Moms keep a finger on the pulse of the household. She makes sure there’s food in the pantry, takes everyone clothes shopping, and gets the kids to where they need to go with the right equipment. That means mom is always buying stuff everyone needs to achieve their goals for that day no matter if it’s schoolwork or sports equipment.

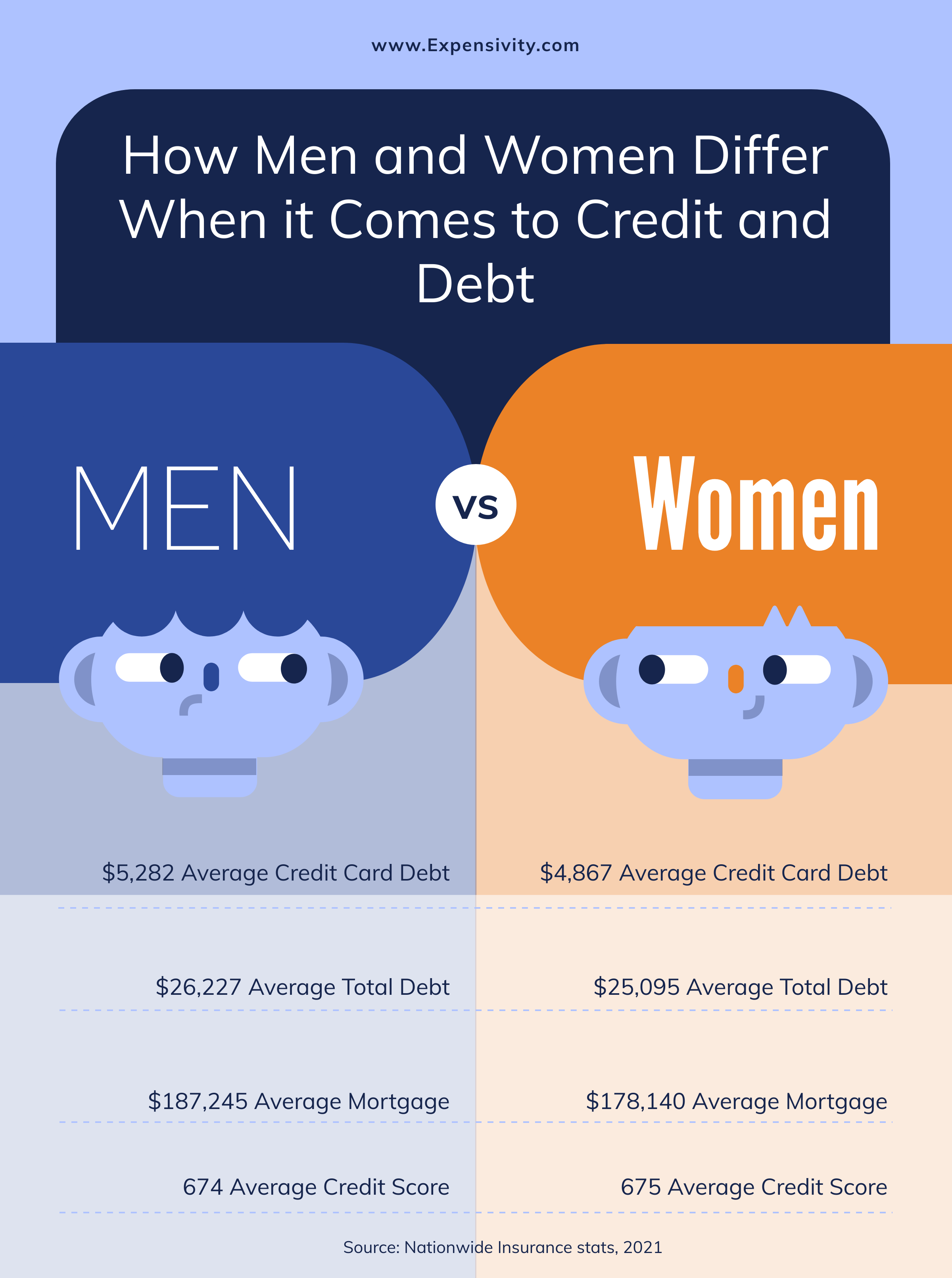

What are the credit cards for single moms? We think:

- Capital One Quicksilver Cash Rewards Credit Card

- Blue Cash Preferred® Card from American Express

- Chase Freedom Unlimited®

Following is a look at the top three credit cards that are great for moms and why they’re worth applying for:

The Best Credit Cards for Single Moms in 2024

1. Capital One Quicksilver Cash Rewards Credit Card

The Capital One Quicksilver Cash Rewards credit card is the best credit card with cash back and no annual fee, ever. It’s a simple card in terms of its cash rewards program in that moms don’t have to keep track of what they’re buying to maximize their returns.

All purchases get 1.5% cash back regardless of where you’re using the card, and the rewards are unlimited.

You can use the card as much or as little as you like and still get the 1.5% cash back bonus. The card offers bonus categories which have an increased rewards percentage rate. The welcome bonus for the card is a generous $200 in cash rewards after spending $500 in the first three months after opening the account.

The numbers sound modest, but moms can easily spend $500 on a card in three months and get 40% back on her purchases.

It’s a nice bonus for using the card for daily expenses, and the card itself makes for a good daily driver for regular purchases that don’t fall into a specific category. The APR on the card ranges between 15.49% and 25.49%. Users get 1.5 cents for every dollar spent, and rewards are stated in cash.

How Can I Redeem Rewards?

Rewards can be redeemed for cash in the form of a check, or used for a statement credit. The cash back can also be applied to purchases at Amazon.com, PayPal, and gift cards. There is no balance transfer option.

2. Blue Cash Preferred® Card from American Express

The Blue Cash Preferred Card from American Express is a great credit card for groceries when it comes to its rewards rate. Moms can get 6% cash back on all of her grocery store purchases for up to $6,000 in one year, then 1% for all purchases afterwards.

It also gives 6% on certain streaming subscriptions, 3% cash back on gasoline purchases, and 1% on all other purchases. Limited-time deals are also offered throughout the year which can help the cash back bonuses add up even faster.

The rewards rate makes this a perfect card for daily use because it puts more money back into the account than just about any other cash back rewards card. It does have an annual fee that’s waived for the first year, and $95 for each consecutive year. However, the annual fee can be easily repaid through the cash back bonuses without taking a large bite out of the rewards.

The welcome offer for opening an account gives a $150 statement credit for the first $3,000 in purchases during the first six months of ownership, 20% cashback on Amazon.com purchases on the card within the first six months (max $200 back), and 0% interest for the first 12 months.

The annual APR ranges between 13.99% and 23.99%. The Blue Cash Preferred card does not offer a balance transfer.

How Can I Redeem Rewards?

Reward redemption comes in the form of a statement credit, gift cards with a $25 minimum for redemption, or merchandise offered through American Express. The Blue Cash Reward Dollars are worth $1 for all redemptions.

You won’t get access to all the famous American Express benefits available on other cards, but you can still get travel and shopping protection, free ShopRunner membership, and the Pay It Plan It program.

The Pay It Plan It program is a great program for moms who need to lower the balance on the card, but can’t do it all at once. There are a total of 10 payment plans available to help moms pay off larger purchases more than $100 over time and immediately repay purchases under $100. Smaller purchases are repaid quickly while a larger purchase can be repaid over time.

3. Chase Freedom Unlimited®

The Chase Freedom Unlimited card features a 1.5% cash back rate on all purchases with no limit. It’s another one of the best cash back rewards cards for moms who don’t always make purchases in specific stores or online sites, but want to get some cash back on their buys.

What makes this one of the best credit cards for cash back is that it has no annual fee, a 5% cash back on travel when purchased through Chase Ultimate Rewards, and 3% cash back on dining and drugstore purchases.

The cashback rewards on dining and drugstore purchases benefit single moms who always pick up food or personal care items for herself and her family.

Another advantage to having the Chase Freedom Unlimited card is that points can be combined with points earned on the Chase Sapphire Preferred Card, Chase Sapphire Reserve, or Ink Business Preferred card. Chase also has transfer partners that allow points to be transferred from a Chase card to a partner card.

