Home prices have skyrocketed in recent years. Overall mortgage interest rates keep climbing (despite some negligible dips), driving up the cost of home ownership above and beyond these price increases.

The steep increase in the cost of owning a home—even compared to just two years ago—is affecting Americans at every stage of life. The extra hundreds of thousands of dollars it takes to finance a home today compared to what it cost two years ago is saddling middle-income families with insurmountable debt.

Housing Prices Have Doubled in 20 Years—and Climbed by $33K in Just Two Years

The most obvious sign of upward pressure in the current housing market is the inflation of home sales prices.

Exploring the Surge in Home Prices

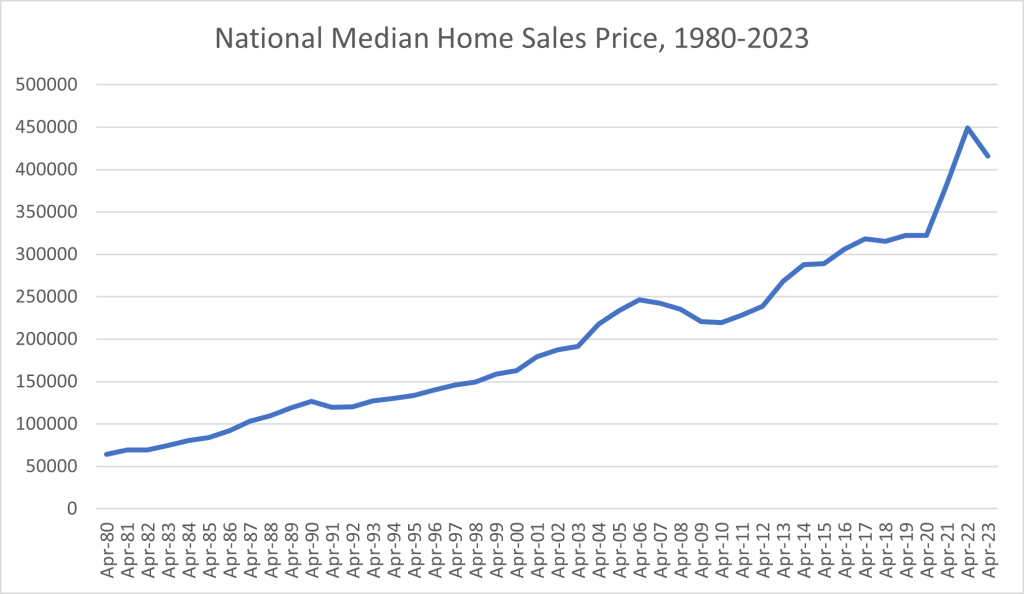

It’s no secret that home prices have exploded in recent years, in some cases pricing would-be buyers out of the market. To better understand the current cost of single-family homes for sale and how that cost has climbed compared to recent years, we should look at median sales prices as reported by the Federal Reserve Bank of St. Louis.

Housing prices are extraordinarily high right now, but technically, this year (2023) has shown a slight decrease in the median home cost compared to last year. The median price actually peaked in October 2022 at $479,500. By January of 2023, it was down (compared to the highs of 2022, that is) to $429,000. The most recent Federal Reserve data shows a median price of $416,100 as of April 2023.

Still, this $416,100 price point marks an increase of more than 8% from 2021, when the median price was $382,600. The current median cost is an increase of almost 33% compared to January 2017, when the median home cost was $313,100. Compared to 2013, when the median cost of a home amounted to $268,100, the median cost has climbed by more than 55% over a decade. And compared to 20 years ago, when the (2013) median home cost was $191,800, that increase adds up to more than 115%.

Housing prices, in and of themselves, may have dropped by a marginal amount in 2023 compared to 2022. However, what’s more important is the reality that the market remains nowhere near as affordable as it was even a couple of years ago—and every single percentage point by which the interest rate increases makes this problem even worse.

The housing market isn’t static year over year, and it wasn’t even before the current jump in sales prices. In general, moderate increases in property value are signs of good health in a housing market. For most of the decade between the Great Recession’s housing market crash and the start of the COVID-19 pandemic, home sales prices increased by an average of 3% to 5% per year, insurance comparison website The Zebra reported. Double-digit price jumps between 2020 and 2021 and 2021 and 2022—12% and 15%, respectively—drove sales prices up at rates well beyond what economists and homebuyers could have expected based on the trends that preceded these years.

