounted to $182 billion, IBISWorld reported in January 2023. To put that figure in perspective, the credit card issuing industry is the 79th largest market in the entire United States and the 16th largest market within the finance and insurance industry, according to IBISWorld.

This hundred-billion-dollar industry consists of just 85 companies, IBISWorld reported. There are major industries in the U.S. that bring in only a small fraction of this revenue and yet consist of hundreds, thousands, or even tens of thousands of businesses. All told, these 85 companies employed 75,612 American workers as of January 2023, IBISWorld reported.

The Last Decade of Growth in the Credit Card Market

The consumer credit market has come a long way since 1950, when, as Forbes reported, the credit card was invented in the form of Frank McNamara’s Diners Club card. Today, Americans hold an estimated 1.25 billion credit cards, WalletHub reported, with total credit card debt in the United States approaching a trillion dollars as of early 2023.

What does the latest data reveal about the credit card industry and the history of consumer experience using credit card accounts? Growth in the card industry has been more volatile in the past five years than it was during the previous five-year period.

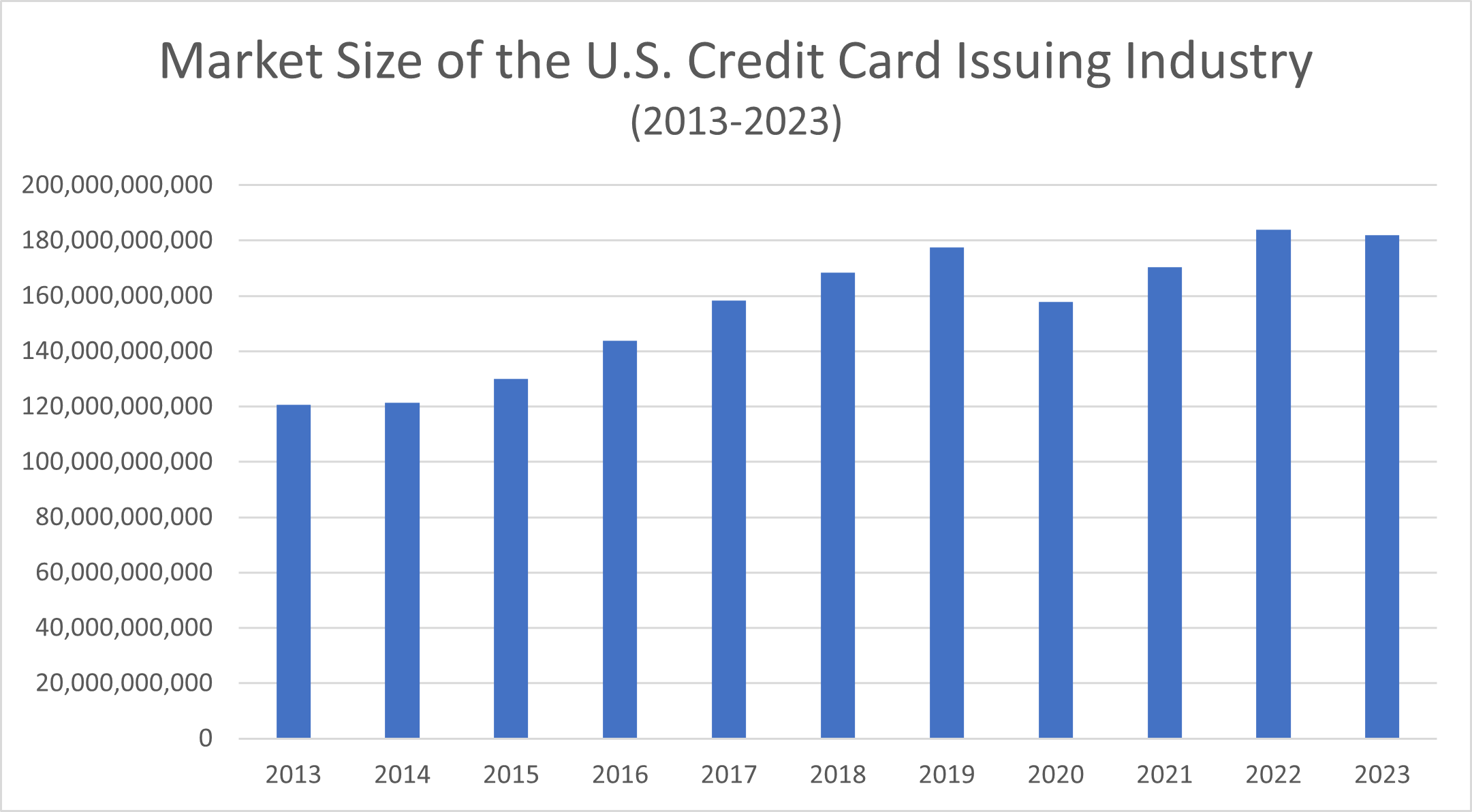

The $120,589,200,000 market size reported for 2013 had climbed consistently to reach $158,236,600,000 by 2017, marking an increase of more than 30% over just five years. In comparison, the net growth of the U.S. credit card issuing market amounted to around 8% between 2018, when the market size reached $168,297,300,000, and 2023, when the market size value reported in January was $181,959,300,000.

