As we embrace the financial milestone of our first credit card, it’s crucial to navigate wisely. We’ll explore the biggest mistakes first-time credit card users make, ensuring you can leverage benefits while avoiding common pitfalls that lead to financial strain. Join us to secure a brighter credit future.

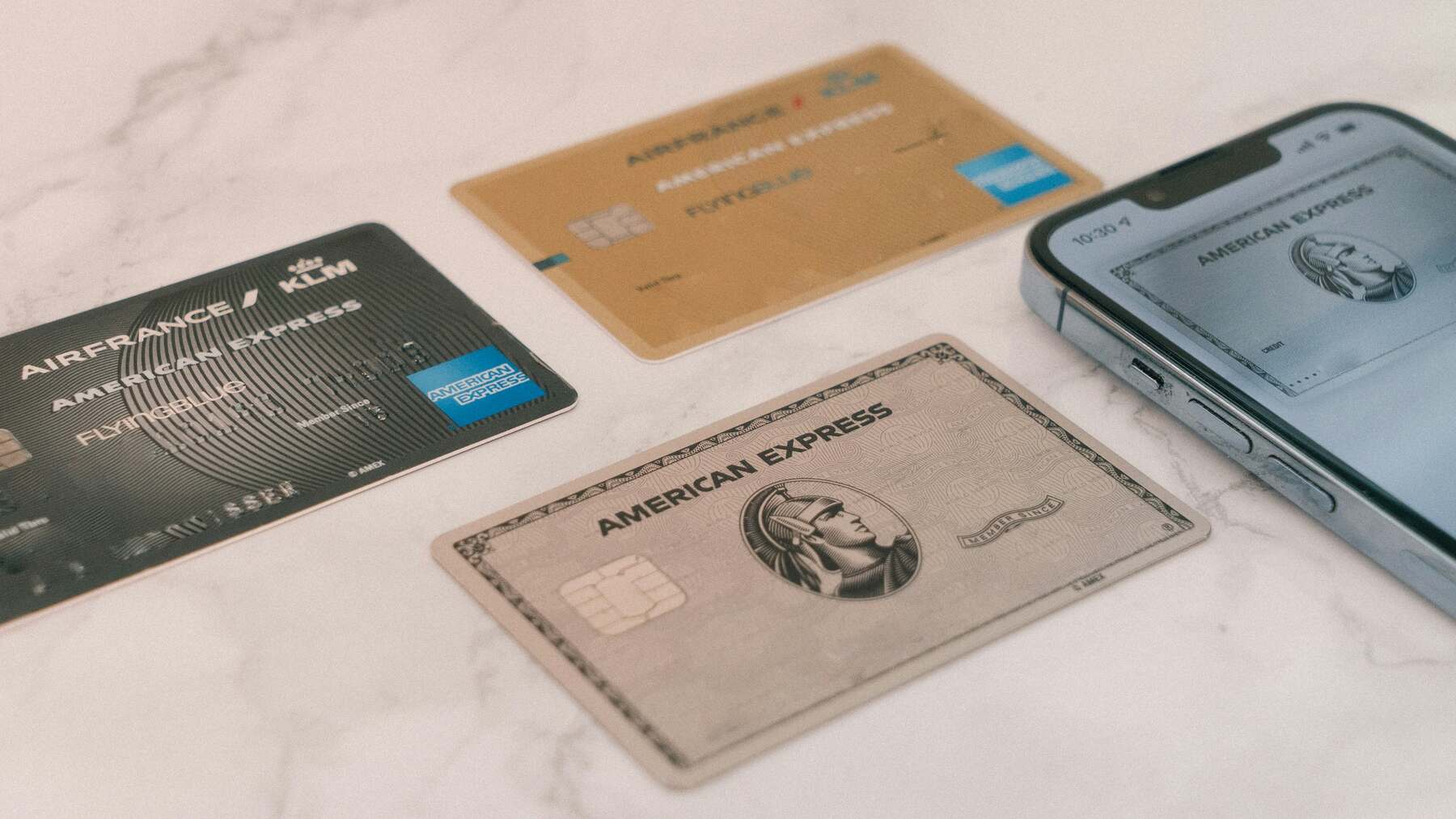

Mistake #1: Signing Up for the Wrong Card

You can make a huge mistake before you even have the credit card in your possession. One rookie mistake is assuming that all cards are the same.

The 1,000+ different credit cards out there on the market have wildly different terms and conditions, interest rates, fees, benefits, rewards opportunities and more.

