Index funds offer non-investors the opportunity to put money into the stock market with a lower level of risk over time. They’re affordable and stable while providing a return on investment that’s higher than a certificate of deposit (CD) or savings account. An index fund does the stock diversification for you and prevents you from being too heavily invested in one type of stock or company. Another beneficial aspect of investing in an index fund is the fact it grows over time with monthly recurring investments into the fund. For those who want their money to grow with an eye towards retirement or long-term investment planning, investing in index funds is a solid path towards financial growth.

But first, what are the 5 Best Index Funds?

- Fidelity ZERO Large Cap Index (FNILX)

- Vanguard S&P 500 ETF (VOO)

- Vanguard Total Stock Market Index Fund (VTSAX)

- Fidelity Small Cap Value (FISVX)

- Fidelity Real Estate Index Fund (FSRNX)

Keep reading for the full story!

Why Should I Invest in Index Funds?

An index fund enables investors to buy stocks as a pool of buyers instead of as an individual. The fund itself is usually comprised of stocks that track a specific market index. Investors buying into an index fund are buying a portion or all of a stock share depending on how the fund allocates the funds for purchase. For example: 10 investors put their money into the same index fund, but the money from each individual investor is not enough to cover the purchase of a single share of stock for each of them. However, when the money from the 10 investors is pooled together, they can buy one share and split the ownership. The longer each investor keeps investing in the index fund, the more ownership they gain in each share. Their portfolios grow over time as does their return on investment.

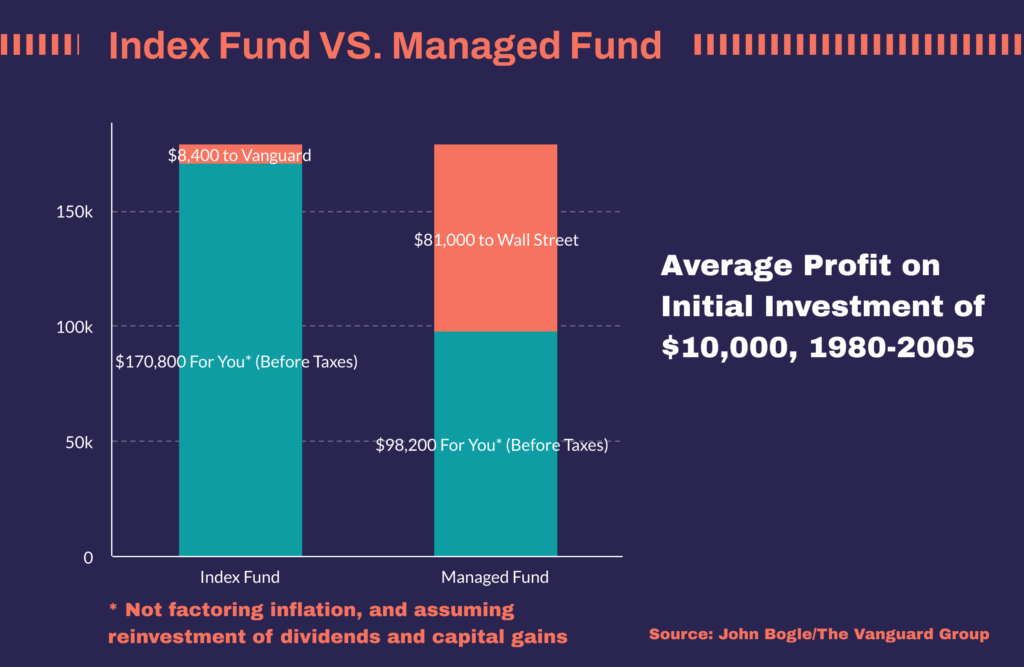

Index funds take a lot of the risk out of investing in the stock market, especially when held for a long period of time. An index fund tracks stocks that are most likely to increase in value over time, and avoids investment in riskier stocks. They are diversified and are passive investments that don’t require daily monitoring by a fund manager. Their fees are much lower which means that more of an investor’s money goes towards actual investment. Index funds are similar to mutual funds, but instead of trying to outperform the market like a mutual fund, they focus on delivering market-average returns. They’re an excellent investment vehicle for casual investors and those who are risk-averse, but would like to put their money to work. Following is a look at index funds and why they’re worth investing in.

Profile of Index Funds

Here’s a look at five index funds that have proven track records and offer different investment options:

1. Fidelity ZERO Large Cap Index (FNILX)

Fidelity ZERO Large Cap Index Fund has a stated objective of providing “investment results that correspond to the total return of large capitalization U.S. companies.” The fund has an average of 500 holdings at any given time, and has 25% of its holdings in companies that include:

- Amazon

- Microsoft

- Tesla

- Berkshire Hathaway

The fund saw an average return of 47% at the end of a 12-month period that ended on 4/30/21, and has returned an average of 17% since it was created in September 2018. The fund has no minimums for investing and has a 0% investment ratio.

2. Vanguard S&P 500 ETF (VOO)

The Vanguard S&P 500 ETF invests in the stocks that are found in the Standard and Poor 500 Index which represents 500 of the largest companies in the U.S. The fund is designed to closely track the index’s return, and the index itself is considered a gauge of overall U.S. stock returns. Stocks in the fund include:

- Apple

- Visa Inc.