On average, IBISWorld reported, the market grew by 1.6% each year between 2018 and the start of 2023. However, a steep decline—nearly 12%—occurred between 2019’s revenue amount of $177,559,600,000 and 2020’s $157,812,100,000 total revenue. A 1% decrease in market size occurred between 2022’s peak market size of $183,875,300,000, and the start of 2023, IBISWorld reported.

Over the past five years, the credit card issuing industry market size has grown at a slower rate than either the economy overall or the finance and insurance sector of the economy, according to IBISWorld.

Who Are the Major Players in the Credit Card Industry?

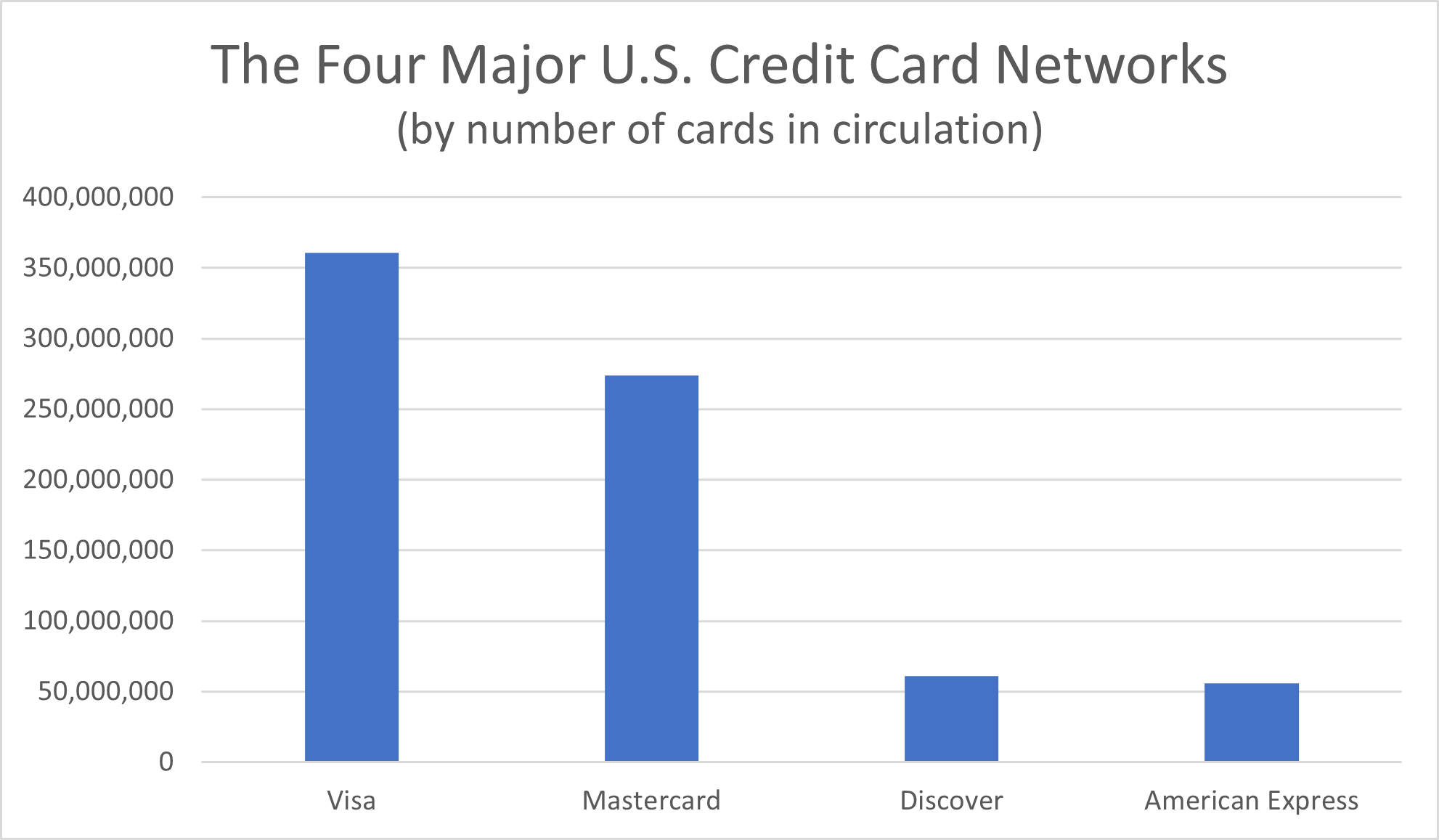

The biggest credit card networks in America are Visa and Mastercard, followed by American Express and Discover. Visa alone accounted for more than half of all credit cards in circulation in the U.S.—hundreds of millions of cards—as of June 2022, Forbes reported. Mastercard credit cards made up 31.6% of all cards.