But, as a first-time credit card user, there’s a good chance nobody ever told you that before you got your card. If they had, you would’ve been less likely to fill out an application for any random credit card just for the promise of a gift card to a favorite store, a T-shirt or a free slice of pizza.

What to Look for in Your First Credit Card

Anytime you’re considering a credit card, you need to look at the specifics of what the card offers. This includes:

- The interest rate, or the percentage-based price you’ll pay to use your line of credit. An interest rate on a credit card is usually expressed as your APR, or annual percentage rate of charge. Rate shopping, or searching for a card with a lower interest rate, can save you a lot of money if you’re paying interest on your credit card purchases.

- The fees the credit card company can charge you. Some cards come with an annual fee just for the privilege of having the card, but others apply when you engage in certain types of transactions or usages or as a penalty for paying your bill late or going over your credit limit.

- The grace period, which is the amount of time you have to pay off a purchase before it begins accruing interest. Not all grace periods are the same, and not all credit cards even have a grace period, so it’s crucial to understand from the get-go how long you have before interest charges start piling up.

- The benefits that come with your card. This includes reward programs like cashback, points programs and airline miles programs as well as free credit score reports, travel insurance coverage, and shopping benefits.

Some of these points may be highlighted in the card’s promotional materials, but you need to look beyond the bolded text and read the fine print. Credit card companies know that most cardholders don’t read the full terms and conditions, and that’s where a lot of sneaky language is hidden.

Failing to read the fine print now may mean facing big consequences later, especially if you confused introductory offers for the card’s permanent terms and conditions.

Types of Credit Cards You Should Know

You might be surprised how many types of credit cards are out there: bank-issued cards, store cards, charge cards, balance transfer cards, hotel cards and airline cards.

There are starter cards and student cards that may interest new credit users. If you’re trying to repair bad credit from a defaulted loan or a bill that’s gone into collections, you might look for a credit improvement card.

Some cards offer 0% financing for a period of time, which makes them perfect for making a big purchase – but only if you’ll pay the bill in full within the timeframe stated in the terms of the offer.

Everything Can Change

The terms of your credit card are subject to change. That means your interest rate could rise, your grace period shrink and new fees be added.

Under the terms and conditions of your card agreement, credit card companies usually reserve the right to make changes as permitted by law. A change in your interest rate is one of the biggest changes that should concern you.

The APR on your card can be variable or fixed. As the name suggests, you can expect a variable rate to vary, or change, periodically. This rate changes in conjunction with some other type of reference rate or index.

A variable rate can be appealing when that rate is low, but this type of rate is risky. It can climb drastically, leaving you with much higher interest charges than you expected – even if you haven’t missed a payment.

A fixed interest rate isn’t tied to this external benchmark, so you might think it’s safe from changing. That’s not the case.

Not only can you get penalized with a higher rate if your payment is late, but your credit card company can also decide to bump up your rate for no reason as long as you have been a cardholder for at least 12 months. All the credit card company has to do is give you 45 days notice, as required by law, of the rate increase.

What to Do Now If You Signed Up for the Wrong Credit Card

If you’ve made this mistake of signing up for a card without doing your research, it’s not too late to fix it. Take the time now to understand the terms of your card agreement. Make sure you’re paying off all purchases before interest starts to accrue, so your APR doesn’t matter.

Find out under what conditions your credit card company can charge you fees and actively work to avoid them. If you’re paying an annual fee, consider if it’s worth the benefits of having the card. Contact the credit card company to see if it will waive the annual fee.

Once you have used this card to carefully build some credit, you can start looking for a card that is a better fit for you. You can close your first card if the annual fee is too high, but keep in mind that there are negative consequences for closing a line of credit, too.

Mistake #2: Going on a Spending Spree

Having a credit card may increase your immediate purchasing power, but it’s not free money. You have to pay back every dollar you charge. If you put more on your credit card than you can afford to pay off in any one billing cycle, you’ll find yourself paying interest on that balance.

Most credit cards come with a specified credit limit. Although the credit card company permits you to spend any amount of money up to that limit, it’s never a good idea to max out your credit card.

The Dangers of Maxing Out Your Card

You may struggle to pay back a high credit card balance. If any kind of unexpected charge comes up, like a car breakdown that requires hundreds or thousands of dollars of repairs, you have no wiggle room. Either way, you could end up paying extra on the purchases you make in the form of interest charges.

Having a high balance on a credit card can also lower your credit score, even if you pay that balance off each month. That’s because your credit score takes into account how much of the credit available to you is being used.