- Tesla

- Amazon

- Johnson & Johnson

The fund was created in 2010 and has returned an average growth of 15% since its inception. There are no minimums for investing and reinvesting, and the average fee for the fund is 0.03%.

3. Vanguard Total Stock Market Index Fund (VTSAX)

The Vanguard Total Stock Market Index Fund Admiral Shares is one of a series of index funds from Vanguard that share a similar name. Make sure to look for the VTSAX when examining the funds. This fund gives investors exposure to the entire U.S. equity market and includes, small-, mid-, and large-cap growth and value stocks. It has low costs for entry, broad diversification, and also has the potential for tax efficiency. It’s a low-cost entry to investing across the entire stock market, but does require tolerance for volatility and risk. Some of the holdings include:

- Visa Inc.

- Microsoft

- Apple

- Tesla

- Berkshire Hathaway

- JPMorgan Chase & Co

- Alphabet

The fund was created in 2000 and has generated a return of an average of 8% since its inception. A minimum investment of $3,000 is required to enter into the fund, but additional investments can be as low as $1. The average fee is 0.03%.

4. Fidelity Small Cap Value (FISVX)

The Fidelity Small Cap Value fund operates similiarly to the FNILX fund, but seeks out smaller companies for investment. It normally invests a minimum of 80% of assets in securities of companies with small market capitalizations. The objective of the fund is to seek out companies that are perceived as being undervalued in relation to their assets, cash flow, growth potential, sales, and other indicators that suggest a company is poised for growth. The fund looks for companies that are similar to companies found in the Russell 2000 index or Standard & Poor’s Small Cap 600 index. Some of the companies in the fund include:

- Assurant Inc.

- Western Alliance Bancorp

- ITT Inc.

- Old Republic

- Cushman & Wakefield

- Hilton Grand Vacations

- Flagstar Bancorp

The fund was created in 2004 and has averaged a return of about 12% over 10 years. The fund has no minimums for investment or additional investments, and fees average 1%.

5. Fidelity Real Estate Index Fund (FSRNX)

The Fidelity Real Estate index Fund invests in equity real estate investment trusts (REIT) and real estate-related investments. It invests at least 80% of assets that are included in the MSCI IMI Real Estate 20/25 Index. The MSCI measures publicly traded real estate securities in the U.S and screens for liquidity, market cap, and percentage of revenue from ownership and operation of real estate securities. Some of the companies found in the index include:

- Equinix Inc.

- Public Storage

- SBA Communications Corp.

- American Tower Corp.

- Prologis Inc.

- Crown Castle

- Weyerhaeuser Co.

- Welltower Inc.

There is no minimum to invest in the fund along with no minimums for additional investments. The fund was created in 2011, and has averaged a 9% return over its lifespan.

All index funds can and do divest themselves of shares in a given company at any time. An investor can expect some funds to retain the stock of specific companies in the fund in order to maintain its nature, but the percentage of ownership can change without notice.

What is an Index Fund?

An index fund is similar to a mutual fund that uses investor money to buy stocks, securities or bonds that collectively make up a specific market index. Individual investors and their funds are pooled together for index fund investing, and the fund manager buys securities on their behalf. Unlike a mutual fund, however, the index fund manager is largely hands-off, and won’t make major decisions unless it becomes apparent that a company is bringing down the performance of the fund. This strategy makes index fund investing a good financial strategy for investors who want to hold for the long term and aren’t interested in owning individual stocks in quantity or making their own investment decisions.

What is a Small Cap, Mid-Cap, and Large Cap?

Cap, or market capitalization, represents the value of all the outstanding shares of a corporation. Small, mid, and large cap refer to the valuation size of the company in question. The valuations are as follows:

- Small cap = value of $300 million to $2 billion

- Mid-cap = value of $2 billion to $10 billion

- Large cap = value of $10 billion and up

The best index fund is one that brings together all three types of companies into one portfolio. This type of index fund investing is considered riskier than other types of index fund investing, but can also deliver higher returns. The more varied the portfolio, the better, but it also comes with the potential for large swings in returns due to the variables in performance associated with each type of market cap.

Is My 401K Safe with an Index Fund?

Yes, your 401K is safe with an index fund. It carries the same risk that you take on when you start your account and leave it to whoever runs the 401K fund for your employer. Investing always carries risk, but the benefit of learning how to invest in an index fund is the knowledge that you can park your money in a portfolio and largely forget about it. Most investments will generate a return over time, and index funds are more likely to have a solid return on investment. The longer you keep your money in an index fund, the more you’ll have waiting for you when you retire.

The best index fund for a 401K is one that has an expense ratio that’s below 1%, and preferably one that’s 0.5%. The expense ratio is the fee that gets paid to the brokerage for the maintenance of your investments. This is something you should be looking at as a general rule when looking into how to invest in an index fund, but is even more important when you’re looking to switch your 401K index fund. Fees are always going to be a fact of life when it comes to index funds, but the best index funds are ones that have the lowest possible fees while investing in indexes that have a history of a steady rate of return.

Related: