Like it or not, the pharmaceutical industry is a critical part of the healthcare system.

As we explore how to improve the pharmaceutical industry—through numerous facets, including economics, ethics, and technology—a clear picture of the need for balance emerges. Continuous improvement in the pharmaceutical sector requires constant adjustments to business strategies, economic decision-making, drug pricing policies, technology integration, and corporate responsibilities.

How Does the Pharmaceutical Industry Work?

To understand the operations of and profitability in the pharmaceutical industry, you need to know how this industry works.

Drugmakers don’t just get an idea for a new medication, start manufacturing it, and put it on the market. New drugs are developed through years of scientific research. Only after a drug has undergone a significant amount of laboratory testing do pharmaceutical companies begin the clinical testing on human subjects that is required to obtain approval from the United States Food and Drug Administration (FDA).

Getting a new drug on the market takes a great deal of time and money. What makes innovation worthwhile for pharmaceutical companies is the patent they are awarded that, for 20 years, allows the company to be the exclusive producer of the drug. This gives the company a competitive advantage. Until that patent ends, no other company can sell the pharmaceutical product they have developed. Once the patent ends, other pharmaceutical companies can begin producing and selling generic forms of the medication.

Naturally, pharmaceutical companies make more money during the years that a patent on a drug gives them a competitive advantage. In fact, the Markkula Center for Applied Ethics at Santa Clara University reported in 2023 that the first appearance of a generic version of a drug reduces the price of the medication by a median of 30%. Once multiple manufacturers are competing to produce the medication at lower costs, the price of the drug can plunge by as much as 95%.

The 20-year patent pharmaceutical companies are rewarded with begins long before the product enters the market. It can take 10 or even 15 years for the drug to be approved, which leaves the manufacturers of name-brand medications relatively little time to recoup their investment in developing the drug and bringing it through the multiple phases of clinical trials required for FDA approval.

Often, drugmakers buy themselves more time through a process known as “evergreening,” the Markkula Center for Applied Ethics at Santa Clara University reported. Making minor adjustments to the use, packaging, or delivery of a pharmaceutical product may qualify the company to extend its patent and keep raking in the profits. While these changes may constitute “valid improvements,” they may also be “inappropriately applied” for little other reason than to benefit the drugmaker, according to the Markkula Center for Applied Ethics.

The process of bringing new products to the market is different in the pharmaceutical industry compared to other industries. It makes sense, then, that there are unique factors involved in the operations and profitability of this industry.

What Do Pharmaceutical Companies Do Well?

How is the pharmaceutical industry doing? Overall, this historically profitable industry is doing well, although perhaps not as well as some other industries.

While numerous industries were harmed by the COVID-19 pandemic, the demand for vaccines boosted this industry’s profitability. In fact, two COVID-19 vaccines were among the top three best-selling pharmaceutical medications in 2021, according to Statista.

In recent years, emerging markets across the globe have presented new opportunities to boost the profits of pharmaceutical companies. Major pharmaceutical companies have eagerly seized this opportunity.

AstraZeneca, for example, reported “particularly strong” performance in leading emerging markets. In the first quarter of 2023 alone, the company reported $3.1 billion in sales of pharmaceutical products in emerging markets, according to Reuters.

What Is the Pharmaceutical Industry Worth?

Let’s first look at the financials: How much does the pharmaceutical industry make?

