There’s a reason advertisements for pharmaceutical products are ubiquitous in the United States: the pharmaceutical industry, which is behind both prescription drugs and over-the-counter medications, is profitable, powerful, and massive.

Decades of strong growth have contributed to making the pharmaceutical industry one of the largest and most profitable—and powerful— industries in the United States and across the world. Industry experts, researchers, and statisticians expect the pharmaceutical market as a whole and many of the individual segments it comprises to continue to grow.

To truly grasp the size and growth of the pharmaceutical market, we need to dig deep into sales revenue amounts and changes over time and projections based on years of past market data, as well as the major growth factors and challenges facing the industry today.

How Big Is the Pharmaceutical Industry?

What is the current status of the pharmaceutical industry? Whether you’re looking at the global market or at the pharmaceutical industry in the United States only, the market is already large and continuing to grow.

The Size of the Global Pharmaceutical Market

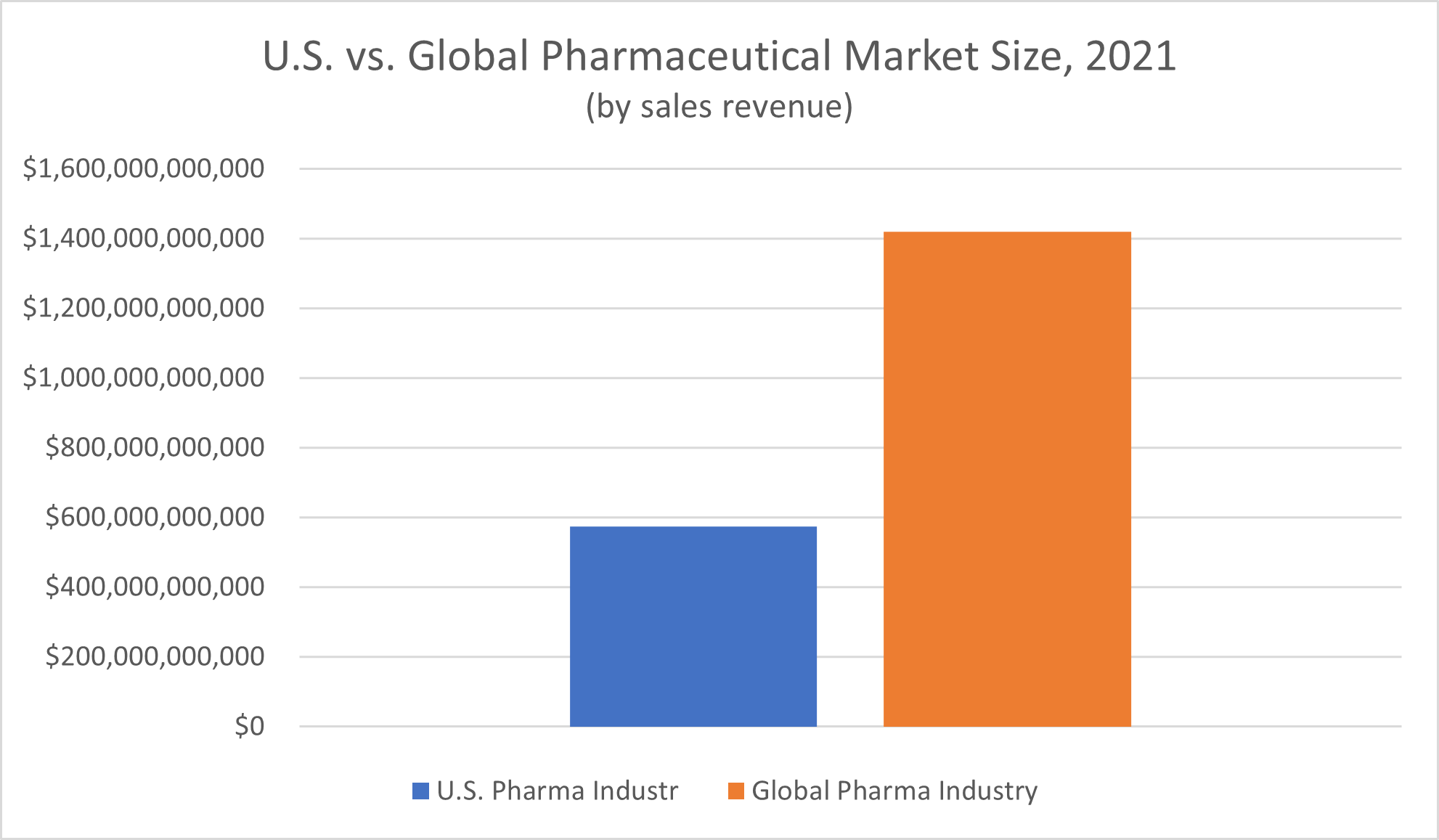

For the global pharmaceutical market, Statista reported a total revenue of $1.42 trillion in 2021. One of the largest segments of pharmaceutical market sales was oncology drugs, or cancer therapies, which made up $99.5 billion of the global pharmaceutical industry’s revenue.

The revenue generated by the global pharmaceutical market amounts to more than nine times that of the dietary supplements market, for which Grand View Research reported a 2021 revenue of $151.9 billion.

Access to over-the-counter and prescription drugs is critical for the health of the world population, but revenue shares aren’t distributed equally across the globe. Nearly half (49.1%) of the worldwide pharmaceutical industry revenue reported for 2021 was generated in the North American market, Statista reported, and the United States is the largest subsection of the market.

How did “big pharma” get so big, anyway? Statista reported that global revenue growth in the pharmaceutical industry has been steadily increasing for more than two decades now, since 2001.

The U.S. Pharmaceutical Industry

Worldwide, the U.S. pharmaceutical industry is the largest pharmaceutical industry, according to Pharmapproach.

The total size of the U.S. pharmaceutical industry, as measured by the amount of nominal spending on medicines in the U.S. as of 2021, was $574 billion, according to Statista. This actual spending amount exceeded the $560.00 billion projections for 2021 revenue generation in the U.S. pharmaceutical industry.

In a single year—2021, compared to 2020—United States total pharmaceutical expenditures climbed by 7.7% to reach $576.9 billion, researchers reported in an article published in the American Journal of Health-System Pharmacy, the official journal of the American Society of Health-System Pharmacists. The researchers credited a 4.8% increase in utilization as the largest factor driving this considerable growth, followed by a 1.9% increase in drug prices and a 1.1% increase in new drugs on the market. Noticeable increases in drug expenditures occurred in 2021 compared to the following year in both clinics and hospitals.

In 2021, the United States pharmaceutical industry spent $22.7 billion on research and development work outside the U.S., Statista reported, and the gross output for the U.S. pharmaceutical preparation manufacturing industry amounted to $217.5 billion.

According to the U.S. Centers for Medicare & Medicaid Services, spending on prescription drugs climbed by 7.8% in 2021, more than doubling the 3.7% growth rate reported for 2020.

It isn’t only by revenue amount that the pharmaceutical industry is so large and influential, but also by the widespread usage of pharmaceutical medications, both prescribed and over-the-counter.

In terms of the actual number of prescriptions written for pharmaceutical drugs, the year 2019 saw an estimated 3.79 billion prescription medications dispensed and/or billed for in the United States alone, Fortune Business Insights reported. The industry has continued to see considerable growth since.

Although the pharmaceutical industry encompasses both prescription drugs and over-the-counter pharmaceutical medications, prescription medicines are likely to be the first medical treatments that come to mind when you think of this industry. Where exactly are patients being prescribed these drugs?

Fortune Business Insights reported that 860 million drugs were prescribed in physician offices in 2020, compared to 336 million drugs prescribed in hospital emergency departments.

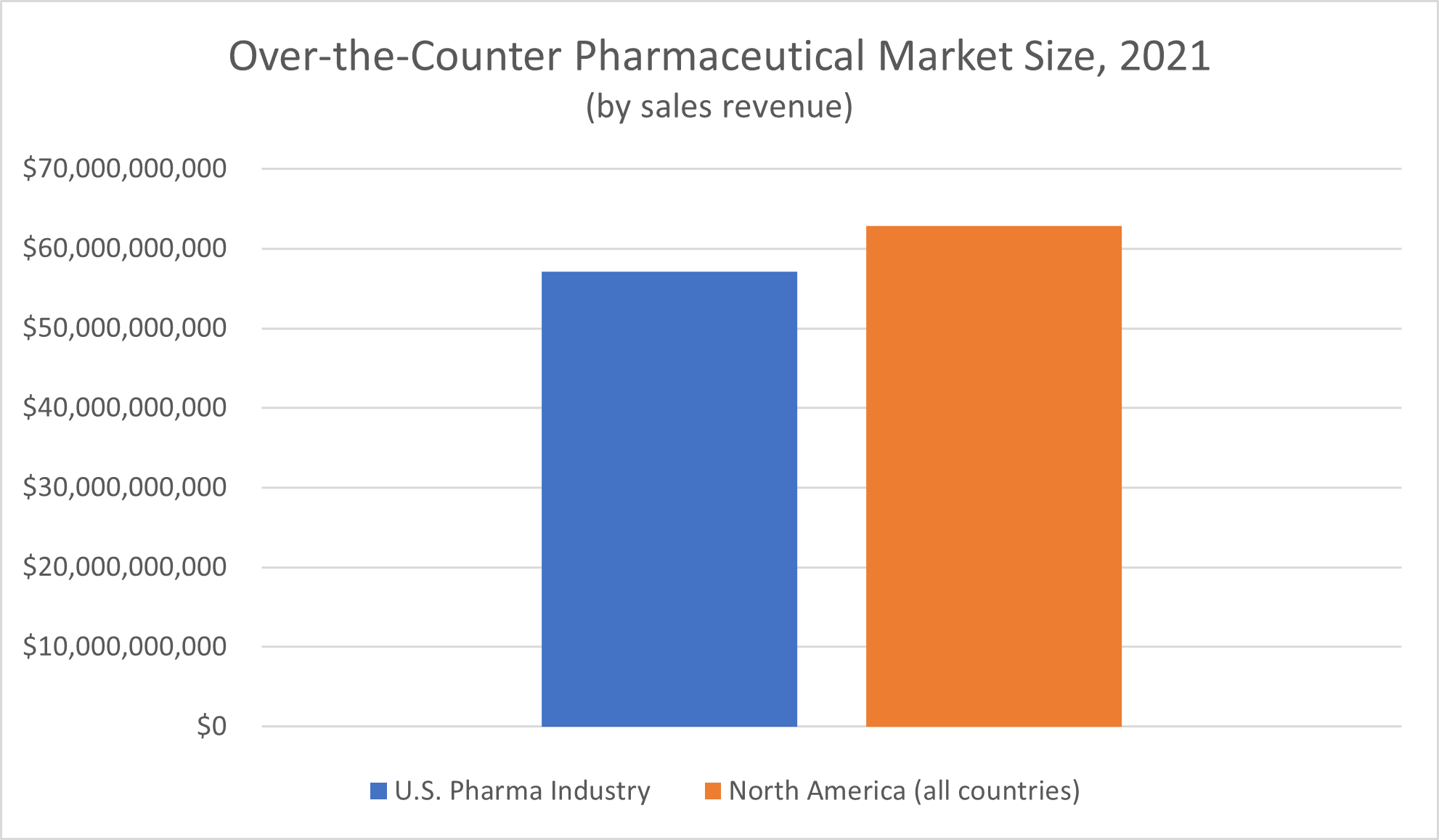

What about the over-the-counter pharmaceutical drug industry? Grand View Research reported a market size of $62.88 billion for all of North America, and $57.1 billion for the United States alone, for 2021.

The pharmaceutical industry—and, particularly, certain segments of it—are among the largest industries in America. Industry research company IBISWorld listed the brand name pharmaceutical manufacturing industry as the fourth largest manufacturing industry in the United States and the 56th largest industry nationwide. The generic pharmaceuticals manufacturing industry was the 42nd largest of the U.S. manufacturing industries and the 266th largest industry in America, IBISWorld reported.

The relative sizes of other segments of the U.S. pharmaceutical industry include the following:

- Pharmacies & drug stores, for which IBISWorld projected a market size of $349.1 billion for 2023, making the industry the sixth largest of the retail trade industry in the U.S. and the 32nd largest industry overall

- The pharmaceutical contract management consulting industry, for which IBISWorld projected a market size of $36.1 billion for 2023

- The pharmaceuticals packing and labeling services industry, for which IBISWorld predicted a market size of $597.3 million for 2023

- The pharmacy and drug store franchises industry, for which IBISWorld projected a market size of $6.9 billion for 2023

- The contract pharmaceutical research services industry, for which IBISWorld projected a market size of $19.5 billion for 2023

- The compounding pharmacies industry, for which IBISWorld predicted a market size of $10.2 billion for 2023

- The institutional pharmacies industry, for which IBISWorld projected a market size of $21.7 billion for 2023

As of 2021, the United States pharmaceutical and medicine manufacturing industry employs 314,170 workers, according to the Bureau of Labor Statistics (BLS).

Is the Pharmaceutical Industry Growing?

Both nationally and globally, the pharmaceutical industry is continuing to grow.

In the U.S. specifically, the pharmaceutical industry has seen consistent, significant growth since the late 1990s. At this point in history, drug spending in America pulled away from that of other wealthy countries, like Canada, the United Kingdom, France, Sweden, and Switzerland, The New York Times reported. Between 1997 and 2007, drug spending in the United States tripled, according to The New York Times. Today, America still leads the world in drug spending, but the growth of the industry as a whole is global, including increases in demand and use in both developed and developing nations.

What Is the Growth Rate of the Pharmaceutical Industry?