If you’re approaching your credit limit each month, you’re sending negative signals that you may not be spending within your means.

How to Avoid Overspending on Your Credit Card

The easiest way to evade the trap of spending too much is to treat your credit card as if it were cash. Instead of saying, “I can buy this today because I don’t have to pay for it until next month,” ask yourself, “If I had to pay for this in cash right now, could I afford it, and would I buy it?”

Taking this view helps you keep in perspective that you’re still spending your own money, even if the credit card happens to be the form of payment you’re using. It also helps you curb impulsive buying behaviors.

Making sure you have a fleshed out and realistic budget in place can also help you make better financial decisions, with a credit card and in general.

Credit Cards and Friends Don’t Mix

New credit card users may be tempted to let someone else use their card or put some purchases on their card such as paying for home remodeling charges, buying expensive items like an engagement ring or a car. This temptation is especially strong when you’re the first of your friends to have a credit card. Be careful.

When it comes to loaning a friend the money for a purchase by putting it on your credit card, just remember that you have to pay up when the bill is due, whether or not your friend has paid you back. Consider how much you trust this friend financially and whether you could still pay the bill if your friend fell short of being able to pay you back.

It’s never a good idea to let someone else use your card, particularly in your absence. Remember that, while you are working hard to stay disciplined and prevent overspending, someone else might not be so diligent.

That’s especially likely if they don’t have the experience of using a credit card themselves, and even more so when they won’t be the one on the hook for the consequences.

Mistake #3: Paying Interest – Ever

The reality is that, if you’re not paying off your entire statement balance before your grace period ends every month, you’re actively wasting your money by having a credit card.

The Impact of Interest

Every single purchase you’re carrying between billing cycles is costing you way more than it would have if you’d just paid in cash. How much more?

The national average credit card APR has hovered between 16% and 18% during the three-year span between summer 2017 and summer 2020. That means, for every $100 you put on your credit card, you’re spending an additional $16 to $18 in interest.

Unless you pay off your purchase in full, that is.

The only way to avoid paying interest when using a credit card is to pay off your balance in full every single billing cycle, within your grace period. If your card doesn’t have a grace period – and it isn’t required to – then you need to pay off each purchase you make as you make it or you will be charged interest from the day you make the purchase.

One more thing you need to know about interest is that it compounds. Once your grace period ends and you start accruing interest, those charges will usually accrue daily.

That means that, by the second day after your grace period ends, you’re already being charged interest on interest. Each day that goes by without the balance being paid in full brings with it more interest charges.

The power of compound interest is such that paying off a credit card balance of even a few thousand dollars can stretch out into years, even decades.

With interest adding up all that time, you’re likely to pay two, three or even four times what the original balance was before you’ve finally paid off your credit card debt.

Two Traps That Will Keep You Paying Interest

One way you’re sure to doom yourself to a lifetime of interest charges is by making the minimum payment amount listed on your billing statement.

The minimum payment is just that – the smallest amount you can pay to prevent your account from slipping into delinquency.

If you make this minimum payment, the credit card company will keep your account open and in good standing, without hitting you with a penalty interest rate or sending your outstanding balance to collections. But you’ll keep on incurring interest charges for as long as it takes you to pay off your purchases.

That’s likely to be a long, long time. Credit card companies have reduced minimum payment amounts in recent years specifically because they can charge more interest that way. For many cardholders, the minimum payment is just 1% to 2% of the balance.

If you’re paying just 2% of the balance amount a month but interest is piling up at 16%, it’s easy to see how you wind up paying much more in interest than you actually spent in the first place.

The only time you should ever make just the minimum payment amount is if you can’t afford to pay any more than that. If this is happening regularly, it may be time to review your budget and your spending habits. The longer you pay only the minimum amount, the more your purchases will cost you in the long run.

Another problem that can contribute to paying unnecessary interest is using a credit card to pay for your regular purchases if you don’t pay it off in full each month.

This may sound contradictory when combined with the warning to only buy with credit the things for which you would pay cash. However, it’s a lot easier to fall into the trap of overspending without realizing it when what you’re putting on your card is essentials – like groceries or gas for your car – instead of frivolous purchases.

Interest charges don’t distinguish between the items you want and the items you need. Long after the groceries are eaten and the gas tank emptied, you could still be paying interest on these purchases.