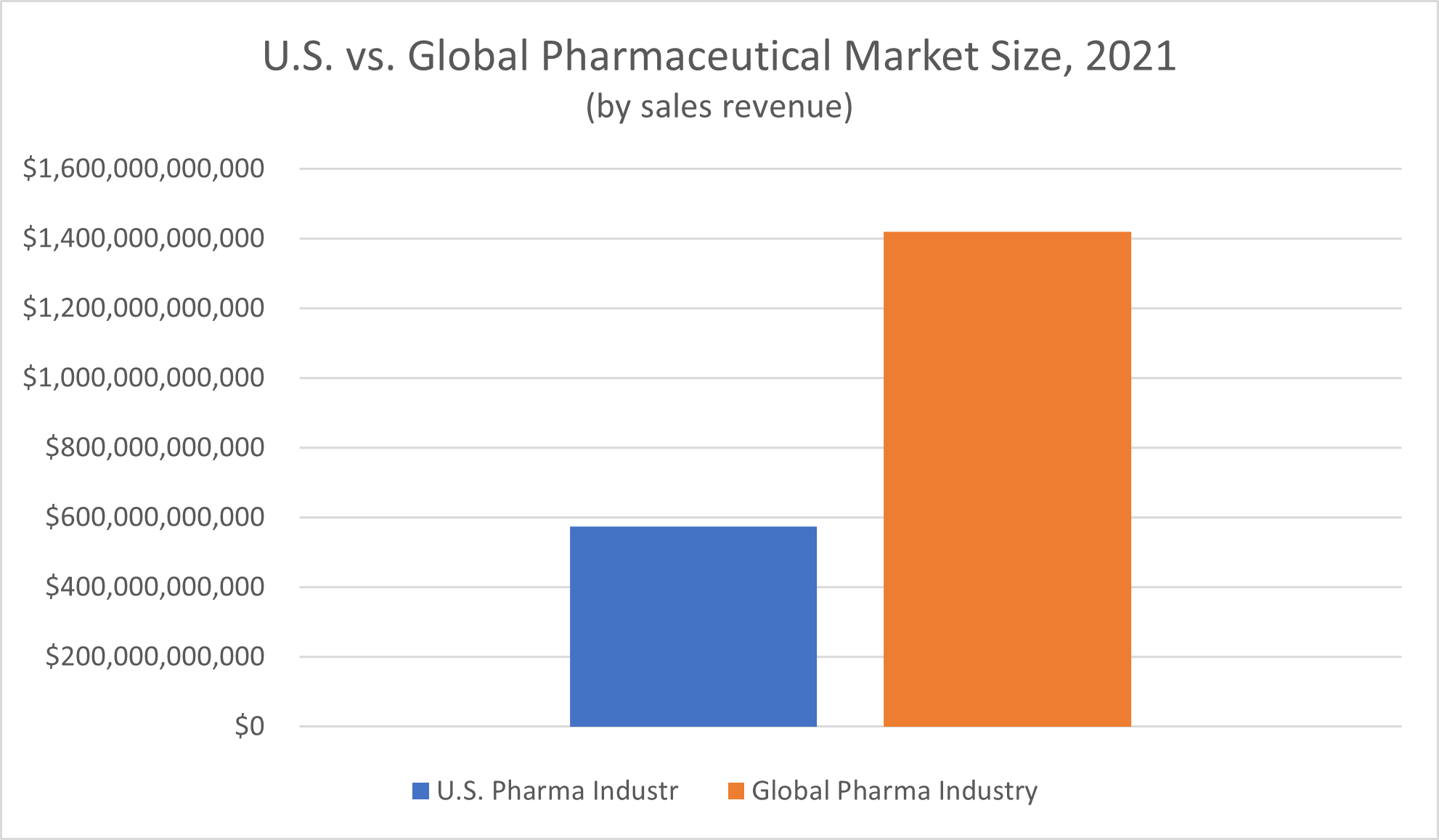

Global spending on pharmaceutical products tops $1 trillion annually. According to Statista, revenue of the global pharmaceutical market in 2021 amounted to $1.42 trillion.

The United States makes up a significant portion of this global market—over 40%. Nominal spending on pharmaceutical medicines in America in 2021 amounted to $574 billion, Statista reported.

Is the pharmaceutical industry the most profitable industry? Despite the massive revenue the market brings in, no, it’s not. “Returns from pharmaceutical companies lagged the S&P 500 by about one-third,” PricewaterhouseCoopers LLP (PwC) reported in 2022.

Still, the winners in this competitive industry tend to win big. “The divide between the leaders and laggards has been widening,” PwC reported, based on a 2021 review of shareholder value in the pharmaceutical industry over the past five years. While the total shareholder return of the top-performing quintile of pharmaceutical companies climbed by 29% during this time, the total shareholder returns of the companies that made up the bottom quintile decreased by 11%.

Could Pharma Companies Be Doing More to Bring Value?

From several standpoints, the pharma industry is successful. Financially, pharmaceutical companies manage to make a considerable profit despite the expenses of research and development, clinical trials and significant government regulation. From a healthcare perspective, it’s hard to overstate the impact of having safe, effective, extensively researched medications widely available to treat both common and severe medical conditions on public health and the health of individual patients.

Yet there are always opportunities for an industry or company to do more—whether that means boosting value for shareholders, improving access to much-needed medicines in emerging markets around the world, or developing cutting-edge new drugs to cure, treat, manage, or prevent serious medical conditions.

With these opportunities in mind, we asked a simple question with complex answers: how can the pharmaceutical industry be improved?

10 Ways the Pharma Industry Can Do Better

#1: Invest in Strategies and Equipment for Long-Term Success

From a financial standpoint, pharma companies, like companies in all industries, make choices about how they use their resources.

That is, when they need raw materials, supplies, and equipment to perform the work of developing drugs, do they treat this need as an expense to be minimized or an investment to make the most out of?

Investing in equipment that will last longer and be more reliable in the long term is one major way pharmaceutical manufacturers can improve productivity, according to industrial automation software manufacturer COPA-DATA Group.

The business strategies and manufacturing equipment that cost the least in the short term may end up costing more long-term, especially if they cause more frequent machine downtime that affects productivity. Perhaps the worst-case scenario is a premature equipment failure that requires early replacement. Pharmaceutical manufacturers in this situation face the added expense of buying new equipment all over again, as well as the downtime (and loss of productivity) that results from having to remove faulty equipment and install new equipment.

IMAGE SOURCE: Root66, Wikimedia Commons, Creative Commons Attribution-Share Alike 3.0 Unported, 2.5 Generic, 2.0 Generic, and 1.0 Generic licenses

It isn’t only in the initial purchase of the equipment itself that pharmaceutical manufacturers make these decisions. Performing routine maintenance on equipment is a task that adds financial costs (and potentially downtime) to the drug manufacturing process yet can spare pharmaceutical companies more pain down the road. It may be cheaper in the short term to skip routine maintenance recommendations when everything is running smoothly, but doing so can contribute to equipment problems later on that carry a much greater cost.