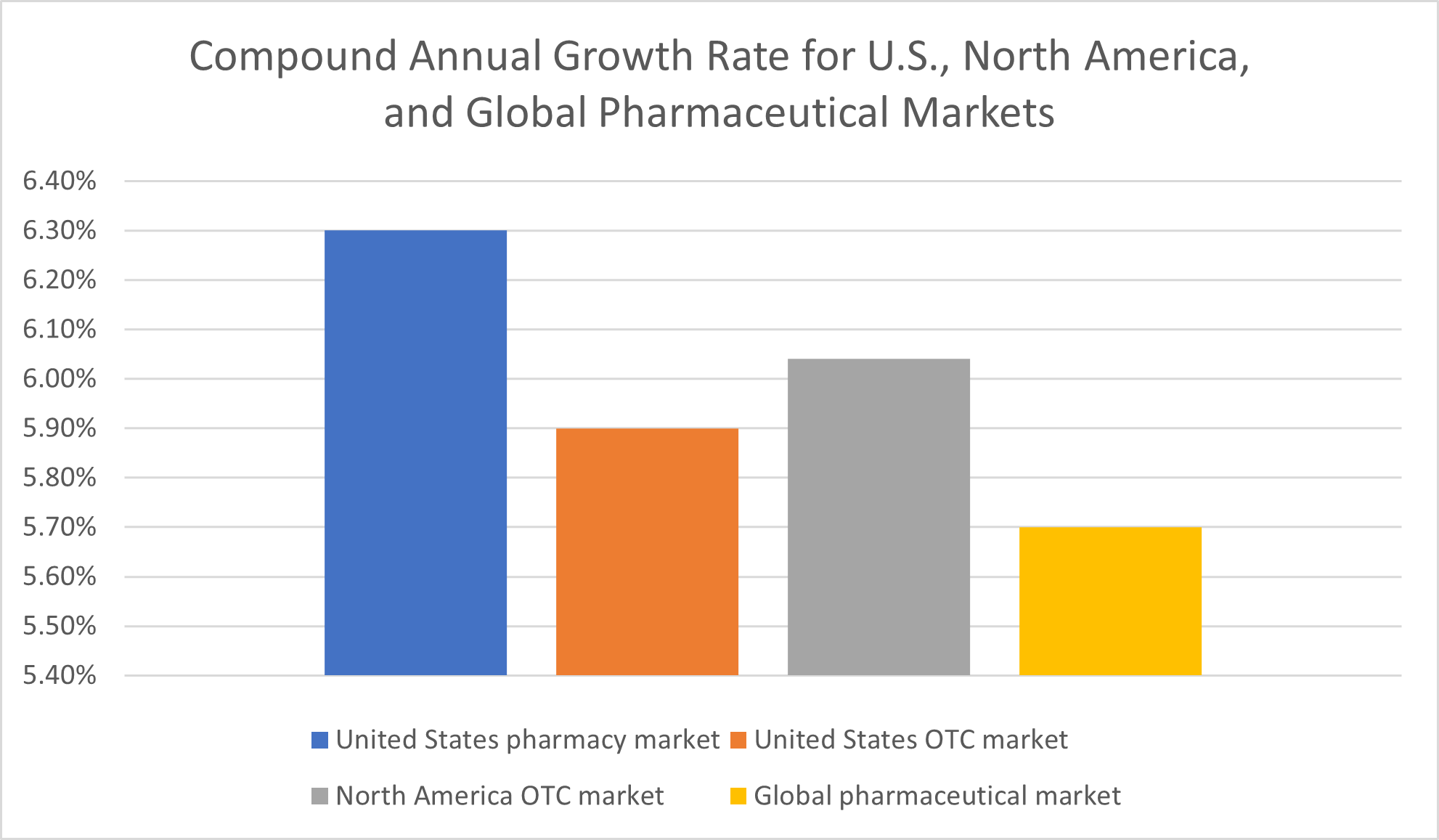

For the U.S. pharmacy market, in particular, Fortune Business Insights projected a 6.3% compound annual growth rate (CAGR) between 2021 and 2028. These predictions come on the heels of what Fortune Business Insights called a “stellar” 5.8% growth rate for 2020.

All in all, Fortune Business Insights expected the U.S. pharmacy market to reach a value of $861.67 billion by the end of its forecast period, 2028.

Over-the-counter health products market growth rates are predicted to amount to a compound annual growth rate of 6.04 % for all of North America and 5.9% for the United States, specifically, between 2022 and 2030, according to Grand View Research.

For the global pharmaceutical market, a demand analysis report by Facts and Factors has projected a compound annual growth rate of 5.70% between 2022 and 2028, the end of the forecast period.

Pharmaceutical Industry Growth Factors

A decades-long pattern of steady growth is what has made the pharmaceutical industry so massive—but what brought about this pattern of growth in the first place? Below, we will dig into some of the major growth factors that have brought about increased revenue in the pharmaceutical market.

Increased Demand for Pharmaceutical Products: Why Are People Taking More Prescription Drugs?

It’s worth noting that the growth of the pharmaceuticals market hasn’t happened in a vacuum. Rather, pharma industry growth accompanies rising healthcare expenditures overall, Fortune Business Insights noted.

That’s because the pharmaceutical industry, particularly the prescription drugs segment, is intertwined with the healthcare system as a whole. Each new prescription is generally accompanied by some sort of physician consultation or examination, often involving medical tests, inpatient or outpatient admissions to health facilities, and a medical diagnosis of some kind.

Behind this trend of increased demand for medical care and, in turn, pharmaceutical drugs are two closely related key factors. Fortune Business Insights identified both an aging population and increasing disease incidence as two of several factors that are fueling the market growth. Advanced age is a risk factor for many diseases and disorders, so it’s unsurprising that the diseases that can be treated or managed by pharmaceutical medications are on the rise as the population ages.

Pharmaceutical Industry R&D: What Is Development in Pharmaceutical Industry?

Another of the important growth factors for the pharmaceutical industry is the increase in the number of prescription drugs on the market, Fortune Business Insights reported. Naturally, as new drugs become available to fill unmet needs for disease management, patients with those medical conditions will become more likely to rely on prescription drugs.

Research and development of new pharmaceutical products is a big part of the industry. Large pharmaceutical companies invest in research for the purposes of developing entirely new breakthrough treatments, as well as devising improved forms of administration and combinations of ingredients that have already been proven effective in clinical trials.

Generally, pharmaceutical companies in the United States must undertake a series of tests, which in later stages include human clinical trials, to demonstrate that a medication is safe and effective. According to the United States Food and Drug Administration (FDA), which regulates drug development, the development process encompasses the following steps and stages:

- The Discovery and Development Step: Discovery and development work is the initial work conducted in scientific and pharmaceutical laboratories to identify compounds that may offer the desired health benefit or the disease process or medical technologies through which innovative interventions may be attempted.

- The Preclinical Research Step: Preclinical research refers to the studies conducted both in laboratories (in vitro, or in a test tube) and through animal testing (in vivo, or in a living organism) to assess the drug’s safety and potential for toxicity.Although in vitro and in vivo animal studies aren’t as heavily regulated as human clinical trials, preclinical research should be conducted in accordance with good laboratory practices, per the Code of Federal Regulations Title 21.

- The Clinical Research Step: Once questions of basic safety are answered through preclinical testing, clinical trials are necessary to establish how the medication affects real human patients. Although clinical research is one of four major steps in the drug development process, it isn’t as simple as conducting a single research study. Clinical research involves several phases of studies administering the drug to human volunteers.

- First, pharmaceutical companies seeking to develop new drugs must submit an Investigational New Drug (IND) application to the FDA. Clinical trials involving human testing consist of four phases. In Phase I clinical trials, pharmaceutical companies begin testing the medication on a small population of volunteers—between 20 and 100 people—over the course of several months to better understand the safety of the drug for humans and the proper dosage for efficacy.

- Phase 2 clinical trials are conducted with up to several hundred participants to conduct drug efficacy studies and to study the medication’s side effects. A Phase 2 study lasts at least several months and potentially up to two years.

- In a Phase 3 clinical trial, researchers study the efficacy of the drug and monitor the occurrence of adverse reactions in a population of between 300 and 3,000 people over the course of up to four years.

- The FDA review step: Once all of the research and testing steps are complete, pharmaceutical companies must compile all of the data collected throughout their research studies into a New Drug Application (NDA) and submit that application to the Food and Drug Administration before they can acquire FDA approval to put the drug on the market. It can take six to ten months for the agency to determine whether the data presented in a complete NDA warrant FDA approval of the drug. A clinical site inspection is also a routine part of the FDA review process. Developing labeling information is also part of this stage of the process. The FDA may require pharmaceutical companies to undertake additional research studies on the drug if questions remain about its efficacy or safety.