How Can I Redeem Rewards?

Rewards can be redeemed for a statement credit, travel, gift cards, or shopping at Amazon.com. Users can also redeem their points for a charitable contribution and get a 25% boost in value. The actual amount of a reward depends on how it’s used. Cash back is worth 1 cent while points for Amazon.com purchases are worth 0.8 cents.

The Chase Freedom Unlimited card has an introductory offer of 0% intro APR on purchases for 15 months and an interest rate between 14.99% and 23.74%. The welcome offer is a $200 cash bonus when spending $500 within the first three months of opening an account.

Welcome offers and cash back rewards are subject to change without notice. Check to ensure that the card you’re interested in obtaining offers a rewards program that is the same or better to get the best possible offer.

Best Credit Cards for Moms Based on Categories

Having discussed in detail our top 3 best credit cards for moms, let’s have a quick overview of other options that we think are great in specific categories. We’ll highlight these credit cards’ features, pros, and cons to help you pick the best one.

Best for Travel and Daily use: Capital One Venture Rewards Credit Card:

An ideal travel card should have features such as special bonuses, cashback or points on travel purchases and lodging, credit, and a reasonable annual fee. The Capital One Venture Rewards Credit Card is our top choice for travel and daily use.

This card can make planning the perfect trip for the whole family cheaper and easier. Here are some of its features:

- Earn a one-time bonus of 75,000 miles if you spend $4,000 in purchases within 3 months of account opening, equal to $750 in travel

- Earn 2x miles per dollar on every purchase you make every day

- Earn 5x miles per dollar on every rental car and hotel booking you make via Capital One Travel

- Redeem your miles by booking a trip through Capital One Travel at the value of 1 cent per mile or get reimbursed for any travel purchase made with the card

- Earn up to $100 credit for Global Entry or TSA PreCheck®

- Annual fee of $95

- Variable APR of 19.99% – 29.99%

Best for Fair Credit: Capital One QuicksilverOne Cash Rewards Credit Card

A great rewards credit card should offer cashback on various expenses, a low annual fee, the possibility of upgrading the credit line, and some special bonus card-specific. The Capital One QuicksilverOne Cash Rewards Credit Card may be a great choice if you’re a mom with a fair credit score.

Here are some of the features that make it stand out:

- Earn 1.5% cash back on every purchase

- Earn 5% cash back on hotels and rental cars booked through Capital One Travel

- Annual fee of $39

- You can be considered for a higher credit line in as little as 6 months

- Enjoy $0 Fraud Liability on unauthorized charges

- Enjoy 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Variable APR of 29.99%

- Contactless card for quick and secure transactions

Best for a Mom Without SSN: Capital One Platinum Secured Credit Card

Yet another Capital One credit card is the Capital One Platinum Secured Credit Card. An ideal card should be one without annual fees, credit-building opportunities, the possibility of a higher credit line, and, if possible, and refundable security deposit.

Due to the unique features of this card, we have voted it the best for moms who are single and do not have a social security number. It is also great for people with bad credit trying to build or rebuild it. Some of its features include:

- $0 annual fees

- Helps you build your credit by relaying your payment history to credit bureaus

- You can drop a refundable security deposit of $49, 99$, or 200$ to get a $200 initial credit line. Your credit history will determine the security deposit you drop

- Variable APR of 29.99%

- Get back your security deposit as a statement credit when you use the card responsibly.

- Be considered for a higher credit line in as little as 6 months

- $0 Fraud Liability on unauthorized charges

Best for Beginners with No History: WebBank Petal®️ 2 “Cash Back, No Fees” Visa®

Great features for a card like this should be a low or zero annual fee, cashback on purchases, no hidden fees, and an opportunity to build credit easily. The WebBank Petal® ️ 2 “Cash Back, No Fees” Visa® ️ is the best card for moms who are new to credit and have no credit history.