A fixed maintenance schedule or reactive maintenance program is better than no maintenance process. However, a predictive maintenance program that uses sensors to reliably forecast when the equipment will actually need maintenance—and plan the ideal time to perform the work—is even better, the COPA-DATA Group reported. Again, the sensors that collect the data used in predictive maintenance programs represent both an extra cost in the short term and potential savings in the long term.

The equipment used in the drug manufacturing process is just one example where this strategy of long-term investment decision-making matters in the pharmaceutical industry. It can be applied to everything from laboratory space used for drug development to the raw materials used in drug production processes.

Even in human resources aspects of operations, pharma leaders should consider the short-term and long-term needs of their growing companies. That is, while hiring less qualified workers for certain roles can reduce costs in the short term, it may make sense for pharmaceutical companies to consider spending more money to attract more highly qualified scientists and researchers. Alternatively, hiring workers with the lowest level of qualifications required for a given job but supporting their professional development through tuition assistance programs may offer the best of both worlds.

In the real world, though, even the most profitable pharmaceutical companies have to balance short-term needs and long-term goals. Choosing the cheapest options in every business investment a pharmaceutical company makes is short-sighted and likely to hinder growth in the long term. On the other extreme, constantly splurging on the highest quality of everything will quickly put a company over its operating budget. The challenge for the leaders of pharmaceutical companies is to make smart choices that balance current budget constraints with long-term goals and strategies.

#2: Build a Better Image With Consumers

The pharmaceutical industry has a major public image problem.

A 2022 Gallup, Inc. poll on Americans’ Views of U.S. Business and Industry Sectors found that just 25% of Americans reported having a favorable (“very positive” or “somewhat positive”) view of the pharmaceutical industry. That low rate of favorable perception places the pharma industry among the three industries with the lowest approval rates in America. Just as small a proportion of the public had a positive view of the federal government, and only the oil and gas industries fared worse, with a 22% rating.

This low approval rating can’t be explained away as mere apathy. Gallup reported that 58% of respondents gave the pharmaceutical industry negative ratings.

Does it matter what the people think of Big Pharma? If they need the medications pharma companies create, won’t they buy them regardless of their disapproval of the industry? What’s it matter if they grumble a little bit while they’re opening up their wallets?

Once upon a time, this may have been the case. Today, though, the pharmaceutical industry is changing. These changes include the way patients use medicine and the amount of say they have in their healthcare.

A major factor in these changes, Forbes reported, is the cost of healthcare and especially medications. Drugs that were once fully covered by health insurance now require copays in significant amounts. A medication for which the copay is “only” $30 could still add up to hundreds of dollars over the course of a year. If the drug is a name brand, customers may have to pay even higher copays—if the drug is covered at all.

As people have been stuck paying more for their medications over the past decade or so, Forbes noted, they’re also paying more attention to how much these drugs cost—and whether they’re worth the price.

This is, essentially, the value proposition pharmaceutical medications offer consumers. Pharmaceutical Executive Magazine describes the core elements of value propositions in the pharmaceutical industry as price and clinical benefit. As Forbes explains, when the costs of prescription drugs creep up, consumers “start weighing the pros and cons of the drug, and whether they can live without it.”

In some cases, they’re willing to stop buying the medication. They may:

- Switch to a lower-cost alternative on the pharmaceutical market

- Look for a non-pharmaceutical supplement that will help them achieve similar effects

- Prioritize other methods of managing conditions, such as through lifestyle changes

- Simply go without, even if doing so has negative effects on their health

Realistically, this evolution in consumer decision-making would apply to increasingly expensive (for the patient) medications even if the popular view of the pharmaceutical industry was all sunshine and rainbows. When the financial costs rise beyond a family’s budget, something has to give. However, the overwhelmingly negative public perception of Big Pharma definitely contributes to consumers’ interpretation of both elements of a drug’s value proposition.

A lack of trust in pharma companies can easily lead patients to undervalue the clinical benefits of a medication, especially in the absence of hard data. More favorable values on lab tests might offer some concrete evidence of a drug’s clinical benefits. On more subjective matters, like medications’ effects on depression or one’s ability to focus, any real clinical benefit may be drowned out by the suspicion patients have that the drug companies don’t really have their best interests at heart. Naturally, the high-profile pharmaceutical industry controversies about companies drastically increasing prices for no good reason can also affect consumers’ perception of the drug’s cost—even if the price of the drug in question is reasonable.

The unpopularity of the pharmaceutical industry conveys consumers’ negative perception of the industry’s ethics. Yet the importance of ethical behavior is paramount in this industry.

Clinical trials involving human participants must be conducted appropriately, with participants giving informed consent and not being subjected to undue harm. The data pertaining to a medication’s safety and efficacy produced by these trials must be collected properly and analyzed and expressed with integrity, even when the findings go against the interests of the pharma companies. Once the medication is approved for the market, high product quality assurance is integral to making sure individual batches of medications are free of contaminants and contain exactly—and only—the intended ingredients.