Mistake #4: Not Checking Your Statement

No question, you need to pay your credit card bill. However, your statement tells you so much more than what your balance is. If you log onto your online banking account to pay your bill but you don’t bother actually looking at your statement, you could end up making a big mistake.

The Three Things You Can Learn From Checking Your Statement

Besides the total of how much you owe, these are the most important things you should be looking at when you get your billing statement, whether in the mail or electronically.

- What you’re spending your money on. The more you use your credit card, the harder it can be to keep track of what exactly you’re buying with it. That’s especially true if you wind up putting any recurring or automatic charges on your card – things that you may not factor in when you’re mentally tabulating your charges but that can put you dangerously close to your credit limit. Taking a few minutes each month to look through the charges on your credit card can help you take stock of how well you’re sticking to your budget and if you’re routinely overspending in any one purchase category – such as going out to eat too often. Some credit cards even break down your spending categories to make it easier for you to see where your money is going.

- Any erroneous charges. Suppose you make a purchase and, due to a technological glitch, your card ends up being charged twice. Maybe you pay your utility bill by credit card, and a utility company estimated your bill at a rate far higher than your actual usage. Whether due to computer errors or an intentional effort to overcharge you, mistakes like these are surprisingly common. If you let them add up, you’re wasting precious dollars on charges you shouldn’t have to pay in the first place. Another reason you should always review your billing statement is because doing so can help you notice duplicate charges or unusually high charges from any billing company.

- Signs of fraud or identity theft. A thief doesn’t have to physically get their hands on your credit card to make fraudulent purchases with it. If you pay your bill without bothering to check your statement, an identity thief could be adding their own purchases to your bill month after month, and you would never know it. If you didn’t use your credit card one month and you don’t bother checking your statement, you could end up getting hit with late fees and other penalties because of the fraudulent charge someone else put on your account. Even if the credit card company eventually waives these penalties, it’s still a hassle.

If you find a billing error or evidence of fraud, contact your credit card company right away to report it and find out what to do next.

Mistake #5: Missing or Making Late Payments

When you get your first credit card, you’re not used to making payments. If you start building credit young, you may not be used to paying any bills on your own just yet. However, it’s important that you quickly make paying your credit bill, in full and especially on time, part of your routine.

The Vicious Downward Spiral of Debt and Missed Payments

One missed payment may seem like it’s not a big deal, but it could set off a cycle of negative financial consequences.

First, you miss a payment and get hit with a late fee. If you were having trouble paying even the minimum payment amount on your bill before the late fee, this added cost only makes things worse. Your balance starts accruing interest, which makes the amount you owe soar even higher.

If your payment is so late that it triggers your penalty interest rate increase under the terms and conditions of your card, you could see that interest rate balloon to a much higher APR without warning – and stay that way for at least six months.

And, under what’s called the universal default clause, other creditors you may have can also see that your account is delinquent.

The Credit CARD Act passed in 2009 prohibits these companies from raising your interest rates on prior purchases because of delinquency on an account with another lender, something that used to happen routinely.

However, your other creditors may still decide to penalize you in other ways, like raising your APR on future purchases (with notice), lowering your credit limit or closing your account altogether.

Further, the impact of these late and missed payments will be a strike against you in the eyes of any other credit card company from which you may want a line of credit.

Letting Debt and Delinquency Get Worse

Bills going into collections, bankruptcy declarations – these are the potential consequences if you ignore credit card debt and delinquency.

Too many cardholders who get in over their heads try to pretend everything is fine. Maybe they hope the problem will go away on its own (it won’t).

Perhaps they think that, if they can just wait it out, they will eventually be in a better financial position and can catch up on their debts then (even though interest charges and fees will have increased what they owe dramatically).

Ignoring delinquency is never the right way to handle this big financial problem. Instead, contact your credit card company directly and let them know that you cannot afford to pay.

The credit card company may be willing to negotiate with you or point you in the direction of any assistance that could help you get back on track with your payments. You could also speak to a credit counselor at a nonprofit debt management organization.

Mistake #6: Paying Fees Unnecessarily

A late fee isn’t the only way having a credit card could cost you. Credit card companies are notorious for charging fees for everything under the sun – even if you haven’t done anything wrong.

From opening and maintaining your account to paying your bill, you could incur fees at just about any point of credit card ownership if you’re not careful.

Types of Credit Card Fees

Aside from the late fee, the most common credit card fee is an annual fee that you pay just to have the line of credit. Not all cards have an annual fee.