Although the median home cost is down slightly from a year ago, buyers are still reckoning with the consequences of two years of over-the-top price increases.

The lowest median home prices in the last 20 years occurred in 2003. January 2003 saw median prices hover around $186,000. Compared to this figure, the median home cost has more than doubled in 20 years. Such a drastic increase in median home prices has happened before. For example, between January 1983 and January 2003, the median home cost more than doubled from $73,300 to $186,000. Still, the much larger amounts of money we’re looking at today compared to in the 1980s or 2000s make these huge increases even more impactful when it comes to how much new homebuyers have to spend to get a house and who can actually afford to do so.

Average vs. Median Prices

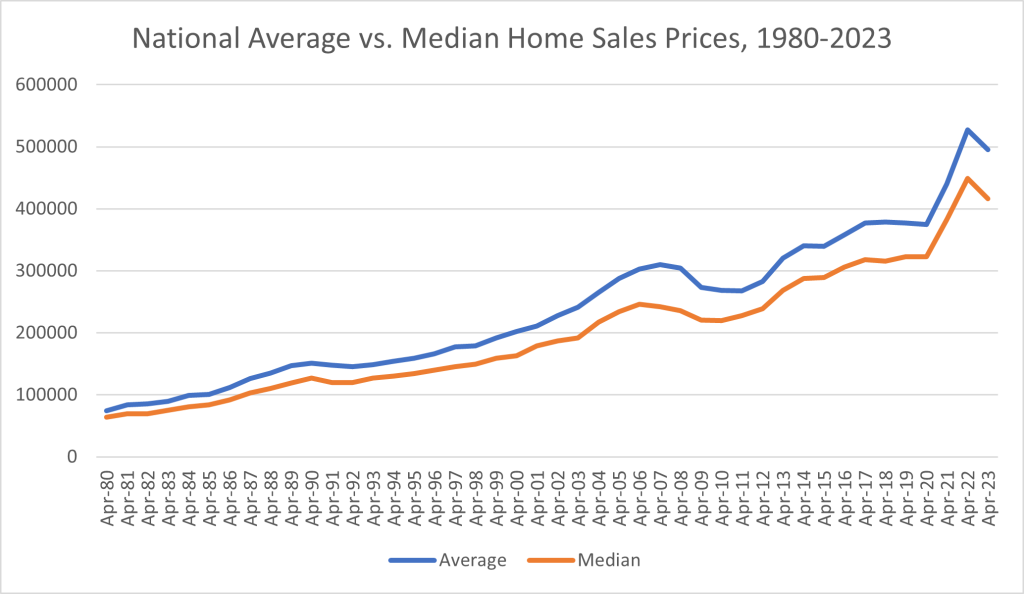

When looking at housing market data, it’s important to distinguish between average and median sales prices. Although both statistics can be used to measure the cost of housing, they aren’t interchangeable. The Federal Reserve Bank of St. Louis reports average as well as median home prices.

Because outliers like exceptionally expensive properties can skew the average home price higher, we’re concentrating primarily on median, or midpoint, prices. Still, it’s helpful to be aware of the trends in average housing costs and how they correlate with trends in the median cost of a home.

Federal Reserve data shows that the gap between the average home price and the median home price has grown larger over the past few decades. In 1980, that difference amounted to a little over $10,000. Today, it amounts to $79,000.

The average sales price of homes sold in the United States was $495,100 in April of 2023, which is nearly 20% more than the median home cost. Like the median prices, average prices in the housing market have dropped slightly since they peaked a year ago (in October 2022)—at $552,600—but they remain a great deal higher than pre-pandemic costs.

Mortgage Interest Rates Hikes

The massive jump in home values compared to a few years ago may be where sticker shock hits prospective homeowners the hardest. However, behind the scenes, the climbing mortgage rate is driving up the cost of home ownership even more.