- The FDA post-market safety monitoring step: Just because new drugs have made their way to the U.S. market doesn’t mean the pharmaceutical companies that developed them are free of regulatory requirements. The fifth and final step of the drug development process is post-market safety monitoring.

- Now that the medical treatment is available to the public, the FDA monitors its safety and effectiveness through reporting programs like MedWatch and the Medical Product Safety Network (MedSun). The FDA conducts routine post-market evaluations and safety reviews. Also called Phase 4 clinical trials, the safety monitoring that is conducted after the drug has been approved for the market expands the study population to several thousand participants. Once the drug is on the market and can be more widely used, any new concerns that arise about the safety and efficacy of the drug are compiled through these reporting programs.

- If a drug that has been approved for the market demonstrates further safety and efficacy concerns after it has been approved for the market, the FDA may require safety labeling changes to the medication, such as the addition of the agency’s strict “black box warning,” or request that the developer recall the drug and remove it from the market.

New Technologies in Pharmaceutical Drug Development

Many of the breakthroughs in the development of over-the-counter and prescription drugs in recent years are due, at least in part, to new technologies. Some of the examples of objectives new technologies have allowed scientists to achieve include the following:

- Expediting processes of modeling and analyzing data

- Using fiberoptics to visualize anatomical structures and effects of medications administered in animal testing

- Making novel methods of administration possible

Breakthroughs in technology are changing how pharmaceutical drugs are made in more ways than one. For example, new technologies have enabled the development of personalized medicine, in which therapeutic choices are made based on an analysis of an individual patient’s genetic information. Personalized medicine allows for more precise and targeted therapies.

Additionally, while small molecule drugs have historically accounted for as many as 90% of the most commonly prescribed medications, large molecule drugs are becoming more popular, online pharmaceutical business platform Pharmaoffer reported. Large molecule drugs, or biologics, are specialty drugs that are more complex than small molecule drugs. Made from living cells rather than chemicals and often administered via injection or infusion rather than oral administration (like a pill), large molecule drugs are also much more expensive to produce than small molecule drugs.

A major area of the use of new technologies in the pharmaceutical sector is computer-aided drug design. According to an article published in the journal Chemico-Biological Interactions, the effective use of computer-aided drug design methods and technologies can help scientists working in or collaborating with the pharmaceutical sector with the following critical tasks:

- Identifying compounds that are promising candidates for new drugs

- Selecting “leads,” or choosing which of these candidates are most likely to be developed into successful drugs

- Improving these chemical compounds and their properties to optimize the likelihood of successfully developing them into safe and effective medications

In computer-aided drug design, artificial intelligence has been valuable. Artificial intelligence computer systems can, in some instances, perform tasks better and faster than a human can. For example, using artificial intelligence technology can allow researchers to manage and interpret large sets of data much faster. Running simulations that use artificial intelligence technology allows researchers to make data-informed decisions about what potential new drugs are most likely to be successful and how their properties could be altered to optimize the likelihood of success.

Artificial intelligence isn’t only valuable in the initial drug design stage. Throughout the clinical research stage of drug development, artificial intelligence systems can be used to identify suitable populations of participants in trials and analyze the extensive data gleaned through the different phases of research.

Companies even use artificial intelligence technology to optimize manufacturing and production practices, which in theory can result in lower drug prices (or, at least, higher profits for the manufacturer). Some companies in the pharmaceutical industry even use artificial intelligence solutions for marketing purposes.

The benefits of using artificial intelligence in pharmaceutical industry testing include not only cost savings but also reduced development time and increased safety.

Diversifying Products by Acquiring Supplement Companies: Why Are Global Pharmaceutical Companies Buying Supplement Manufacturers?

In the competitive landscape of health and wellness, prescription drugs and other pharmaceutical products serve the specific need of treating or preventing diseases or medical conditions. However, companies in the pharmaceutical industry are increasingly looking to acquire nutritional supplement companies that manufacture products with the more general goal of improving wellness.

The supplement industry today remains much smaller than the pharma industry. Its $151.9 billion market size reported for 2021 amounted to only one-ninth of the $1.42 trillion revenue reported for the global pharmaceutical market. Still, the supplement industry—at least in the global market— is growing at a faster rate than the pharmaceutical industry.

According to Grand View Research, the global pharmaceutical market is expected to grow by a compound annual growth rate of 8.9% between 2022 and 2030, compared to the 5.7% CAGR predicted by Facts and Factors for the global pharmaceutical market. The impressive growth of the supplement industry, fueled by consumers’ focus on improving wellness to prevent the kinds of medical conditions that the pharmaceutical industry thrives on treating (but not curing), has large pharmaceutical companies now “racing to buy nutritional supplement companies,” Medium reported.

Bayer, for example, now manufactures the One-a-Day brand of vitamins, and Pfizer owns the Centrum brand of vitamins and the vitamin C-based immune-immune boosting supplement Emergen-C, the Alliance for Natural Health USA reported.

Diversifying their product lines to include supplements as well as medicines is a smart choice for pharmaceutical companies that aim to remain competitive even as more consumers aim to improve wellness before they develop the risk factors for chronic diseases. By benefitting financially from both supplements taken to optimize wellness and medical treatment methods that treat sickness, companies in the pharmaceuticals market can profit from consumer spending regardless of the individual’s health status.

Opportunities in Emerging Markets: Where in the Global Market Should Pharmaceutical Companies Be Focusing?

Nearly half of the revenue attributed to the global pharmaceutical market is generated in North America. As a whole, developed nations—where more consumers have access to medical care and pharmaceutical drugs—are responsible for the greatest share of revenue generation for the global pharma market.

However, global management consulting firm McKinsey & Company has predicted opportunities for significant growth, based on its analysis of market trends, in emerging markets in developing nations. In fact, McKinsey & Company predicted in 2017 that “emerging markets could still see a doubling of pharma revenues for the top 20 markets in the next ten years.”

Some of the global markets where pharmaceutical companies stand to increase revenue significantly include:

- Asia: China, India, Bangladesh, Indonesia, Vietnam, the Philippines, Saudi Arabia, Pakistan

- Africa: Algeria, Egypt, Nigeria, South Africa

- South America: Argentina, Brazil, Chile, Columbia

- Other: Mexico (North America), Poland (Central Europe), Russia (Eastern Europe and Northern Asia), Turkey (Southwestern Asia and Southeastern Europe), Kazakhstan (Central Asia and Eastern Europe),

To increase revenue generation in developing nations, these companies need to understand and meet the needs of local markets based on factors like disease prevalence, access to medical care and drug prices, according to McKinsey & Company.

That’s not to say, of course, that the pharmaceutical industry should (or will) turn away from pursuing the revenue already established through its efforts in the local markets of developed countries. However, expanding sales to a truly global market can serve the dual purpose of increasing sales revenue even more while improving the health, longevity and quality of life of the global population.

Profitability in the Pharmaceutical Market

Given the costs of clinical trials and drug development, one might wonder if the seemingly massive revenue generation of the pharmaceutical market does much more than recoup the costs of drug efficacy studies and safety studies. Additionally, pharmaceutical companies have to contend with high manufacturing costs. In particular, certain specialty drugs made to treat cancer, rheumatoid arthritis, and other medical conditions have especially high manufacturing costs, according to the Congressional Budget Office.

However, the reality is that the major players in the pharmaceutical industry are more profitable than other large companies, not less. A 2020 article published in the Journal of the American Medical Association found that, based on profitability data from both large pharmaceutical companies and companies in other industries that are listed on the S&P 500 Index between 2000 and 2018, “the profitability of large pharmaceutical companies was significantly greater than other large, public companies” based on key measures that include gross profit, net income, and earnings before interest, taxes, depreciation, and amortization.