The companies that actually lend money, in the form of a line of credit, to cardholders aren’t Visa and Mastercard but rather banks, credit unions, and other financial institutions. Among these credit card issuers, Chase is the largest. Upwards of 93 million credit cards issued by Chase are currently in circulation, according to Forbes. The second largest credit card issuer is Citi, which currently boasts 48 million credit cards in circulation.

Profitability of the Credit Card Industry

How does the credit card company make money, and how much money does it make?

A June 2022 report by management consulting firm McKinsey & Company called credit cards “one of the best-performing businesses in financial services” based on the 3.6% return on assets the industry saw during 2020. That return exceeds the net profit margins reported for several major industries in the U.S., including most retail sectors.

However, issuing credit cards is essentially lending money, and that means taking the risk that the money lent may not be paid back promptly (or at all). Risks in the credit card industry include loan losses (if the cardholder fails to pay their bill) as well as losses that result from fraud.

Loan loss provisions needed to protect the bank from the financial impact of non-payment, reductions in usage fees, and higher interest expenses to the bank as a result of rising interest rates are all factors that can eat away at profitability in the credit card industry.

Credit card companies make money in three main ways.

Charging Credit Cardholders Interest

Do you carry a credit card balance instead of paying off the full statement amount each month? If so, you’re directly contributing to the profits of credit card banks through paying interest charges.

Credit card interest rates are generally much higher than interest rates for mortgage loans or auto loans. Even compared to personal loans, credit card interest rates tend to be higher, according to Forbes. While a line of credit may be easier to access than consumer loans, you’re likely to pay more in interest on your credit card balances if you’re not promptly paying off your new purchases each statement period.

For the consumer credit card market, cardholders who carry a balance—especially a revolving balance—are the most profitable. Even if you are paying off the entire balance each statement period, though, your credit card usage still brings in profits to the credit card company.

Charging Cardholders Fees

Non-interest income also contributes to revenue in the credit card industry. Another way credit card issuers make money is by charging fees to cardholders. Credit card companies may charge several types of fees.

Some credit cards come with annual fees that, once the cardholder has opened the account under an agreement that includes annual fees, are unavoidable without closing the account. Credit card companies may charge annual fees for cardholders with lower credit scores.

However, even cardholders with stellar credit may find it worthwhile to pay annual fees for cards that offer the best deals, such as generous rewards and perks like high cashback rates, bonus points on rewards cards, and more travel miles than they could get from a card with no annual fee.

Other fees are based on how you use your credit. Late fees, for example, are avoidable as long as the cardholder makes the minimum payment by the due date.

Credit card banks charge additional fees when consumers use their lines of credit as balance transfers or cash advances instead of routine credit card transactions. Balance transfers are essentially movements of debt from accounts with higher interest rates to those with lower interest rates.

Although not all credit card issuers charge balance transfer fees—and some waive these fees for a period of time as part of promotions—consumers will often pay fees of between 3% and 5% of the balance they transferred, according to NerdWallet.

Credit cards like Chase can also be used at an ATM, but a credit card cash advance is different from withdrawing your own money using a debit card. Because the money you’re withdrawing belongs to the credit card bank rather than your own checking or savings accounts, you are likely to face additional fees for using it.

Most credit card cash advance fees are charged based on a percentage, typically between 2% and 5%, and cardholders may be subject to a minimum dollar amount fee.

Charging Merchants Transaction Processing Fees

Interest charges and fees bring in plenty of revenue for the credit card industry. As of January 2022, the Consumer Financial Protection Bureau reported that Americans paid $120 billion per year in interest and fees between 2018 and 2020, which translates to a per-household burden of around $1,000. However, these aren’t the only means through which credit card companies make money.

Even if you pay your balance off in full each month, actively avoid credit card accounts with annual fees, make payments on time every time to avoid late fees, and treat balance transfers and cash advances as a last resort, you’re still contributing to revenue for the consumer credit card industry.

Your credit card spending, in and of itself, brings in revenue for the industry. For each transaction consumers make with a credit card, the credit card company charges a processing fee. The portion of transaction processing fees that credit card companies receive, which typically amounts to between 1% and 3% of a transaction, is called “interchange” fees. These fees are paid by the merchant, not the cardholder directly, to the cardholder’s bank.

As consumers have gravitated toward using the credit card payment method more frequently—whether for convenience, out of financial need, or to reduce the risk of falling victim to fraudulent sellers—this higher transaction volume has increased interchange revenue for credit card companies.

Credit Card Accounts

For credit card issuers to bring in revenues in the range of $182 billion, one thing is for sure: a large number of credit card accounts is contributing to the industry’s profitability.

Credit cards were used to make $49 trillion in transaction volume in 2021, McKinsey & Company reported.

At least one, if not more, general purpose credit cards are found in over three-quarters of U.S. households, the Board of Governors of the Federal Reserve System reported in its FEDS Notes in September 2022. This figure led the Board of Governors of the Federal Reserve System to call credit cards “one of the most ubiquitous consumer financial products in the United States.”

Of all adults in the U.S., 83% have at least one credit card, the Board of Governors of the Federal Reserve System reported in 2020. Most credit cardholders have more than one card.

The average number of credit cards per American adult is 3.8, job search website Zippia reported, and over a third of American adults report having at least three credit cards.

Just because most Americans have one or more credit cards doesn’t mean they are using the full balance available to them (as they shouldn’t). Most Americans, thankfully, aren’t maxing out their credit cards (or, at least, not all of their credit cards).

In February 2023, Bankrate reported an average credit utilization rate of 25.6%. That’s surprisingly good news because it’s in line with experts’ recommendation that consumers keep their credit card utilization—in other words, the percentage of their available credit limit that their credit card balance takes up—below 30%.

Most experts say the ideal credit card utilization rate is somewhat lower, between 1% and 10%, WalletHub reported. While there’s room for improvement, the average credit card utilization rate still falls squarely in the recommended range.

Credit Card Balances

A look at credit card usage data doesn’t present all good news, however. In January 2023, CNBC News reported that almost half of the credit cardholders in America—46%—reported carrying a balance from month to month. Carrying a revolving balance on your credit card month after month instead of paying the balance in full at the end of the statement period means that consumers are incurring interest and, ultimately, paying more for the same purchases compared to if they had paid in cash.

It’s not that having a credit card balance is, in and of itself, a bad thing. With each transaction for which a consumer uses credit card accounts, the account balance builds. Having a balance of some sort on credit card accounts can positively influence consumers’ credit scores because it shows active use of the credit that has been made available to the consumer.

However, paying off that balance completely as quickly as possible—preferably before the account begins to incur interest—is one of the smartest moves a consumer can make with regard to credit card spending.

“Revolvers,” or consumers whose credit card accounts carry a balance month to month at least some of the time, “pay not only the bulk of interest charges, but also the majority of credit card usage fees,” the Board of Governors of the Federal Reserve System reported in September 2022.

Credit Card Debt

What is the current credit card debt in America? Collectively, Americans carry a balance of $986 billion in credit card debt, the Federal Reserve Bank of New York Center for Microeconomic Data reported in a report published in the fourth quarter of 2022. That figure represents an increase from the pre-pandemic levels, when it reached $927 billion, and now amounts to the most credit card debt in history.

Credit Card Debt Statistics

The average amount of credit card debt for American adults in 2022, according to Experian, was $5,910, up 13.2% from the 2021 average of $5,221. Per family, the average credit card debt amount as of December 2022 was $6,270, Zippia reported.

According to a recent survey conducted by GOBankingRates, “most” adults in the United States have credit card debt, and a concerning percentage of Americans have upwards of $1,000 in credit card debt.

Of those surveyed, 30% reported credit card debt amounts of between $1,001 and $5,000. Another 15% had at least $5,001 in credit card debt, and 6%—which, statistically speaking, equates to 14 million Americans—reported upwards of $10,000 in credit card debt.

There is also a quite difference between the average credit card debt in the state with the highest debt compared to the state with the least credit card debt.

Paying off this much debt is a tall order. Less than 40% of adults in the United States expect to pay off their credit card debt over the next year, GOBankingRates reported. Nearly one-quarter of survey respondents expect paying off their debt to take two years. Five years is the predicted time it will take to pay off credit card debt for 5% of respondents, while another 3% of Americans “never” expect to pay off their credit card balances.

What Are the Implications of Carrying Credit Card Balances Long-Term?

Considering how much credit card holders pay in interest—with Lending Tree reporting double-digit, highest-ever average credit card interest rates of 23.55% as of February 2023—these high credit card balances and long timeframes spell bad news for consumers.

If you carry a balance of just $1,000 at the average credit card interest rate of 23.55%, you’ll pay nearly $20 per month in interest charges alone. That may not seem like a lot of money at first, but over the course of two years, that adds up to an additional $468.96 compared to if you had paid off your credit card balances in full from the get-go.

(The good news is that if you’re paying down the balance each statement period, you will at least start to incur lower interest charges, as opposed to if you carried the full balance for the entire two-year period.)

For those carrying credit card balances closer to the $5,221 average credit card debt, the impact of interest charges is amplified. At that 23.55% average credit card interest rate, consumers with the average balance on their credit cards will pay over $100 in interest charges per month.

If you took two years to pay these credit card balances off in full (and didn’t pay them down incrementally during this timeframe), you would be looking at interest charges as high as $2,448.24.

Credit Card Debt Delinquency

Carrying credit card debt is less than ideal for a consumer’s finances, even if they can gradually pay down their balance or at least keep on top of making the minimum payment each statement period. Unfortunately, when credit card accounts carry a balance too high to keep up with, the cardholder may eventually fall behind on payments.