Mortgage Rates Reached a 20-Year High in 2023

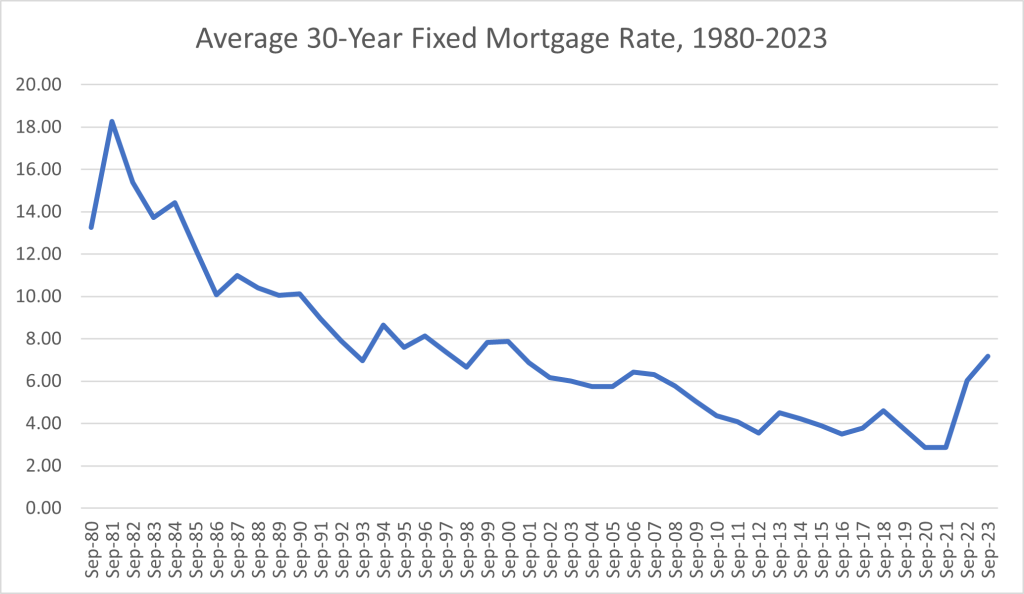

In September of 2023, the national average interest rate for a 30-year fixed-rate mortgage amounted to 7.18%, the Federal Reserve Bank of St. Louis reported. That’s a dramatic increase from just two years ago, when the average interest rates (as of September 16, 2021) hovered at 2.86%. Although this figure is slightly down from the April 1, 2021, high of 3.18%, it reflected the overall average for that year of interest rates around (and, at times, under) the 3% mark.

Technically, the 7.18% average interest rate reported for September 2023 isn’t a record high. In mid-October of 1981, the average 30-year mortgage rates were above 18%. Still, this is the highest the average mortgage rates have been in over 20 years. Taken together with the massive increase in the median sales price of homes—which, for the record, was just $69,200 in 1981 and remained below $190,000 throughout 2001, compared to the $400,000+ it is now—these high mortgage rates are particularly problematic.

The Impact of Spiraling Mortgage Rates on the Housing Market

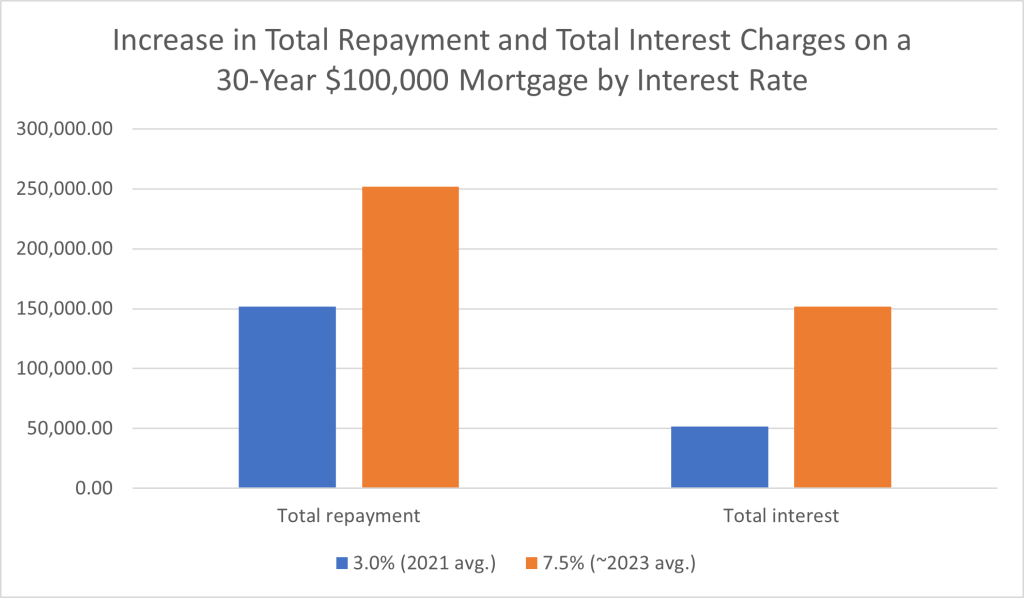

Let’s take the surging home prices out of the equation for a moment and focus instead on the impact of high mortgage rates. Using an amortization calculator like the one at bretwhissel.net, we can compare the impact of rising interest rates on the same dollar amount—say, for the sake of simplicity, $100,000—to get a sense of just how much this factor affects the cost of homeownership.

At an interest rate of 3.0%, $100,000 financed over 30 years amounts to a total repayment of $151,776.00. Borrowers would end up paying $51,776 in interest alone. Of their $421.60 monthly payment, interest would account for $250. (Remember, this rate is per $100,000 borrowed.)

When the interest rate climbs to 7.5%, as it came close to in August 2023, the impact it has on the cost of home ownership is huge. That same $100,000 mortgage loan, again financed over 30 years, now raises the total repayment amount to $251,715.60. A whopping $151,715.60 of that payment is pure interest.

That’s right—the interest alone under this high mortgage rate is almost as much as the entire principal plus all interest under the 3.0% average (give or take) interest rate just two years ago.

Under this 7.5% interest rate, the monthly payment amount per $100,000 financed climbs to $699.21, a difference of 66% compared to the more reasonable 3.0% interest rate. Perhaps the most stunning reality is that $625 of the $700 monthly payment, or 89%, is pure interest. No wonder borrowers whose mortgage rates are in the 7.5% range end up paying 2.5 times the amount they originally borrowed once the 30 years of interest payments are factored in.

The upshot of these rising mortgage rates is that financing just $100,000 for a home at average interest rates now costs 66% more than it did two years ago, even without factoring in the increase in home prices. In the real world, of course, there’s no taking home prices out of the equation. Today’s buyers are being hit with a double-whammy of record-high home prices and soaring interest rates. That’s what makes this housing market so incredibly challenging even compared to times, like the 1980s, when interest rates were in the double digits.

What the Current Housing Market Means for Prospective Buyers

It’s safe to say that the cost of buying a new home—with a mortgage loan—has reached a new high. Between the jump in the median price of houses nationwide between 2021 and 2023 and the elevated mortgage rates, it costs twice as much to buy a home now as it did two years ago.