Cards that offer more extravagant rewards are also more likely to charge a fee (or at least, a higher fee). If you’re tempted to choose a credit card with an annual fee, make sure what you’re getting in exchange for the card – airline miles, cash back, points or other card benefits – are worth what you’re spending in annual fees.

Other fees you may face include:

- Overlimit fees, if you spend so much that your card balance goes over your credit limit

- Balance transfer fees, if you choose to use a balance transfer check provided by a credit card company to pay another bill or debt

- Foreign transaction fees, if you made purchases in another country or if you made online purchases from a vendor based in another country

- Card replacement fees, if you lose your credit card

- Additional card fees, if you add an authorized user, like a spouse, to your account and request a separate card for that user

- Account inactivity fees, if you don’t use your account for a while

- Credit limit increase fees, if you request a higher credit limit amount

- Paper statement fees, if you opt not to have your statements delivered electronically

- Reward program fees, if your card offers some types of rewards or cashback program

- Reward redemption fees charged when you actually use the rewards you have earned

- Expedited payment fees, if you need your payment processed quickly, such as to avoid a late fee

- Returned payment fee, if your attempted payment fails to go through, whether due to insufficient funds to make the payment or a banking or technological error

Most credit cards don’t carry all of these fees. When selecting a card and reading the terms and conditions of your cardholder agreement, you should make sure you understand what fees can be charged and under what circumstances.

You can also avoid fees by making sure you stay under your credit limit, make your payments early and meet other obligations to avoid triggering some of these conditional fees.

Using Your Card for Cash

You should be particularly wary of fees and charges when using your card for a cash advance. A cash advance is essentially borrowing cash from your line of credit, and this credit card usage is much different from making regular purchases.

Cash advance fees can be charged as a flat rate or a percentage of the amount of money you take out. They apply every time you use your credit card like a debit card to get money out of an ATM. If you make a habit out of taking a cash advance, you’re going to rack up a lot of money in fees.

Perhaps even worse, cash advances are typically excluded from the grace period you get for the items you purchase. This means you’ll begin accruing interest charges on this money immediately.

Only take a cash advance from your credit card if absolutely necessary, and don’t wait until your billing cycle ends or your payment is due to pay off this balance. Otherwise, the convenience of getting cash quickly will really cost you.

Mistake #7: Not Taking Advantage of Your Card Benefits

Rewards and special offers can really add to the value you’re getting out of your credit card, but you need to be smart about getting the benefits you want and using the benefits you have.

Using the Right Card the Right Way

When choosing a card, benefits and rewards should factor into your decision – but not at the expense of other important points.

A cashback rewards card may give you back a penny for each dollar you spend, but you’d have to spend an awful lot to make that reward worth paying an annual fee in the range of a few hundred dollars. Don’t pay more in fees or interest than you can realistically earn in rewards.

Make sure the type of reward card you choose makes sense with your lifestyle. For example, you shouldn’t opt for a card that rewards you with airline miles if you don’t travel frequently.

If it’s an introductory offer that’s catching your interest, make sure you understand the terms and what you must do to meet them. Otherwise, you’ll be lured in by the promise of reward bonuses that never actually materialize.

Credit Card Perks, Points and Rewards

Credit card benefits aren’t all about cash back or airline miles. You can collect points that can be used for everything from statement credits to gift cards and charitable giving.

Some benefits of a card, like price protection programs and extended warranties, may be even more valuable than rewards points because they can save you money and protect your purchases.

Mistake #8: Losing Your Credit Card (And Not Reporting It)

Novice credit card users are, unfortunately, particularly prone to misplacing their cards. If you’re used to paying cash, you might forget to get your card back out of the tray or folder in which your check is brought to the table at a restaurant, for example. (Even experienced card users make this mistake on occasion.)

Fortunately, losing a credit card isn’t like losing cash. The line of credit available to you isn’t gone forever. Unfortunately, though, the amount of damage that could be done if a dishonest person gets their hands on your card is limited only by the upper reaches of your credit limit.

Losing your wallet full of cash could mean kissing goodbye all of the money you had on your person, but losing your credit card could allow for unlimited transactions of hundreds, or even thousands, of dollars.

If you ever lose your credit card, it’s crucial that you notify your credit card company right away. Otherwise, you might be responsible for paying for the fraudulent charges on the card, especially if a lot of time has passed between the first instance of fraud and the time you notified your creditor.

Fraud and Theft Protection

Credit card fraud is an even bigger problem for credit card companies than it is for consumers.

Under federal law, the credit card company can’t make you pay for any unauthorized charges made after you report a card as stolen or any unauthorized charges made with the credit number as long as the card itself remains in your possession.