What Is Credit Card Delinquency?

Delinquency is the term for overdue or late payments. A credit card account may appear as delinquent on the cardholder’s credit report as early as 30 days after the payment is due, according to Experian, although Investopedia noted that most credit card debt isn’t reported as delinquent to credit reporting agencies until payments are two to three months overdue.

When your credit card account becomes delinquent, you can face a number of problems: late fees, being pursued by a collections agency for repayment, closure of the account, and a drastic decrease in your credit score. Having delinquencies on your credit report makes other lenders less willing to offer you a line of credit (and more likely to charge you higher interest rates and fees if they do, based on the risk of further delinquency).

The damage your credit score takes may affect other aspects of your life, too, making it more difficult to rent an apartment, increasing insurance rates, and requiring you to pay deposits for utilities that a customer with better credit wouldn’t have to pay.

Current Rates of Credit Card Delinquency

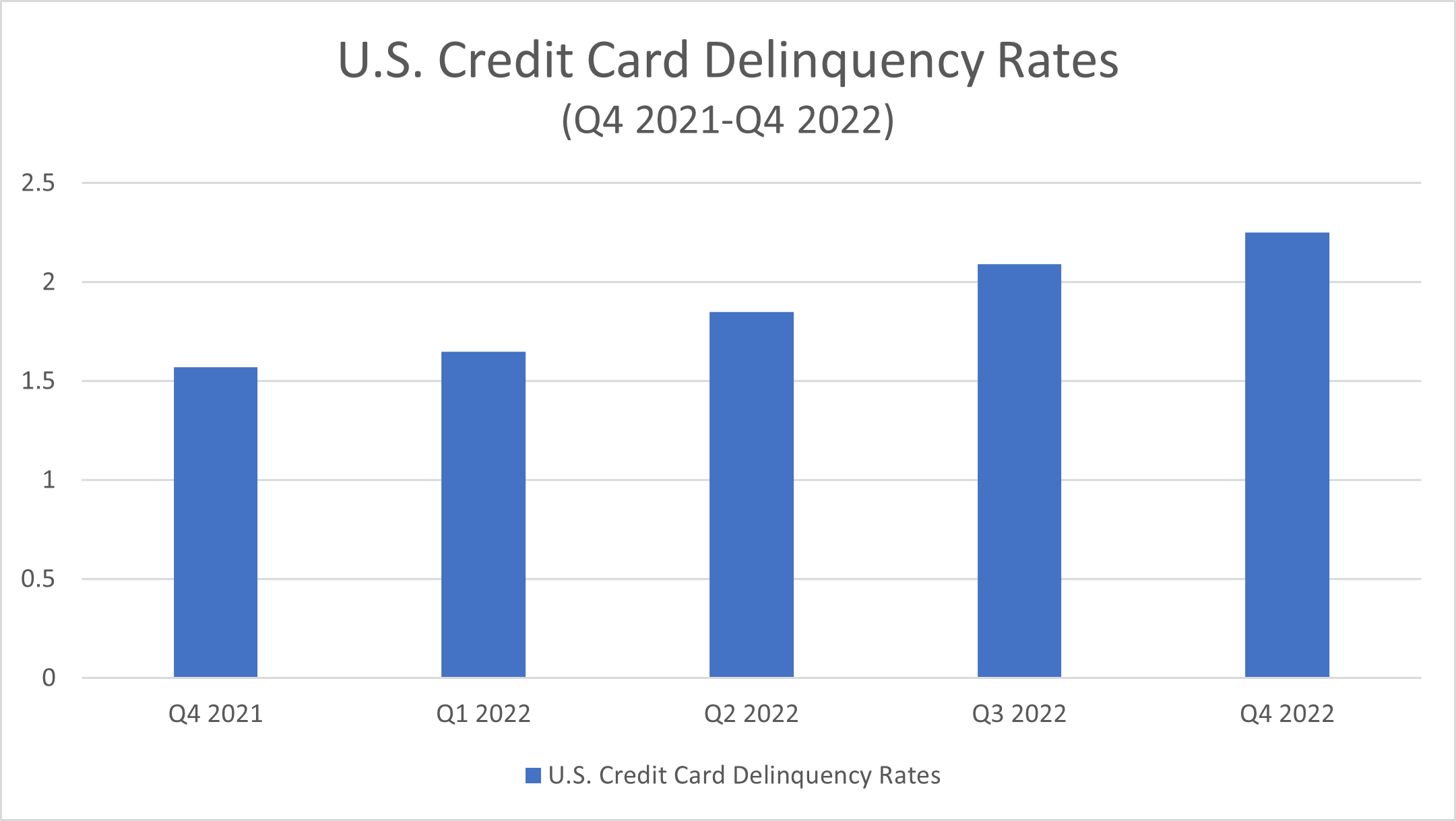

Unfortunately, after delinquency rates dropped from the second quarter of 2020 through the third quarter of 2021, the number of delinquent credit card accounts is once again on the rise, the Federal Reserve Bank of St. Louis reported.