Even accounting for research and development expenses and other factors, researchers concluded that “the difference was less pronounced” and “the difference in net income margin was reduced,” but still found that “pharmaceutical companies were significantly more profitable.”

In fact, the notion that the cost of research is so high as to eclipse the profits of the pharmaceutical industry—and that drug prices need to be as high as they are—is misguided. A 2017 report on High & Rising Drug Prices: Myth vs. Fact by the American Hospital Association stated that eight out of 10 major companies in the drug industry “spend more on advertising than on research and development.” While out-promoting other drugmakers may be part of the competitive landscape of the pharmaceutical industry, particularly the brand name drugs segment of the market, the fact that the majority of the large pharmaceutical companies analyzed are engaging in what the study authors called “unnecessary spending that they instead could put toward research and development or lowering the cost of a drug” only drives home how profitable the industry really is.

The most profitable products on the pharmaceutical market are sometimes known as “blockbuster drugs.” This term refers to drugs that bring in at least $1 billion in revenue per year.

The Best-Selling Drugs in the World

Which mass-market and specialty drugs bring in the most revenue for the pharmaceutical industry?

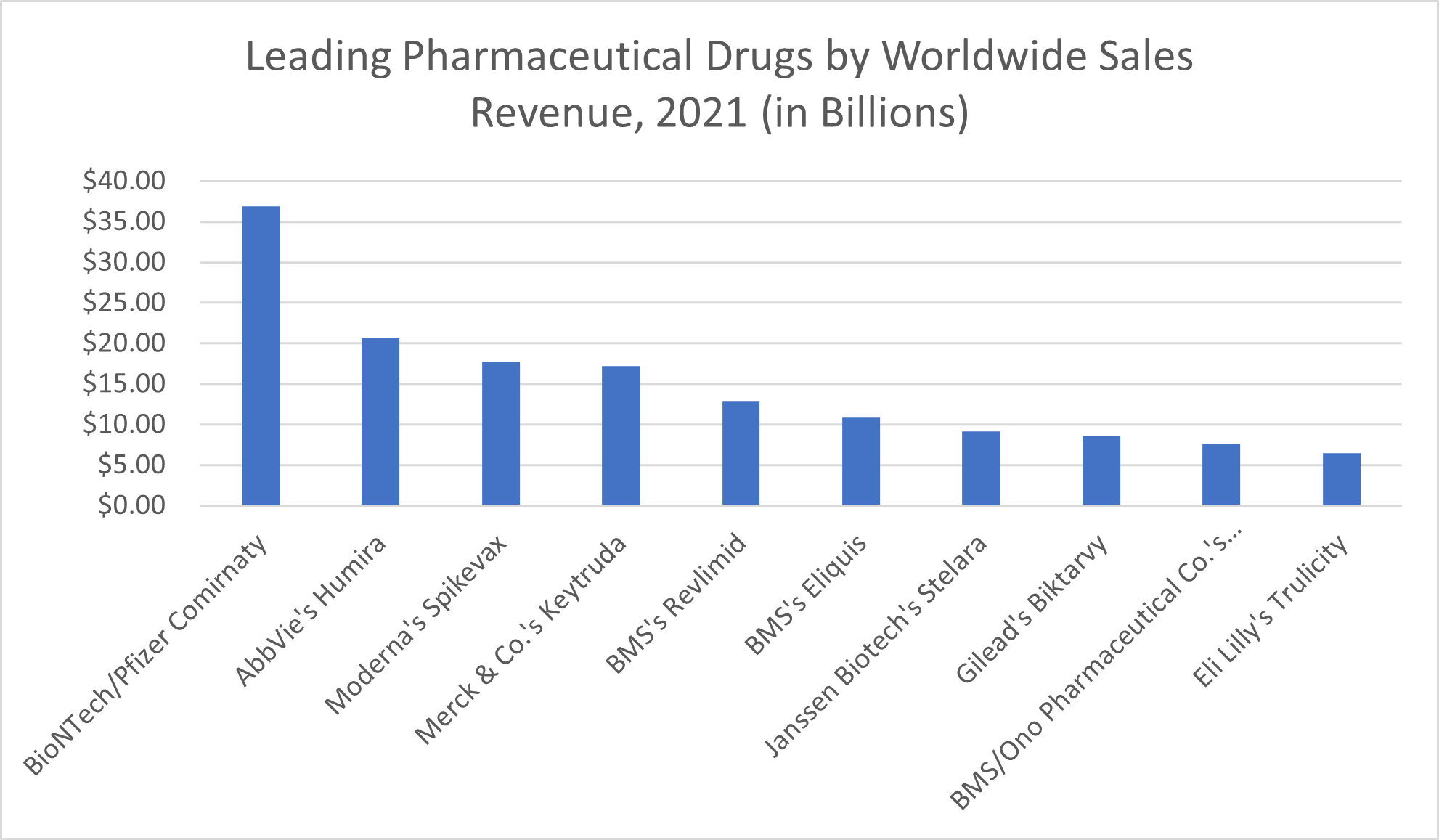

In 2021, the leading pharmaceutical products by sales worldwide, according to Statista, include:

- Comirnaty, the COVID-19 vaccine produced by BioNTech and Pfizer, which brought in $36.9 billion

- Humira, AbbVie’s rheumatoid arthritis medication, which made the company $20.7 billion

- Spikevax, the COVID-19 mRNA vaccine by Moderna, which brought about revenues of $17.7 billion

- Merck & Co.’s Keytruda, part of the immunotherapy group of specialty drugs used to treat cancer, which brought in $17.2 billion in sales revenue

- Bristol Myers Squibb’s Revlimid, another cancer treatment—this one for the blood cancer multiple myeloma—that earned BMS $12.8 billion in sales revenue

- Eliquis, a blood thinner produced by Bristol Myers Squibb that brought in $10.8 billion in sales revenue

- Janssen Biotech’s inflammation-reducing biologic Stelara, which treats conditions like psoriatic arthritis, plaque psoriasis, Crohn’s Disease, and Ulcerative Colitis and which brought in $9.1 billion in sales revenue in 2021

- Biktarvy, Gilead’s HIV treatment, which amounted to $8.6 billion in revenue

- Cancer treatment Opdivo, which earned its joint developers BMS and Ono Pharmaceutical Co. $7.6 billion in sales revenue

- Eli Lilly’s diabetes drug Trulicity, which brought in $6.5 billion in revenue

Top Pharmaceutical Companies

Unsurprisingly, many of the makers of the top-selling pharmaceutical drugs are also among the largest pharmaceutical companies in the world.