This also makes it great for immigrants who have yet to build a credit score. Here are some of its main features:

- $0 annual fee

- Variable APR of 17.99%-31.99%

- No fees whatsoever

- 1.5% cash back on eligible purchases, provided you’ve paid your monthly payment on time for 12 months

- 1% cash back on eligible purchases

- 2% – 10% cash back at select merchants

- Credit limits between $300 – $10,000 depending on creditworthiness

- Eligible for people without a credit score

- Reports payment to 3 major credit bureaus

Best for Unsecured: Celtic Bank Reflex®️ Platinum Mastercard

An ideal card for this scenario should allow for all credit types, have a chance to increase credit limit quickly, have a reasonable initial credit limit, and be widely accepted. The Celtic Bank Reflex®️ Platinum Mastercard®️ is great for moms looking to build their credit.

While it may have a high annual fee and APR, it makes up for these costs in other benefits. Here’s a quick overview of its features:

- An initial credit limit that ranges from $300 to $1,000

- Double your credit limit from $1,000 to $2,000 when you make the first six monthly minimum payments on time

- Mastercard Zero Liability Protection on unauthorized charges

- Monthly reporting of your payment to three major credit bureaus

- Suitable for all credit types, including bad or no credit

- Check if you qualify for the card with no impact on your credit score

- Use card everywhere Mastercard®️ is accepted

- APR of 29.99%

- Initial annual fee of $75 – $125; after that, $99 – $125 annually.

Best for Single Moms with Bad Credit: WebBank Petal®️ 1 “No Annual Fee” Visa®

A great card option should have a low or no annual fee, no initial deposit, good cashback, and an opportunity to request a credit limit increase within a short time frame. With all the expenses and bills you must pay, it is not unusual for moms to have bad credit.

In such cases, we advise you to go for the WebBank Petal ® ️ 1 “No Annual Fee” Visa®️.

The issuers of this card look past your credit score when determining your eligibility. It is also a great way to build your credit. Here are its features:

- Initial credit limit of $300 – $5000

- $0 annual fee

- Variable APR ranging from 24.99%-34.49%

- Qualify for a credit limit increase in as little as 6 months. Terms apply

- 2% – 10% cash back at select merchants

- Zero foreign transaction fees

- Monthly reporting to three major credit bureaus

- No initial deposits required

- Track your money and automate your payments on the Petals mobile app

Best Card With 0 APR: Citi Simplicity

It goes without saying that an ideal card should first have 0% APR for a longer period and then features such as no annual fee, penalty rate, or late fees. The Citi Simplicity®️ card is best for single moms who want $0 APR for a long time.

This card is also lenient on late payments. Here are some of its features:

- 0% Intro APR for 21 months on balance transfers from the date of the first transfer

- 0% Intro APR for 12 months on purchases from the account opening date. After that, the variable APR will be 19.24% – 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening

- No annual fee

- No late fees

- No penalty rate

- Intro balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balance transfers completed within 4 months of account opening

- Citi® Quick Lock to keep you protected

Best for Cash Back, Shopping, and Groceries: Blue Cash Everyday®️ Card from American Express

An excellent card option in this case should allow cashback in several stores, online retailers, gas stations, and ideally, 0% intro APR. The Blue Cash Everyday®️ Card from American Express is the best for moms who want cash-back rewards when purchasing groceries, gas, and general shopping.

Its unique features are:

- Earn 3% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases, then 1%.

- Earn 3% Cash Back on U.S. online retail purchases on up to $6,000 per year, then 1%.

- Earn 3% Cash Back at U.S. gas stations on up to $6,000 per year in purchases, then 1%.

- Enjoy a $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months.

- Enjoy $7 monthly statement credits ($84 yearly in credit) to subscribe to The Disney Bundle.

- Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout.

- 0% intro APR on purchases and balance transfers for 15 months from the account opening date. After that, 19.24% to 29.99% variable APR. See Rates & Fees.

- $0 annual fee.

Best for Cash Back, 0 APR, No Annual Fee, Daily use: Chase Freedom Flex

The ideal daily-use card should have cash-back rewards, no APR, and no annual fee. Special bonuses and relative freedom when it comes to redeeming cashback too.