Finally, medications—especially those that the patient needs to live—should be sold at reasonable prices. Certainly, one of the major factors in consumers’ distrust of pharmaceutical companies is the high costs of pharmaceutical products.

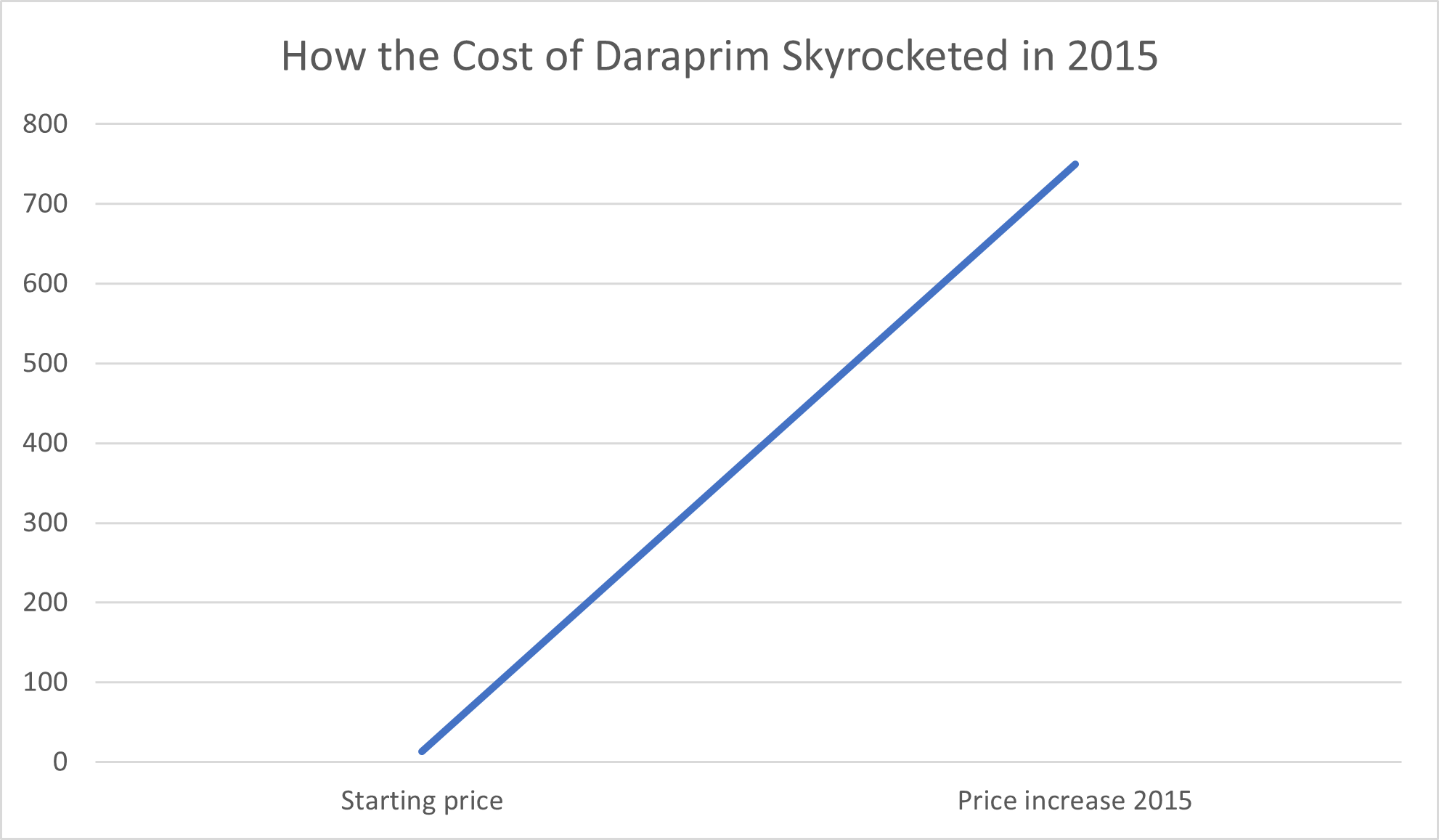

Consumers have good reason to be wary of greed in the pharmaceutical industry, whether from large pharmaceutical companies or new start-ups. For example, in 2015, Turing Pharmaceuticals raised the price of Daraprim, a drug used to treat parasitic infections that can be fatal in babies and people with compromised immune systems, 50-fold. Behind this overnight leap from $13.50 per pill to a mind-blowing $750 per pill was former hedge fund manager Martin Shkreli, who, The Guardian reported, defended the price hike on the basis that “the profits will help create better medicines in the future.”

Also in 2015, pharmaceutical company Mylan “jacked up the price of life-saving EpiPens by more than 400%,” in the words of the Los Angeles Times. The company later produced a generic “merely tripling the price” EpiPens had previously sold for. The Los Angeles Times noted that Mylan “did no research to create” EpiPens, having only purchased the right to sell the products, and suggested the reason for the massive price hike was little more than “unfettered corporate greed.”

Price hikes by pharma companies have continued to persist since these events, riling up public outrage with each headline. January 2023 saw pharma companies raise prices on close to 1,000 drugs, USA Today reported. While the median price increase amounted to 5%, the increase for dozens of medications climbed to 10% or more—and the price of one drug, Omnipaque, jumped by 26%.

Drug pricing is a particularly visible and complex area of ethics. On the one hand, it is true to some extent that the profits pharmaceutical companies make from their existing drugs drive innovation in future pharmaceutical development. Without this funding, further development of drugs to treat acute medical conditions and chronic diseases would falter. On the other hand, though, the costs of research and development fail to fully explain massive jumps in drug prices, especially pertaining to drugs that have been on the market for years.

Pharmaceutical companies really do take on a great deal of expense when going through the drug research and development process. The median capitalized cost of bringing a new medication to the market in the United States between 2009 and 2018 was $985.3 million, the Journal of the American Medical Association (JAMA) reported in 2020. The average amount invested in drug research and development was $1335.9 million. In the most expensive therapeutic area, JAMA reported a median cost of $2771.6 million. These astronomical figures are a valid reason it isn’t always possible for pharma companies to simply “lower costs.”

Part of the problem of the costs of drug development is the high failure rate of drug research and development. In an article published in Acta Pharmaceutica Sinica B (the English-language Journal of the Institute of Materia Medica, the Chinese Academy of Medical Sciences and the Chinese Pharmaceutical Association), researchers reported a clinical drug development failure rate of 90%. The Library of Economics and Liberty recounted an even higher failure rate, reporting that just one in 50 new drugs in the development process ever make it to the market.

Often, the FDA reported, these drugs make it through at least one phase of testing before failing. The farther a new drug in development gets through the testing process, the more money the pharmaceutical company is sinking into research that could ultimately turn into nothing. In that sense, charging higher drug prices is a form of risk management—a way to insulate the company from potentially catastrophic failures of drugs currently in development.

That said, the notion that all drug prices have to be as high as they are because of these risks and expenses is simply not true. Pharmaceutical companies are profitable, even with the high costs of research and development. There are economic challenges facing the pharmaceutical sector, but the costs of clinical development, while high, don’t fully explain high drug prices.

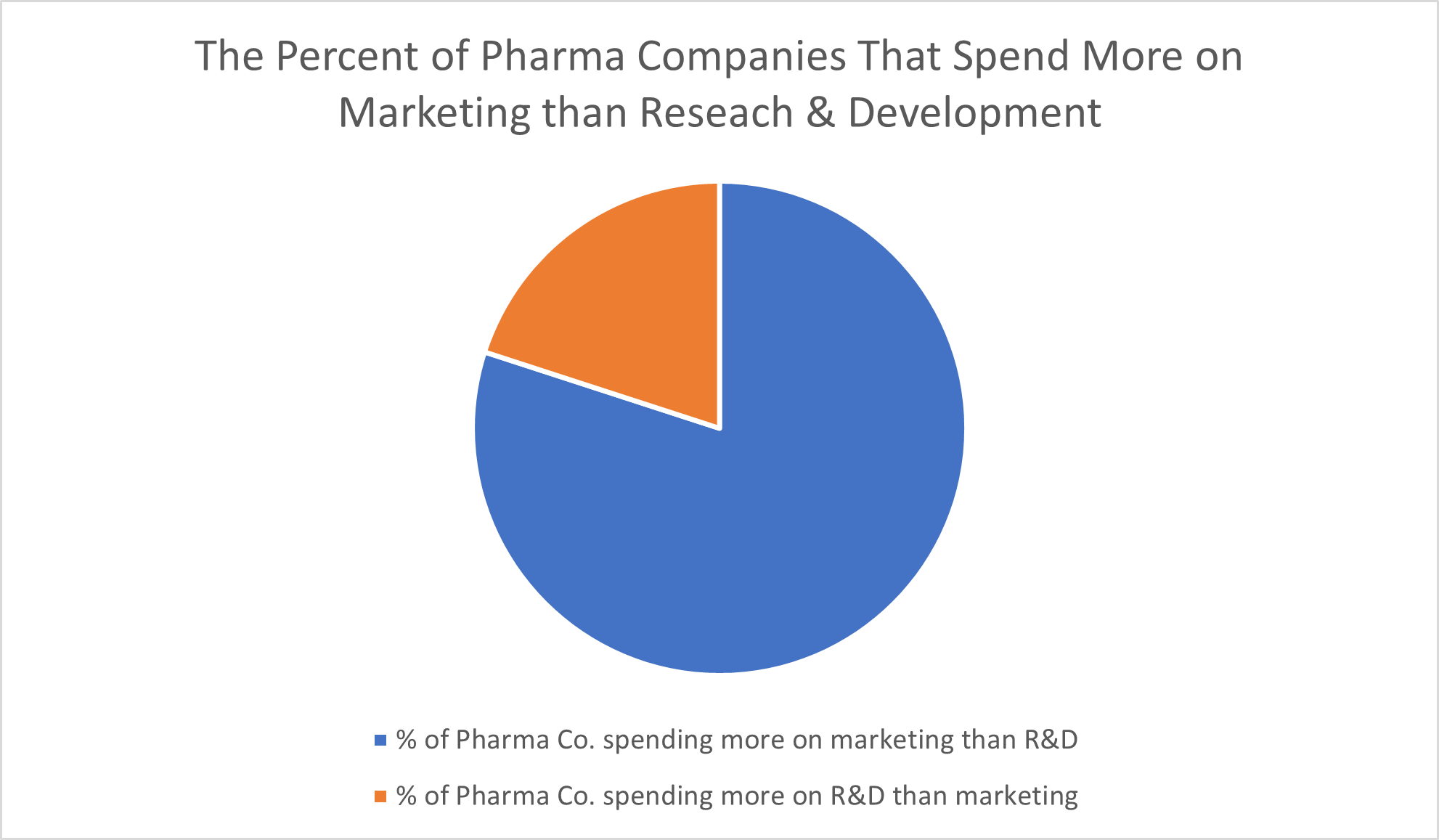

The American Hospital Association concluded in its 2017 report “High & Rising Drug Prices: Myth vs. Fact” that eight out of 10 pharmaceutical companies “spend more on advertising than on research and development.” Sure, some marketing costs are expected, but blowing such a significant amount of funds on marketing campaigns constituted, to the researchers, “unnecessary spending that they instead could put toward research and development or lowering the cost of a drug.”

International nonprofit organization Médecins Sans Frontières (MSF), also known as Doctors without Borders, goes even further in its assertions. “Big Pharma exaggerates the costs of R&D of new medicines to justify their high pricing, and often categorise ‘opportunity costs’ and non-research activities, such as the cost of buying another company, as R&D costs,” it said in a 2019 article. Further, MSF points out that the pharmaceutical industry “pockets more than they re-invest,” that companies frequently abuse the patent system by making minimal changes to products primarily to extend patents, and that tax credits, taxpayer-funded grants and other financial incentives make up for some of the risks and costs of developing a new drug.

#3: Make More Efforts to Positively Impact Healthcare

How does the pharmaceutical industry influence healthcare? Pharmaceutical innovations of the past are critical to the healthcare system we have today.

Medications made by pharmaceutical companies save lives, allow for the management of chronic diseases, and may prevent conditions from worsening. Vaccines drastically reduce the risk of contracting infectious diseases in the first place, including diseases—like polio—which were once both alarmingly common and severe enough to cause death or permanent disability.

Yet opportunities still exist for pharmaceutical companies to have a positive impact on healthcare. For example, medication nonadherence, or failing to take the medication prescribed to a patient, is a major problem in the healthcare system. By some counts, the proportion of patients who have trouble taking their medication as directed is as high as 50%, 65%, or even 75%.

When patients don’t take their medication, they don’t receive the clinical benefits their doctors are trying to provide them. Infections may spread, and chronic diseases can progress to more advanced and serious stages. The pharmaceutical industry feels this hurt, too, as it loses money when patients fail to refill their prescriptions.

Can the pharmaceutical industry improve patient medication adherence rates? Lowering drug prices is one major step pharmaceutical companies can take. “Millions” of patients don’t take the medicines their doctors prescribe purely because of the cost, Harvard Health Publishing (by Harvard Medical School) reported in 2015. Aside from efforts to reduce costs, pharmaceutical companies can also make it easier for patients to take their medicine in other ways.

IMAGE SOURCE: LadyofProcrastination, Wikimedia Commons, Creative Commons Attribution-Share Alike 2.0 Generic license

“Drugmakers from London to Tokyo to Cambridge, Mass., are pouring money into programs aimed at cajoling — or nagging — patients to take every last pill their doctors prescribe,” STAT News reported in 2016. These efforts range from planning events and campaigns to inform patients of the importance of medication adherence to sending patients gift cards to reward them for refilling their prescriptions and even embracing futuristic technologies like ‘smart’ pills. In the medication development stage, finding ways to improve efficacy and reduce side effects can also make patients more likely to adhere to their doctors’ orders and take their medicine.

#4: Get More Out of Technology

Technology is shaping the future of business in all industries. The pharmaceutical development and manufacturing industry is no exception.

The pharmaceutical industry already uses technology in a variety of ways, including through the development process and the manufacturing process. Yet there are hitherto missed opportunities that pharmaceutical companies are only beginning to seize.

Take artificial intelligence, for example. Calling artificial intelligence “an important trend in the pharmaceutical industry,” the George Washington University School of Business noted numerous applications of AI for drugmakers. Among the ways artificial intelligence can help the pharmaceutical industry are supporting clinical trials, processing large amounts of data, automating manufacturing processes, enhancing quality control and assurance and developing new marketing approaches.

Other technologies the pharmaceutical industry should embrace more thoroughly in the years to come include blockchain technologies to store and secure data and employing enterprise resource planning software systems that allow for integrated management of all aspects of the business.

#5: Develop More Efficient Methods of Compliance

The pharma industry is one of the most heavily regulated industries—and for good reason. The products this industry produces have direct impacts on its customers’ health. Shoddy product quality may be undesirable in many areas of consumer products, but in pharmaceutical products, it can be downright dangerous.

Regulations are an inevitable part of the drug industry in America. While complying with these regulations is always going to put some level of a burden on pharmaceutical companies, one way to minimize this burden is to develop more effective methods of complying with these regulations.

One of the easiest and most effective ways to maximize the efficiency of complying with regulations is to adopt technologies that streamline compliance, according to the COPA-DATA Group. When pharmaceutical manufacturers switch from paper-based data recording methods to electronic data recording technology that produces quality assurance reports and compliance documentation simply—even automatically—the potential impact on the time and effort a company must devote to compliance is huge.

#6: Promote Transparency in Dealings With Government Regulators

Pharmaceutical companies’ dealings with federal government agencies like the FDA, the Centers for Disease Control and Prevention (CDC), and the National Institutes of Health (NIH) don’t end with matters of compliance.

From both an ethical and public relations standpoint, the pharmaceutical industry should make efforts to be more transparent about relationships with these regulators. Government scientists do profit from big pharma’s successes. While it isn’t always inappropriate for them to do so, the secrecy with which these payments occur can give rise to scandals.

In a June 2022 article published in the Washington Examiner, nonprofit organization OpenTheBooks.com reported that, based on government disclosures produced under court order, “NIH and its scientists received an estimated $400 million in third-party paid royalties” between 2010 and 2020. More than 1,800 current and former National Institutes of Health scientists were among the recipients of the tens of thousands of royalty payments pharmaceutical companies made government scientists during this decade.

Is it improper for government scientists to receive these royalty payments? Maybe, but maybe not. It’s certainly possible that these royalties can, at least in some instances, constitute conflicts of interest—a fact that the media has not only picked up on but spun as arguments for congressional reform at best or conspiracy theories at worst.

“The question of whether or not these royalty payments are a good thing is a complex and controversial one,” biotech industry media company BioBuzz Media reported. The benefits of including these royalty payments in the current system of scientific research and drug development include incentivizing innovative research and the process of transforming the findings of taxpayer-funded research into actual medications on the market. Yet, BioBuzz Media noted, “These payments also create a financial incentive for researchers to prioritize the interests of the pharmaceutical industry over the public interest.”

Royalty payments from Big Pharma to government scientists “are in order” in situations “when bench scientists’ research leads to monetized benefit in the private sector,” author Wesley J. Smith acknowledged (if grudgingly) in an article published in the conservative editorial magazine NATIONAL REVIEW in May 2022. Yet Wesley particularly took issue with the revelation that some of the royalty payment recipients worked in leadership and administrative positions rather than research roles with the NIH.

What really muddies the matter of royalty payments from pharmaceutical companies to government scientists is the lack of transparency around these payments. For example, among the most controversial instances of pharmaceutical royalty payments made to NIH employees were those made to Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases. During the height of the COVID-19 pandemic, Fauci became a household name.

“Dr Anthony Fauci told the BMJ that as a government employee he was required by law to put his name on the patent for the development of interleukin 2 and was also required by law to receive part of the payment the government received for use of the patent,” the British Medical Journal reported in 2005. Fauci was already head of the National Institute of Allergy and Infectious Diseases at the time. The BMJ reported that Fauci “said that he felt it was inappropriate to receive payment and donated the entire amount to charity.”

Yet the government has consistently chosen not to be forthcoming in sharing this information, even when scientific publications, the press, and government watchdog organizations have requested it. In fact, the government ignored the Freedom of Information Act requests OpenTheBooks.com filed. The government only complied with the request under a court order issued after the organization sued the National Institutes of Health. Even then, the government redacted critical information—leaving the data left intact in the released data “effectively useless,” OpenTheBooks.com CEO and founder Adam Andrzejewski wrote in the Washington Examiner article.

Solving potential problems of conflicts of interest in these dealings may not be fully on the pharmaceutical industry to fix, especially if it’s true that, as Fauci explained in the 2005 BMJ article, federal law requires government scientists’ names to be included on patent applications. Yet the pharmaceutical industry does have the power to foster the kind of transparency surrounding these payments—from its end, as the companies issuing these royalty payments—that would allow the press and the public to better understand who is receiving payments and why, as well as judging whether any conflict of interest is occurring.

Additionally, the onus is on the pharmaceutical company to be transparent in situations in which government scientists subsequently leave the agency to work for Big Pharma. This situation happens with more frequency than you might think. While workers, in general, should have the right to choose to leave the public sector for the private sector, increased transparency could lay to rest concerns over whether government scientists are behaving improperly in their dealings with pharmaceutical companies while in their government post or that, once they have moved to the private sector, they are using their government connections to give their companies unfair advantages.

It’s not possible, under the current system, to separate government science and research agencies and private-sector pharmaceutical companies entirely. Through these government agencies, “US tax dollars funded every new pharmaceutical in the last decade,” the nonprofit Institute for New Economic Thinking reported in September 2020. Short of revamping the entire drug development and regulatory system (and, in all likelihood, hindering the future of pharmaceutical innovations), the next best thing for the public would be efforts from both sides to promote transparency in the relationships between the federal government and Big Pharma.

#7: Prioritize Environmental Sustainability

We all have to do our part to combat climate change, and that includes the pharmaceutical industry. Like other industries, the pharmaceutical sector needs to focus more on the environmental sustainability of its development and manufacturing processes.

Doing so may include seeking methods of drug research and manufacturing that produce less waste and pollution (including greenhouse gases) and consume lower volumes of energy and natural resources like water, according to industry news site Pharmaceutical Technology.

#8: Plan for Disruptions of Supply Chains

With medication shortages “near an all-time high” in May 2023, in the words of The New York Times, being agile enough to withstand supply chain disruptions is critical for pharmaceutical companies and public health. Pharmaceutical companies should take proactive steps to make their supply chains more resilient, management consulting firm McKinsey & Company reported.

These steps may include working toward end-to-end transparency of their supply chains, incorporating routine stress-testing and reassessment into their planning, and expanding their supplier network to insulate the company from disruptions.

IMAGE SOURCE: Wikimedia Commons, Creative Commons Attribution-Share Alike 3.0 Unported license

#9: Embrace Diversity

In the pharmaceutical industry, as in other industries, an increased focus on diversity and inclusion has become evident. Diversity in the pharmaceutical industry means not only making efforts in hiring and retaining talent from a wide array of racial, ethnic, cultural, and gender backgrounds but also making human trials of medication more representative of real-life patient populations.

Pharmaceutical companies should also focus on ways they can meet the needs of underserved patients—and cultivating a diverse workforce is essential for better understanding the needs and challenges facing these communities and how to address them, the trade group Pharmaceutical Research and Manufacturers of America (PhRMA) reported.

#10: Learn From the Supplement Industry

Based on the $151.9 billion revenue amount reported by Grand View Research in 2021, the global dietary supplements market is only around one-ninth the size of the global pharmaceutical market. As such, you may wonder what insights this much larger, established industry could gain by learning from the supplement industry.

While the supplement industry as we know it today is undeniably smaller and newer, it’s also growing at a faster rate. While Fortune Business Insights has predicted a compound annual growth rate of 6.3% between 2021 and 2028 for the pharmaceutical industry, Grand View Research has projected a compound annual growth rate of 8.9% between 2022 and 2030 for the supplement industry. A difference of a couple of percentage points may not seem like a lot, but the difference between these growth rates amounts to a 40% difference in the projected growth rate for these industries.

In many cases, patients take supplements in addition to, not instead of, their prescription and over-the-counter pharmaceutical medications. A multivitamin supplement, for example, doesn’t replace antibiotics to treat acute infections or medicines used to treat chronic conditions, like insulin for diabetes. However, in some cases, extensively studied and highly effective supplements pose direct competition to pharmaceutical products.

While there are plenty of bad actors in the supplement industry, this industry doesn’t suffer from nearly the same level of consumer distrust as the pharmaceutical industry. In 2022, the Council for Responsible Nutrition published survey results that concluded that 77% of the general population and 84% of self-reported supplement users found the supplement industry “trustworthy.” That’s a far cry from the mere 25% of Americans who reported any positive impression of the pharmaceutical industry.

Increasingly, Big Pharma has been eager to not only emulate the successes of the supplement industry but also acquire these profitable ventures for their own. Major pharmaceutical companies are buying popular supplement brands, a business move that allows the company to benefit from both treating sickness and promoting wellness.

What Is the Future of the Pharmaceutical Industry?

Despite challenges like the risky and lengthy drug approval process, increased scrutiny over drug prices, a poor public image, and a great deal of competition within the market, the pharmaceutical industry isn’t going anywhere. The data shows that favorable growth is expected across the industry, with leading drugmakers seeing the greatest increases in shareholder value and revenue.

Yet taking even some of the steps that could improve the pharmaceutical industry will give pharmaceutical and life sciences companies the ability to do so much more. They can reduce some of the risks and costs that plague the industry. They can enhance innovation in the lab and support increased access to medications among underserved patient populations.

One of the insights worth noting is that, in many cases, these recommendations for improving the pharmaceutical industry stack upon one another. Embracing technology supports compliance and equipment maintenance for better long-term performance. Taking active steps to improve their public image puts pharmaceutical companies in a better position to help make a positive impact on the healthcare system—which, in turn, further improves public perception of the company.

Improving the pharmaceutical industry doesn’t have to be an all-or-nothing proposition. Taking small steps toward building a better company may be a more manageable path forward than drastically revamping equipment setups and networks of supply chains, investing millions in public relations campaigns, or creating brand-new departments or positions that revolve around compliance, sustainability, and diversity and inclusion.

Despite the competitive landscape of the pharmaceutical market, improving the industry is as much a collaboration as it is a competition. Every effort each individual company in this sector makes to improve itself raises the bar for the industry as a whole. Consider it a sort of peer pressure for good—the good of patients, shareholders, the environment, and more.