The maximum you can be made to pay for fraudulent charges is $50 under the Fair Credit Billing Act (FCBA).

Because credit card companies are the ones stuck with the bulk of the bill for fraudulent charges, they’re often willing to take extra steps to protect both you and themselves from theft. Your card may include complimentary fraud early warning services and a promise of $0 liability for fraudulent purchases.

Credit Card Account Freezes

It used to be that anytime you misplaced your credit card, the credit card company would have to send you a new card with a new account number. Some banks charge a fee for this replacement card. Further, it can be inconvenient to change credit cards that are linked to automatic bill payments or saved to online purchasing accounts.

Today, many credit card companies offer the opportunity to simply “freeze” your card. Freezing a credit card is like pressing the pause button on your ability to use it for purchases. Some credit card companies allow you to freeze the card easily online, or in a mobile app, with the touch of a button.

Keep in mind that freezing a credit card isn’t the same as freezing your credit – an action that prevents new accounts from being opened in your name if you’re trying to deal with the effects of identity theft.

Freezing your credit card is a great option if, say, you misplace your card at home, in your car or at the home of a friend you trust. Perhaps you know where you left the card but can’t get it back right away. Freezing your card prevents anyone from racking up charges on your card while it’s out of your possession.

Once you get it back, you can simply log into your online card management account and unfreeze the card. Make sure you review any purchases that occurred prior to your freezing the card, in case someone had already attempted any fraudulent activity before you realized it was missing.

Mistake #9: Applying for Too Many Cards at Once

Once you’re comfortable using your card, you may start to think about getting another one. Having multiple credit cards is so common that the average American reports having four credit cards.

Getting another credit card isn’t a mistake in and of itself. It can be the smart thing to do, especially if you use different cards for different purposes, rewards, discounts and other benefits. The problem is when you damage your credit with too many applications too quickly or when you use multiple cards to dig yourself deeper into debt.

The Impact of Multiple Cards on Your Credit Score

Having more credit cards, overall, can improve your credit score. It raises the total amount of credit available to you and, assuming that you don’t increase your spending as well, it means you’re using a lower percentage of your available credit. That’s something lenders and creditors like to see.

If you apply for too many cards in too short a time – for instance, applying for one new card within six months of your most recent credit application – your credit could suffer. That’s partly because every time a credit card company checks your credit, it’s recorded on your credit report.

Also, the length of your credit history, including the age of your newest account and the average age of all of your credit accounts, factors into your credit score. Each time you open a new account, you decrease the length of your credit history, which could result in a lower credit score.

When More Cards Equal More Debt

If you’re not paying off your first credit card balance in full each month, it’s not a good idea to get a second card. Carrying balances on multiple cards means you’re getting hit with interest charges from multiple sources, potentially incurring more fees and raising the risk of missing a payment.

Remember, the credit available to you, from one account or many, isn’t free money or extra income. It’s a loan that you have to pay back – with interest, if you don’t pay in full within the grace period.

Don’t forget the store credit cards count, too, even if you can’t use them elsewhere. Although store credit cards can offer great discounts and rewards, they often come with exceptionally high interest rates – as high as 20 to 30%.

Mistake #10: Not Understanding Your Credit Score

A lot of the mistakes you can make with your first credit card stem from misunderstanding how credit scores work. In turn, credit card mistakes can hurt your credit score.

The Myths About Building Your Credit History

A big part of the reason to have a credit card is to build a credit history. If you’re like many misinformed consumers, you might think that you’re only building that creditworthiness if you are consistently making purchases and carrying a balance.

Not only is this not accurate, but it’s harmful to you financially. Carrying a balance actually lowers your credit score while forcing you to pay interest on your purchases.

What should you do instead? For one thing, don’t feel pressured to use your card on a regular basis if that doesn’t fit into your lifestyle or budget.

You don’t have to actively be making purchases all the time just to build a credit history – you just need to use the card occasionally and show that you can make payments on time. Just be sure that you choose an account that doesn’t charge any fees or penalties for inactivity.

Also, you should keep paying off your balance in full. Contrary to popular belief, having a balance doesn’t prove to creditors that you’re a good person to lend money to.

In fact, if you carry a revolving balance on your cards, you’re keeping your credit utilization rate higher than lenders like to see – lowering, rather than raising, your score.

Knowing how to use credit cards the right way – and avoiding these rookie mistakes – can help you start building credit with confidence.