Moms can use the Chase Freedom Flex card to earn cash back in fixed and rotating categories. As long as you don’t mind constantly monitoring your account to keep track of its rewards structure, this card may be great for you. Here are its features:

- Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter!

- Earn 5% cash back on travel purchased through Chase Ultimate Rewards®

- Earn 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service

- Enjoy unlimited 1% cash back on all other purchases

- Enjoy a $200 Bonus after you spend $500 on purchases within the first 3 months from the date of account opening

- There is no minimum to redeem cash backs. Redeem cash back as a statement credit or direct deposit into most U.S. checking and savings accounts. You can also redeem as Gift cards (1 cent per point), travel booked through Chase (1 cent per point), and Amazon purchases (0.8 cent per point)

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.24%-28.99%

- No annual fee

- 3% foreign transaction fee

These are the quarterly bonus categories for Chase Freedom Flex in 2023:

- Quarter 1 (Jan. 1-March 31): Target. Grocery stores. Fitness clubs and gym memberships

- Quarter 2 (April 1-June 30): Amazon.com. Lowe’s.

- Quarter 3 (July 1-September 30): Gas stations and electric vehicle charging. Select live entertainment.

- Quarter 4 (October 1-December 31): To be determined

What Makes a Good Credit Card for Moms?

The best credit cards for moms offer a generous sign-on bonus, bonus points for certain types of shopping behavior, and a higher percentage for regular purchases. The best credit cards for rewards help moms lower their monthly credit card balance or put cash into the bank account when money’s tight.