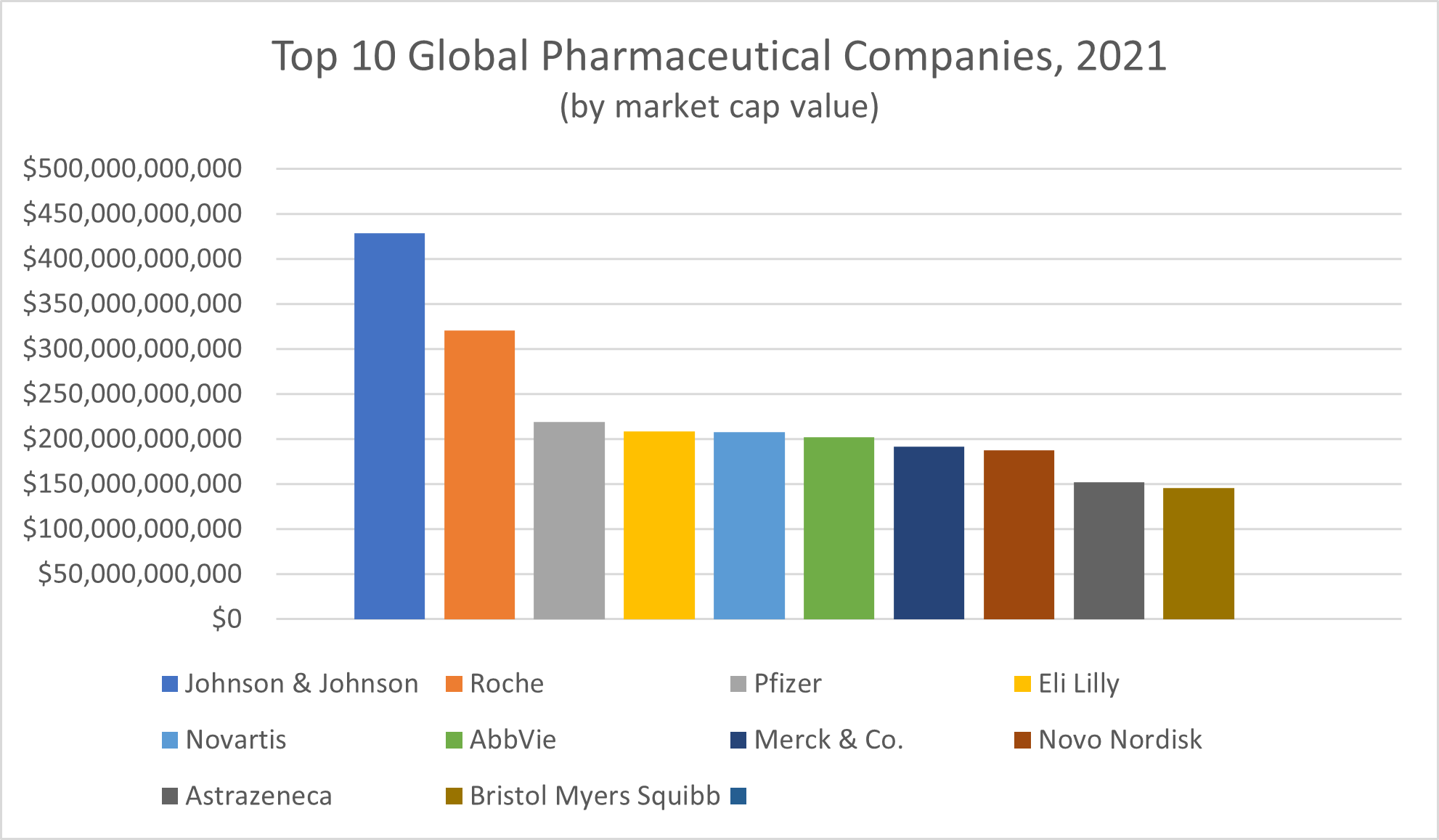

Leading companies in the pharmaceutical industry, according to publisher Visual Capitalist, include:

- Johnson & Johnson, with a market cap value of $428.66 billion

- Switzerland’s Roche, with a market cap value of $320.41 billion

- Pfizer, with a market cap value of $219.39 billion

- Eli Lilly, with a market cap value of $208.99 billion

- Switzerland’s Novartis, with a market cap value of $207.70 billion

- AbbVie, with a market cap value of $202.60 billion

- Merck & Co., with a market cap value of $191.67 billion

- Denmark’s Novo Nordisk, with a market cap value of $187.83 billion

- AstraZeneca, with a market cap value of $152.28 billion

- Bristol Myers Squibb, with a market cap value of $145.80 billion

Of the 10 largest pharmaceutical companies in the world, six are based in the United States, Venture Capitalist reported. Among the remaining manufacturers of the 10 top-selling pharmaceuticals, Gilead Sciences ranked 16th, with a market cap value of $83.62 billion, and Moderna ranked 17th, with a market cap value of $83.25 billion. (Janssen Pharmaceuticals, originally a small business founded in Belgium in 1953, was acquired by Johnson & Johnson in 1961.)

All in all, the 10 largest pharmaceutical companies in the world reported bringing in a collective $130.6 billion in profits and $734.8 billion in total revenue in 2021, Fortune reported.

Among actual pharmacies, which fill prescriptions and sell over-the-counter drugs, the largest companies include major retail pharmacies like CVS, Walgreens, Walmart, Kroger and Rite Aid, Fortune Business Insights reported. Other key companies involved in the pharmacy market include Cigna’s Express Scripts Pharmacy, UnitedHealth Group’s Optum Pharmacy, and Albertsons Companies, Inc., according to Fortune Business Insights.

Diseases and Conditions Driving Growth in the Pharmaceutical Industry

Knowledge of and prevalence of disease are two important factors in the growth of the pharmaceutical market. Pharmaceutical medication applications in areas like mental health, women’s health, cancers, cardiovascular disease and more are on the rise. Growth has been reported across a vast array of segments of the pharmaceutical industry, including both acute and chronic diseases and communicable and noncommunicable diseases.

Some of the types of medical conditions that are driving major growth for the pharmaceutical market include autoimmune disorders, cancer, and cardiovascular disease.

Acute vs. Chronic Diseases

Acute medical problems certainly contribute to the revenue of the pharmaceutical industry, as in the case of antibiotics for bacterial infections and painkillers prescribed for short-term use following an injury or surgery. However, much of the revenue growth in the pharmaceutical industry arises not out of these acute conditions but rather out of chronic diseases. Chronic conditions require long-term and even life-long disease management, and the prevalence of these diseases is on the rise.

It should come as no surprise that chronic diseases are a major influence on the sales revenue of the pharmaceutical industry. The National Health Council reported that chronic conditions—diagnosing, treating, and managing them—account for upwards of 75% of all health care expenditures.

Heart disease, cancer, stroke, hypertension, diabetes, pulmonary conditions, and depression and other mental illnesses are among the most prevalent types of chronic diseases. Thanks to breakthroughs in medical treatment in recent years, even HIV/AIDS is now increasingly viewed as a “chronic disease” that is “no longer necessarily a lifethreatening condition,” the World Health Organization reported.

Communicable vs. Noncommunicable Diseases

Cancer, cardiovascular disease, diabetes, and chronic respiratory diseases make up the “big four” noncommunicable diseases, according to the World Health Organization (WHO). Noncommunicable diseases are important because they account for 74% of global deaths, or approximately 41 million total deaths, each year, the World Health Organization noted. In spite of the significant impact of infectious disease epidemics, most global deaths result from noncommunicable diseases.

Autoimmune Disorders

Medical treatments for autoimmune disorders like multiple sclerosis (MS) and rheumatoid arthritis “dominated” the United States pharmacy market in 2020, Fortune Business Insights reported. Thanks, in large part, to the growing disease incidence of conditions like arthritis, which now affects in out of every four American adults, the autoimmune disease market segment outperformed even the oncology drugs market segment.