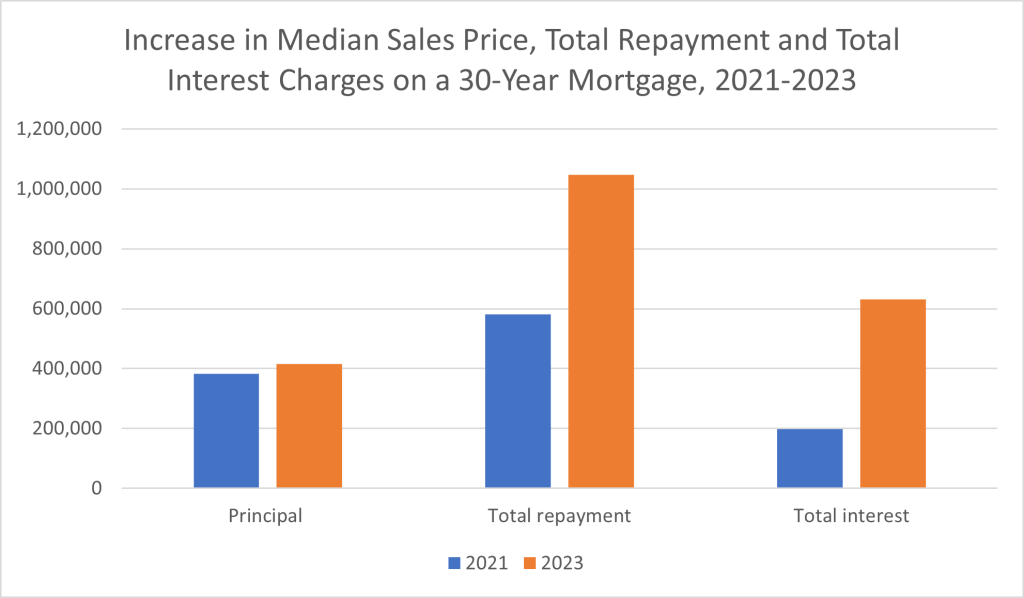

Let’s explore these numbers. To see the difference in home buying costs over just two years, we’ll use the median sales price from the second quarter of 2021 and the second quarter of 2023, with the 3% and 7.5% interest rates as referenced above. To make things even, we will use the median home sales prices as the principal borrowed, although it would obviously put real homebuyers in a better position if they have a down payment to apply toward their new home purchase.

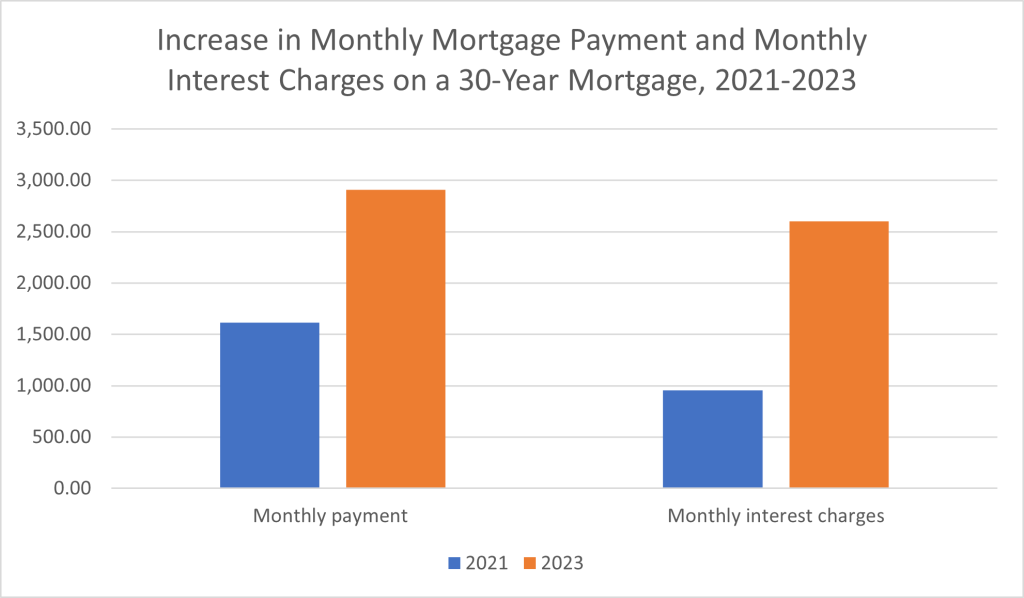

If you borrowed $382,600, the median sales price of a home in the second quarter of 2021, at an interest rate of 3%, you would end up paying $580,701.60 over the course of your 30-year mortgage. As it is, that’s a lot—upwards of 50% more than the principal loan amount. You would wind up paying $198,101.60 in interest alone. Your monthly mortgage payment (not including taxes, homeowners insurance, and homeowners association fees) would be $1,613.06, of which $956.50 was pure interest.

Fast-forward to the second quarter of 2023. At an interest rate of 7.5%, a 30-year mortgage on the $416,100 median home price would amount to a total repayment amount of $1,047,394.80. By the time you paid off your mortgage, you would have paid two and a half times (250%) the principal loan amount. Your interest charges alone would add up to $631,294.80, or 50% more than the principal amount. Your monthly payment would climb to $2,909.43, and $2,600.63 (almost 90%) of that monthly payment would be interest.

Whether you’re looking strictly at monthly payments or at the total mortgage loan repayment amount, the data is clear: the cost of buying a home has nearly doubled in just two years.

We’ll explore the reasons for this crisis—which range from shifts in the population and its housing needs to the vocally (and bitterly) decried greed of institutional investors—in the next article. What federal government data, academic institutions, industry associations, and credible national news sources all agree on is that, at least for many middle-income Americans, the housing market is in trouble.