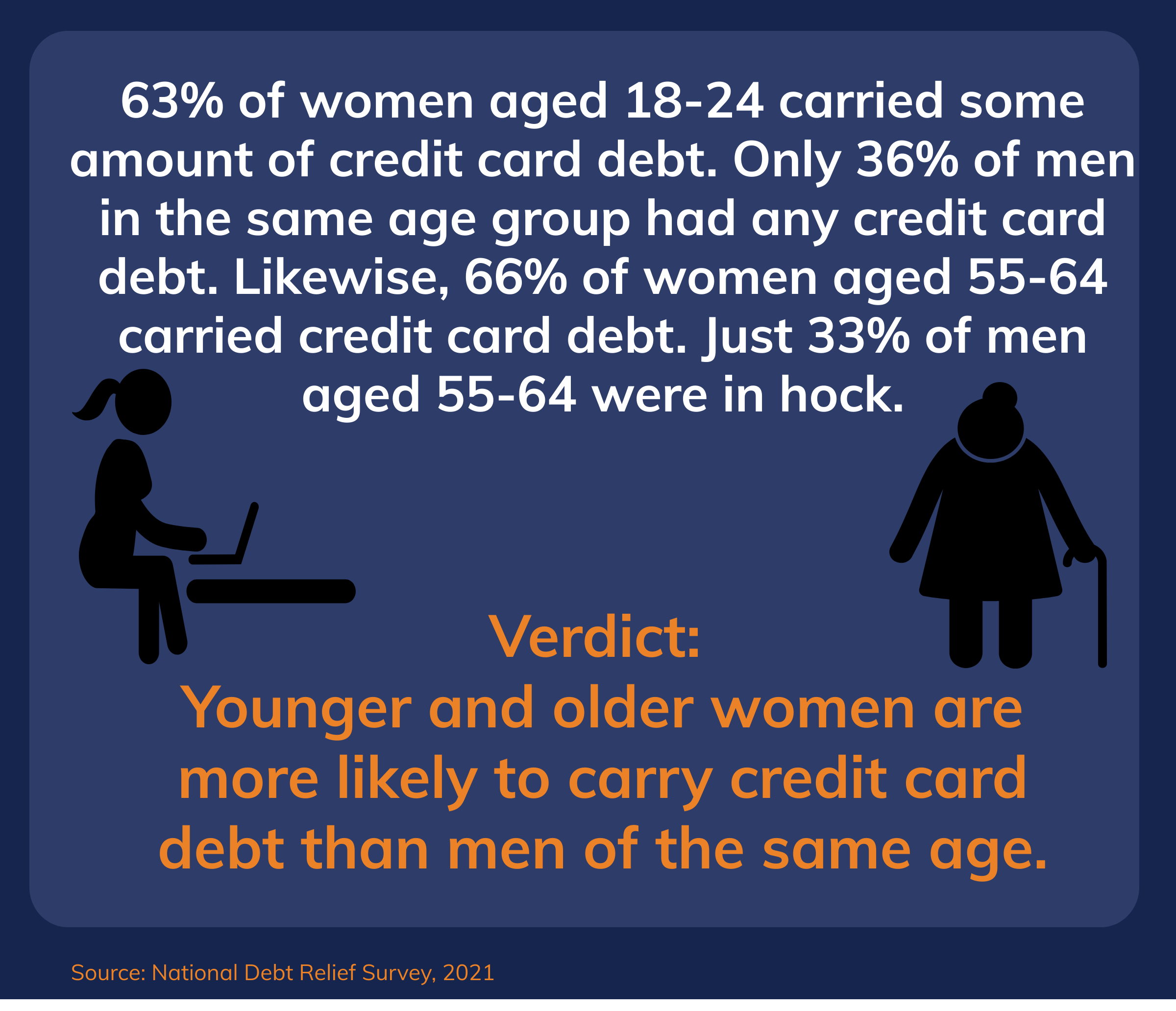

Sometimes it happens that moms are raising their kids on their own and need some extra financial help from time to time. That can mean turning to a credit card to buy needful things for the family, but it can also make it harder to stay out of credit card debt.

The best credit cards for single moms offer generous bonuses for signing up and rewards. The more rewards mom can get in her credit card statements, the easier it is for her to keep the balance low and keep her debt manageable.

Moms of all statuses benefit from having the best credit cards for cash back to help them manage the budget, build up a balance of points for a special purchase, or pay off a card balance and put more money in the bank account.

As you’re looking into the best credit cards for moms that are single, make sure that the rewards and points offered provide the best return for their use. The best credit cards for stay at home moms may not necessarily be the best credit cards for single moms because of different needs and goals.

Why is a Cash-Back Card Good for Moms?

A cash-back card is good for moms because it gives her flexibility in terms of how she uses the rewards. Mom has the option to use the cash back to pay down the balance, or she can cash out the points and get the amount deposited directly into her checking or savings account.

The best credit cards for rewards for moms are ones that give increased percentages for shopping at stores that she already frequents.

The best credit cards for cash back give points for gas stations, grocery stores, and restaurants of any type. Moms are always filling up the tank, picking up groceries, and stopping at the drive-through, so why shouldn’t she have the best credit cards for rewards in her wallet?

Credit cards are beneficial to moms in that they help her stretch the budget. Sometimes money is tight at the worst times, especially when family member needs something important for a school project or activity.

How Do You Determine the Best Cash-Back Cards for Moms?

The best credit cards for cash back helps mom buy what’s needed in a timely fashion, then helps pay for the purchase with cash back. The best credit cards for rewards are ones that have generous reward percentages on purchases.

A card that offers one percent cash back on all purchases is great, but why not look for the best credit cards for cash back that offer higher percentages on a permanent basis?

Moms who look for the best value on merchandise not only get to save on the item, they also get an extra discount in the form of a cash back reward.

Some cards come with an annual fee that’s sometimes waived for the first year. Moms who have tight budgets should look into the best credit cards for rewards and no annual fee to maximize the rewards programs.

Cards with no annual fees tend not to be as generous with rewards, but they’re also saving moms an average of $100 a year in fees. Ultimately, there is a trade-off for getting the best credit cards for rewards no annual fee with lower rewards rates.

However, the fact is, moms are still getting a cash back bonus for using their rewards cards, and that’s money they wouldn’t otherwise have by spending their cash.

Can a Good Credit Card Help Me Get Out of Debt?

Yes, a good credit card can help you get out of debt provided you use the card wisely. The best credit cards for balance transfers offer 0% interest for 12 to 18 months. The longer you can go without paying interest on a balance transfer, the better.