Cancer Therapies

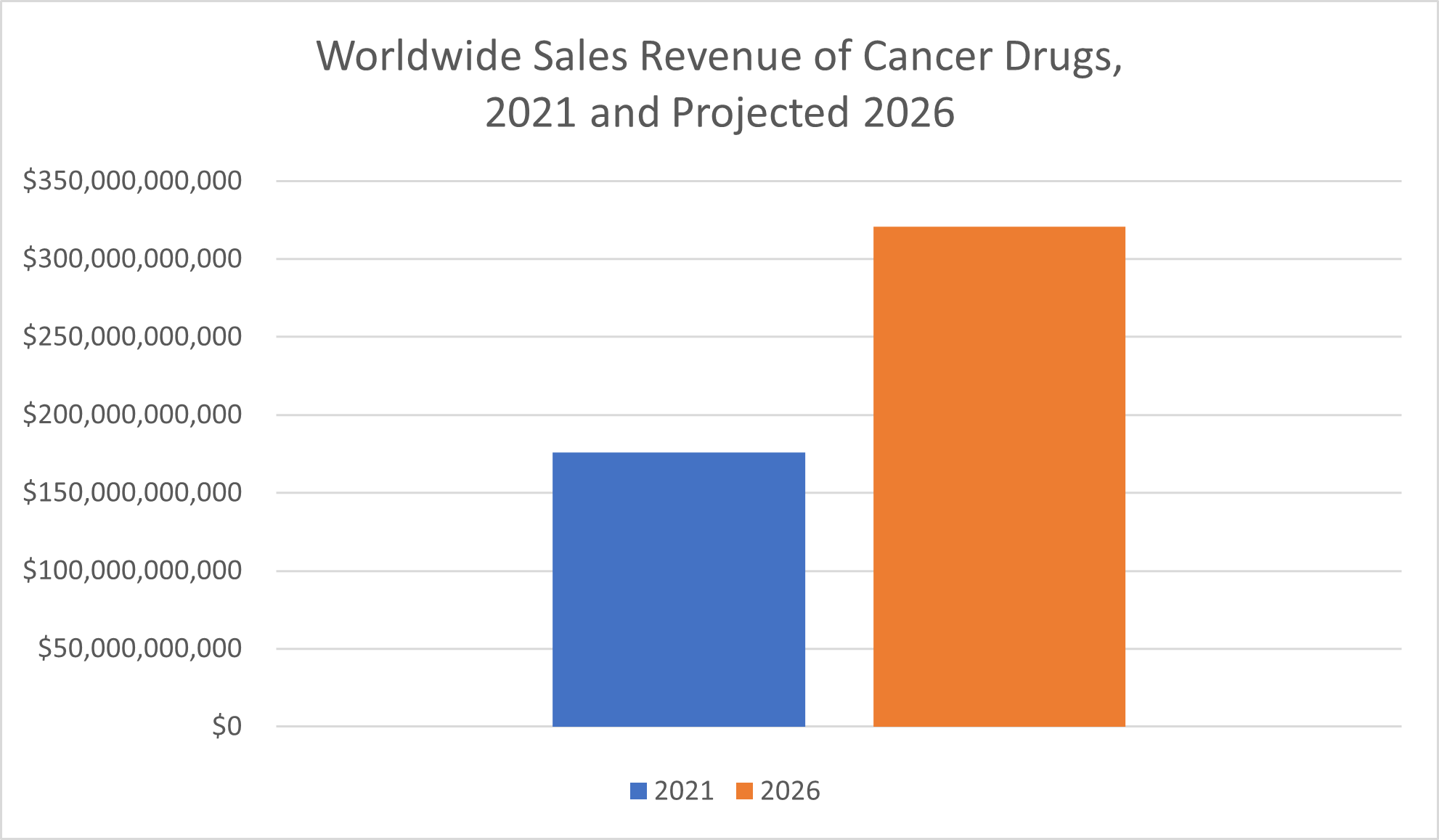

Sales of oncology drugs—drugs and therapies to treat cancer—are “already way ahead of” that of most other drug classes, Statista reported, and growth in this segment of the pharmaceutical market isn’t expected to slow down anytime soon. In fact, the $176 billion in sales of cancer drugs in 2021 more than doubled the sales revenue of the next highest-sales class of drugs, vaccines. Statista predicted that sales of oncology drugs will nearly double between 2021 and 2026, when their worldwide revenue is expected to amount to $320.6 billion.

Cardiovascular Disease

Cardiovascular diseases are the leading cause of death worldwide. According to the World Health Organization, cardiovascular disease claims 17.9 million lives each year.

In a 2022 press release, Precedence Research reported the global cardiovascular drugs market size as $162.64 billion. Precedence Research has predicted a compound annual growth rate of 4.52% for cardiovascular disease drugs for the forecast period between 2022 and 2030, anticipating a global market size of $231.7 billion by the end of the forecast period.

While North America remains the highest revenue holder for the cardiovascular drugs market, the fastest-growing region is the Asia-Pacific region, Precedence Research reported.

Orphan Diseases

Generally, drugs that target a larger market—by treating diseases that are common or widespread—tend to bring in more revenue for pharmaceutical companies. Orphan drugs are drugs that instead target orphan diseases, or rare diseases and conditions. Because fewer people have the condition these specialty drugs treat, the demand for these medications is smaller.

Although a single rare disease may not affect many patients, rare diseases collectively have a much bigger impact. According to a report published by the QuintilesIMS Institute and funded by the National Organization for Rare Disorders, between 25 million and 30 million Americans suffer from a total of 7,000 rare diseases, many of which can threaten or at least limit the patient’s life. This statistic drives home why developing treatments for even comparably rare diseases and disorders is critical.

Fortunately, the development of drugs to treat and manage orphan diseases has advanced considerably in recent decades, due in large part to the Orphan Drug Act of 1983. This legislation, which the QuintilesIMS institute report characterized as “universally considered a success,” provided incentives like market exclusivity, clinical research subsidies, waivers of regular FDA fees, and tax incentives to the developers of medications that fit the definition of orphan drugs. The result was thousands of orphan drug designation requests by drug developers and hundreds of orphan drugs approved for the market over the decades that followed.