In the fourth quarter of 2021, credit card loan delinquency rates amounted to 1.57%. The delinquent credit cards rate climbed to 1.65% in the first quarter of 2022 and then 1.85% in the second quarter.

By the second half of 2022, credit card delinquency rates exceeded 2%. Rates of credit card delinquency climbed to 2.09% in the third quarter of 2022. The latest report from the Federal Reserve Bank of St. Louis put the fourth quarter credit card debt delinquency rate at 2.25%.

These delinquency rates are, USA TODAY reported, still below pre-pandemic levels of credit card delinquency—but not by much. They also remain well below the peak rate of 6.77% that occurred in the second quarter of 2009, following the Great Recession of 2008. Still, the steady rise in credit card delinquency has experts concerned about the future of this challenging macroeconomic environment.

How Credit Card Debt Compares to Other Types of Consumer Debt

What about credit card debt as it compares to other types of household consumer debt?

Credit card debt in the fourth quarter of 2022 accounted for approximately 5.83% of the $16.9 trillion total household debt amount, the Federal Reserve Bank of New York Center for Microeconomic Data reported.

Mortgage debt, which amounted to $11.92 trillion, made up the largest share of national household debt, accounting for 70% of household debt. At $1.6 trillion, student loan debt made up approximately 9.47% of total household debt in America, followed by auto loan debt, which amounted to $1.55 trillion (approximately 9.17% of the national household debt amount).

What Is the Future of the Credit Card Industry?

Credit card industry trends don’t develop in a vacuum. They shape and are shaped by other aspects of the economy, including unemployment rates, consumer behavior, cardholders’ disposable income amounts, and technology.

The Effects of the Pandemic and Recovery on the Credit Card Industry

Recent years have been volatile across industries, and credit card trends have followed suit. Interest rate hikes, inflation, financial uncertainty, and other factors that affect many consumers have had mixed effects on credit card industry trends both during and after the acute phase of the pandemic.

Further, as some of the pandemic’s effects continue to linger in certain industries, like travel and hospitality, they affect consumer spending behavior and, in turn, cardholders’ credit card usage.

Factors like reduced motivation for discretionary spending because of lockdowns and extra money from government stimulus checks allowed Americans to pay down their consumer debt during the COVID-19 pandemic, Bankrate reported. In fact, according to Bankrate, credit card debt declined by 17% between the fourth quarter of 2019 and the first quarter of 2021.

By the fourth quarter of 2022, however, total credit card debt was back to pre-pandemic levels, the Federal Reserve Bank of New York reported.

Is the Credit Card Industry Growing?

By several measures, yes, the credit card industry is seeing positive growth. The number of credit card accounts and the total credit card balance reported for American consumers have both increased, according to the latest data.

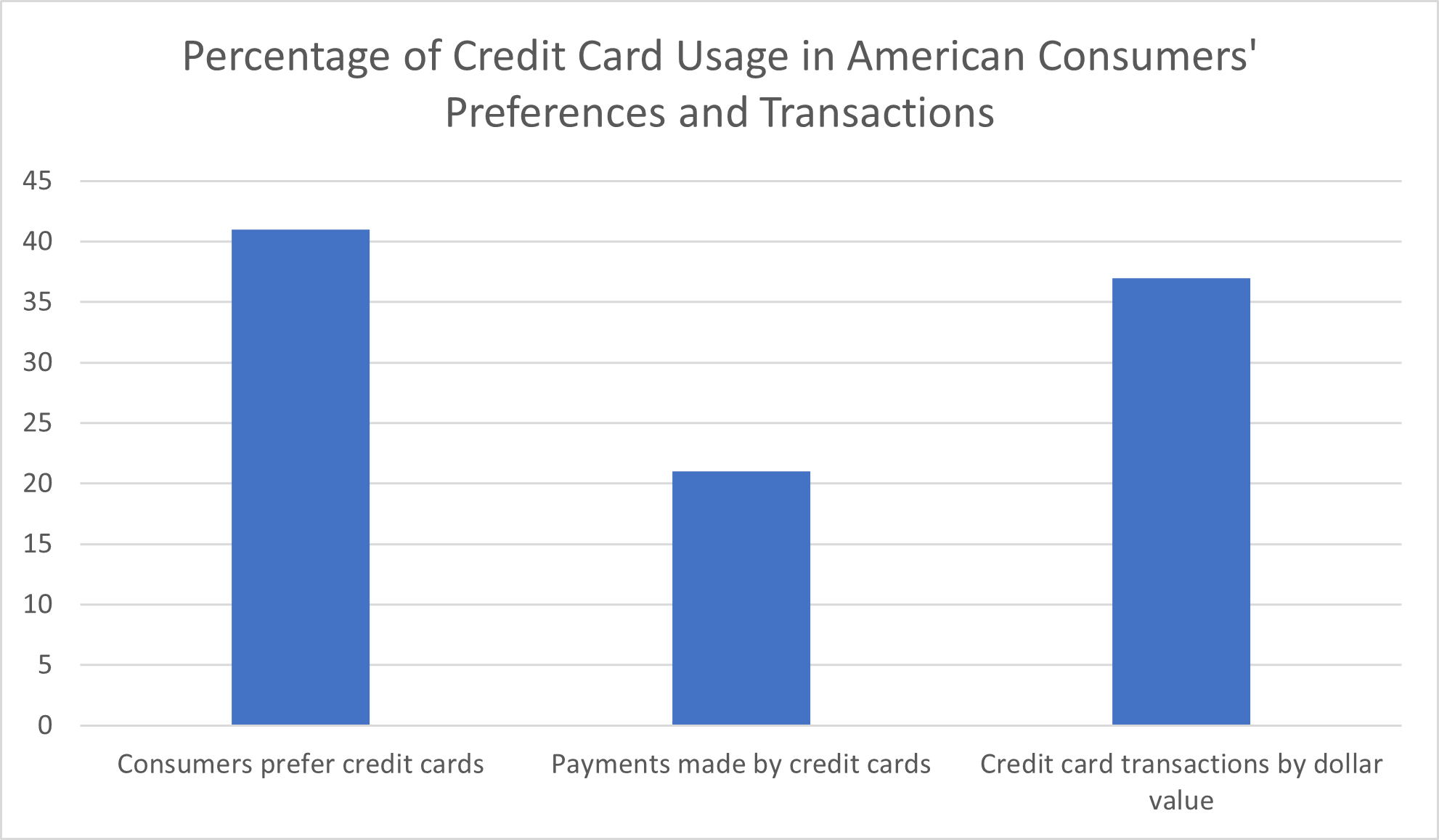

Today, 41% of consumers prefer to use a credit card payment method, Zippia reported in December 2022. When it comes to actual transactions, rather than preferences, 21% of all payments in the United States are made by credit card accounts. By dollar value, McKinsey & Company reported, credit card transactions make up 37% of consumer purchases in America.

In terms of the number of transactions, credit card transactions still lag slightly behind transactions with cash or debit card payment methods—accounting for 30% and 27% of payments, respectively, according to Zippia—but they still represent a huge chunk of all business transactions. (Payment methods used in the remaining transactions include prepaid cards, checks, bank transfers, and others.)

Challenges Facing the Credit Card Industry

Some of the biggest challenges credit card companies must overcome are competition from other forms of financing and from other credit card issuers.

Non-Credit Card Forms of Financing

Cash and credit are far from the only methods consumers can use to pay for their purchases today. If a consumer doesn’t have—or just doesn’t want to spend—the cash to make a larger purchase, they may look at other financing options. Retail stores offer consumer financing options like layaway or buy-now, pay-over-time arrangements, often with benefits like low-interest promotional periods.

To consumers who have concerns about credit card debt, especially younger consumers, these point-of-sale financing loans may seem less complicated and less dangerous, financially speaking.

Of particular concern for traditional credit card issuers is the Buy Now, Pay Later (BNPL) transactions trend. Younger consumers, in particular, are using this option to essentially make purchases on credit but skip the actual credit cards.

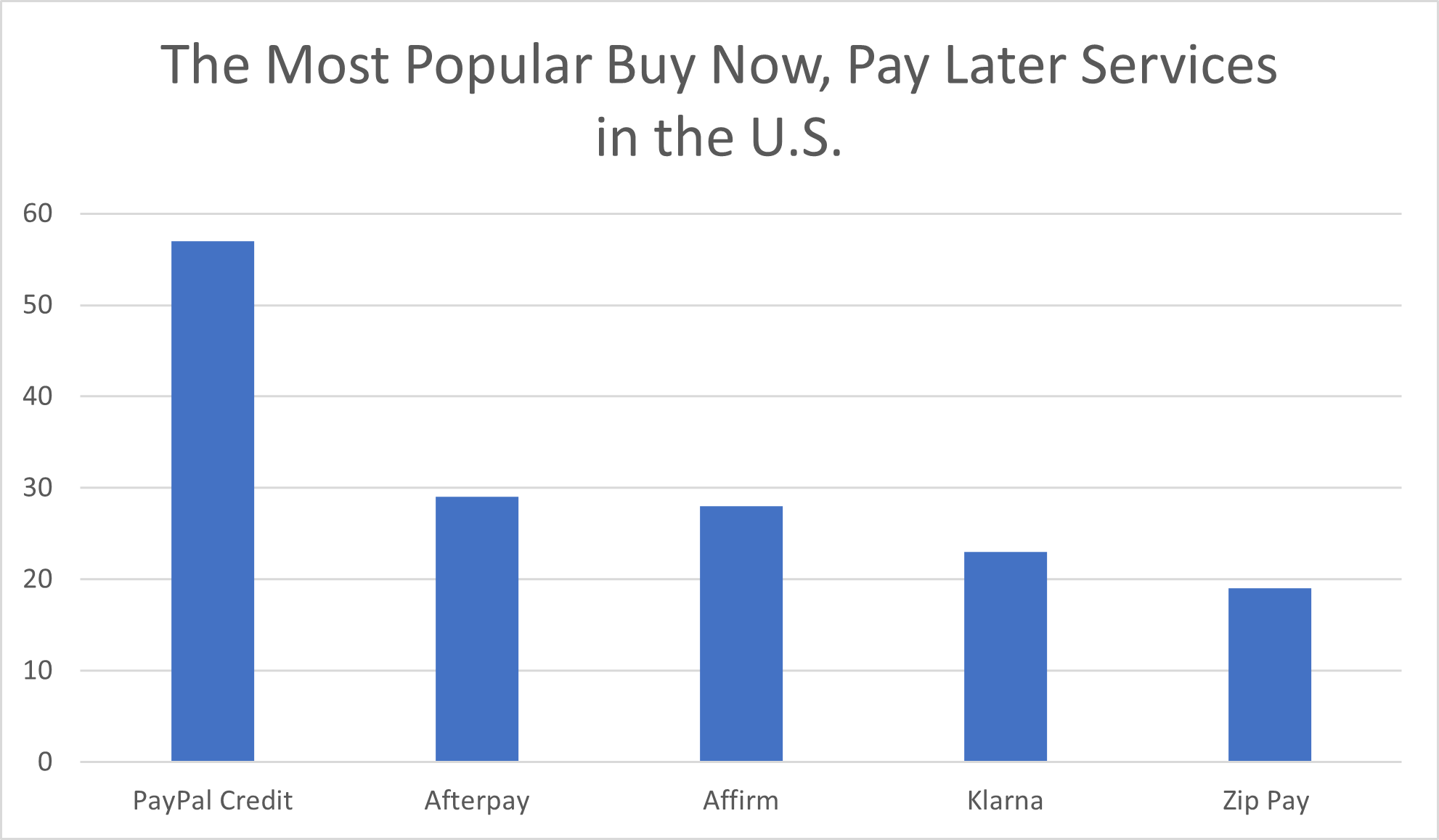

As of January 2023, Bankrate reported that the largest Buy Now, Pay Later platform in the U.S. was PayPal Credit, which 57% of NBPL users reported using. Next most popular were Afterpay, which 29% of BNPL consumers reported using, and Affirm, which 28% of these consumers used.

Rounding out the top five BNPL platforms were Klarna, which 23% of these consumers used, and Zip Pay, which 19% of these consumers used.

How extensively do PayPal Credit, Afterpay, Affirm, Klarna, and the rest threaten the profits of the credit card industry? According to Bankrate, 60% of American consumers reported using a Buy Now, Pay Later option to make purchases. Nearly half of those who have used this payment method are still making payments on their purchase, with an average debt of $883.

Most worrying for the credit card industry is that more than half of consumers who used BNPL services reported that they “prefer” this option over credit cards “because they’re easier to pay and offer more flexibility,” Bankrate reported—even though 57% of consumers who used Buy Now, Pay Later eventually reported “regretting their purchase.”

Despite this apparently rampant buyers’ remorse, 38% of consumers who reported making BNPL transactions expected to “eventually replace” traditional credit cards with these payment methods.

This data may sound like the credit card industry is in a dire situation, but credit cards are deeply entrenched in the modern economy. Just because more consumers are trying Buy Now, Pay Later payment methods or even expecting to one day replace their credit card spending with these services doesn’t mean credit cards are going anywhere.

Although BNPL platforms do pose a potential “risk to profitable growth,” business consulting firm McKinsey & Company recommended “reimagining” credit products with consumer engagement and needs in mind as the path forward for credit card issuers.

Competition in the Credit Card Industry

Competition within the credit card industry is fierce, too. While credit card companies benefit from serving cardholders who carry a balance (and pay interest on that debt), these companies have to weigh the likelihood of bringing in profits in the form of interest payments against the risks of lending money.

To credit card companies, consumers with a history of delinquency or especially poor credit scores are riskier than those with a good credit score and a good track record of paying bills and loans.

Consumers with established (good) credit know they only need (and use) so many credit cards, so interesting these sought-after consumers in a new credit card can be challenging, especially with so many options available. To get a consumer to sign up for a new line of credit, credit card companies need to offer something that makes a new credit card particularly compelling.

The most successful credit card companies often convince consumers to apply for a new credit card by offering the best deals in terms of cashback or rewards, an exceptional customer experience, or perks such as trip or travel insurance, extended product warranties, or exclusive access to airport lounges and event ticket presales.

As such, credit card issuers and even their individual credit card products must proactively look for ways to beat out the competition.