The transfer fee is something else to keep in mind when looking at the best credit cards for balance transfers.

The best credit cards for transfers usually charge a fee for a balance transfer of anywhere between 3%-5%. The fee is much lower than what you would pay in interest, but it does add to the amount you’re seeking to pay down.

You also need to prepare to exercise fiscal discipline when looking into the best credit cards for debt consolidation as you want to get out of debt, not deeper into it.

How Do You Determine the Best Credit Cards for Balance Transfers?

Sometimes the best credit cards for balance transfers also offer a sign-up bonus, giving you the best credit cards for sign up bonus and rewards. The sign-up bonus can consist of spending a certain dollar amount in a set amount of time, and you’ll get a portion of the money you’ve spent returned to you.

This means that you’re parking a credit card transfer balance on a card and also using it.

This is where your fiscal discipline comes into play. Your best strategy to get that cash back is to spend on that card for the cash back bonus only. Don’t use your other cards in the meantime in order to avoid increasing their balances. The best credit cards for sign up bonus have a lower spending amount that is easy to reach in a short amount of time.

The best credit cards for transfers have a no-interest period of at least 15 months with the best credit cards for consolidation offering 20 months for no interest. The longer you can go without paying interest on a balance transfer, the more money you save, and the sooner you pay down your debt.

Some of the best credit cards for debt consolidation give you a couple of months for additional balance transfers. That gives you the option to transfer multiple balances onto one card after your initial balance transfer.

How Do You Determine the Best Credit Cards for Zero Interest on Transfers?

Some credit cards offer no late fees, a long introductory 0% interest rate for balance transfers, no annual fees, or punish you by increasing your APR for a late payment. These are among the best credit cards for zero interest on a balance transfer.

You might not get a lot in the way of perks for owning the card, and a cash back rewards program may not offer much in the way of percentage rates or rewards.

However, when you want the best credit cards for consolidation, you want a card that you can use for paying off a balance without a lot of temptation. Another thing to consider when looking at the best credit cards for consolidation is how you’re going to use the card in the future.

You may need to use the card now and again, so look for the best credit cards for low interest as well as being the best credit cards for debt consolidation.

If you still have a balance after the 0% transfer period has expired, you don’t want to pay a lot in interest. The best credit cards for low interest keep the balance manageable, and make it easier to pay down even when interest is charged.

Should I Use My Credit Card for Everyday Expenses?

The concept of a credit card is that it’s a personal line of credit that you use to make purchases that you don’t have cash for at the moment. The other concept is that you do have the cash, but you want to hold it in reserve for any reason, and then pay off the balance when it comes due.

Therefore, yes, you should use your credit card for everyday expenses in order to take advantage of the best credit cards for rewards.

No matter if you carry a balance or pay it off, you’ll always get the rewards. The card issuer is giving you a rebate on your purchases, not an existing balance. Getting a rebate on your spending is something that you can’t get when spending cash.

Moms should consider the best credit cards for dining along with the best cards for gas and groceries to get a return on the money they spend.

Moms can find a rewards card for just about every type of shopping activity. The best credit cards for dining give her a break on those nights she doesn’t feel like cooking dinner and has the benefit of cash or points for buying a meal.

Shopping online for merchandise for the family can also help mom earn points for statement credit or help her put aside points for something she’s got her eye on.

How Do You Determine the Best Credit Cards for Online Shopping?

The best credit cards for online shopping offer higher percentages or extra bonus points for her shopping habits. Before deciding on the best credit cards for gas and groceries or the best cards for online shopping, make sure to read through the rewards programs, how they work, what they offer, and how points can be redeemed.

That way, single mothers can get the best cards for daily use and get more money back for her shopping habits.

Another way to use cash-back rewards cards is to pay utility bills and other recurring bills. Instead of using cash or check to pay for a recurring bill, use one of the best credit cards for paying bills and get money back for a bill that you have to pay.

Set your cash aside and pay the balance before it comes due to avoid paying interest. You benefit by getting rewarded for using your card to pay your utilities and similar types of bills. The best credit cards for utilities are any rewards card that pays at least 1% for all purchases.