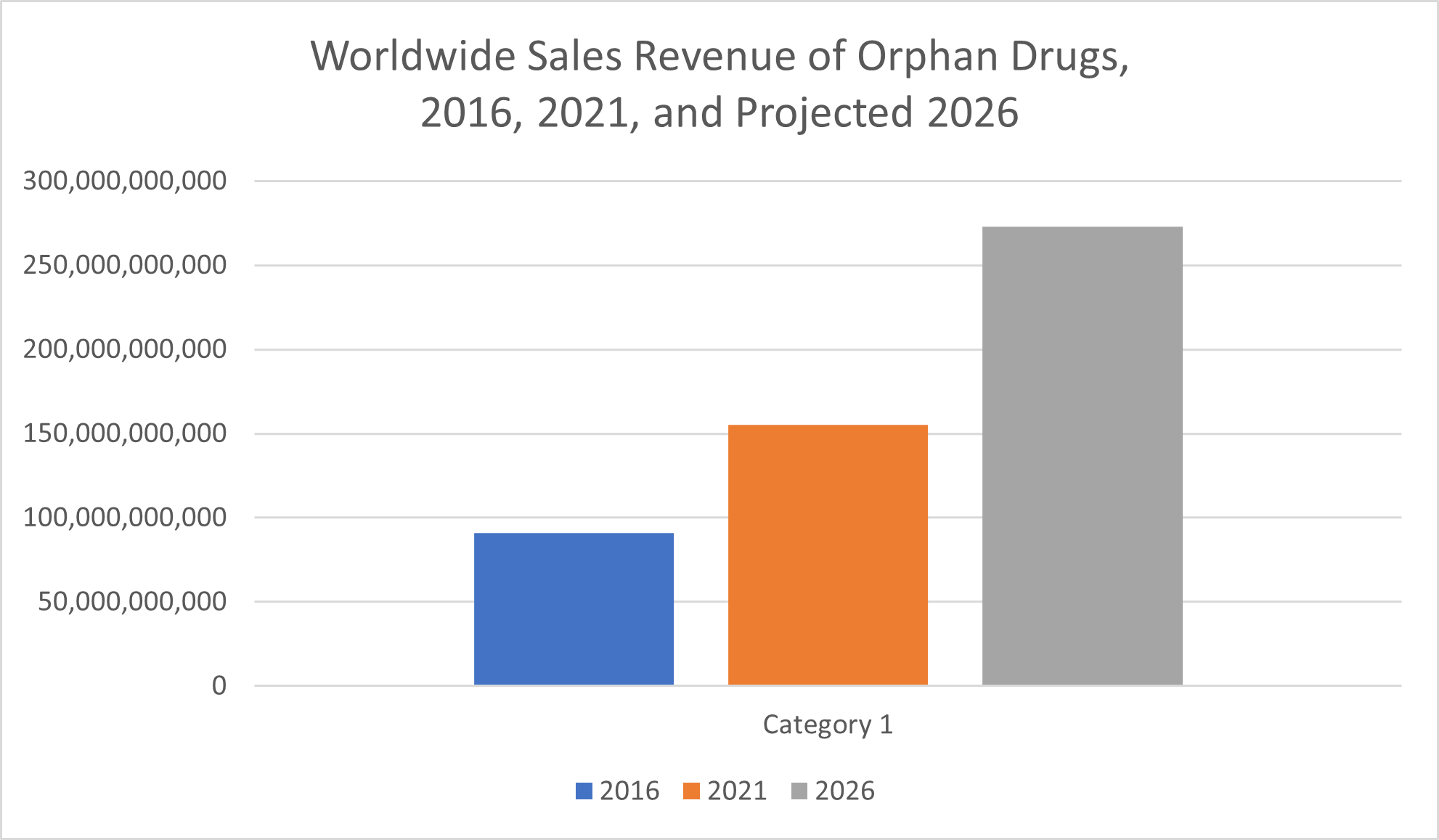

Even though an orphan disease is rare, among orphan drugs, too, sales revenue has climbed steadily in recent years. Statista reported $155 billion in orphan drug sales in 2021, marking an increase of more than 125% from the $66 billion reported less than a decade earlier, in 2012.

From 2016 to 2021, global prescription orphan drug sales increased by over 70%, from $91 billion to $155 billion. Over the next five years, sales of these medications are expected to increase even more, according to data from Statista. Sales of prescription drugs for orphan conditions are projected to reach $273 billion by 2026, which would amount to an increase of more than 75% over the forecast period from 2021 to 2026.

Which Drug Classes Bring in the Most Sales Revenue Overall?

All medications are important for the patients who benefit from taking them, but not all drugs are equally valuable from a sales revenue standpoint. In an article published in the International Journal of Environmental Research and Public Health, researchers reported that the top five most important medications from the sales perspective include only drugs used in the treatment of cardiovascular disease and metabolic disorders like diabetes. The market for these drugs is already large and continuing to grow.

Consumer Perspectives on the Pharmaceutical Industry

Considering how widely pharmaceutical products—both over-the-counter and prescription drugs—are used, you might expect the consumers who rely on these medications to have a largely favorable opinion of the industry. In fact, the pharma industry is one of the most widely disliked industries in America.

Just one-quarter of Americans reported a positive perception of the pharmaceutical industry in 2022, the Gallup, Inc. Americans’ Views of U.S. Business and Industry Sectors poll reported. Even worse, 58% of Americans surveyed reported having a negative perception of the pharmaceutical sector. That’s equal to the percentage of Americans who reported a negative perception of the federal government as a whole. Only the oil and gas industry fared worse in terms of public opinion, with a negative perception rate of 62%. These three industries were the only industries for which the majority of Americans reported negative perceptions.

What Is the Biggest Issue Facing the Pharmaceutical Industry?

There’s no doubt about it—the pharmaceutical industry is massive and continuing to grow. That said, and despite big pharma’s power, influence, and profitability, there are numerous challenges facing pharmaceutical companies today.

In addition to the routine challenges faced by other industries, like supply chain interruptions, labor shortages, inflation, and competition within the market, key players in the pharmaceutical industry also face challenges relating to regulations, the risks and costs of drug development, patent expirations, recalls, and lawsuits.

Regulations

The pharmaceutical industry is heavily regulated.

The Food and Drug Administration, part of the federal Department of Health and Human Services, regulates pharmaceutical products in the United States. In other countries, other regulatory bodies oversee drug development, approval, and marketing. These regulatory bodies include:

- The European Medicines Agency (EMA)

- The Therapeutic Goods Administration (TGA) in Australia

- The Pharmaceutical and Medical Devices Agency (PMDA) in Japan

- Health Canada

- Swissmedic in Switzerland

Although the regulations placed on the pharmaceutical market are largely for the public good—requiring proof of the drug’s safety and efficacy—they do place burdens on the companies operating in the pharmaceutical market.

Drug Development Costs and the Risks of Failure

Largely as a result of these regulations, drug development is, in general, not a quick process. The Biotechnology Innovation Organization (BIO) reported an average duration of 10.5 years to take a pharmaceutical medication from Phase I to full regulatory approval. The trade group Pharmaceutical Research and Manufacturers of America (PhRMA) reported an average of 10 to 15 years to fully develop one new medication.

In an article published in the Journal of the American Medical Association (JAMA) in 2020, the researchers concluded that the median capitalized cost to bring a new pharmaceutical drug to market in the U.S., based on data for drugs approved between 2009 and 2018, amounted to an astonishing $985.3 million. The average investment amount, the researchers determined, was even higher, at $1335.9 million.

The cost of getting a new drug approved depends in part on the therapeutic area, or the type of drug being developed. The least expensive drugs to develop, researchers reported in the JAMA article, were nervous system agents that treat nervous system disorders, for which the median estimated cost amounted to $765.9 million.

For the most expensive therapeutic area, antineoplastic and immunomodulating agents, the median cost rose to $2771.6 million. Antineoplastic drugs are drugs, such as chemotherapy, that are used for cancer treatment, the Centers for Disease Control and Prevention (CDC) reported. Immunomodulating agents are used to suppress the immune system to treat certain cancers, the American Cancer Society reported.

Even for large pharmaceutical companies that can cover the significant cost of laboratory testing and clinical trials, FDA drug approvals are not a sure thing. In fact, “90% of clinical drug development fails,” researchers reported in an article published in Acta Pharmaceutica Sinica B, the English-language Journal of the Institute of Materia Medica, the Chinese Academy of Medical Sciences and the Chinese Pharmaceutical Association.

Only one out of every 50 new drugs to undertake the development process ultimately reaches the market, the Library of Economics and Liberty reported. Consequently, only 37 new drug approvals were granted by the FDA for the entire year of 2022.

Among new drugs that make it to the clinical research study phase of development, around 70% successfully make it through Phase I testing, the FDA reported. Unfortunately, just 33% of these drugs in development are successful enough in Phase 2 to move on to Phase 3 testing. Even fewer—25% to 30% of new drugs—move on to Phase 4.

Success rates in academic drug development efforts fare somewhat better, particularly when these efforts involve collaboration between academic institutions and companies in the pharmaceutical industry. The researchers behind a study of nearly 800 academic drug development efforts undertaken between 1991 and 2015 found the following success rates by phase of clinical trials, according to an article published in the journal Clinical and Translational Science:

- Preclinical testing: 32%

- Phase I clinical testing: 75%

- Phase II clinical testing: 50%

- Phase III clinical research testing: 59%

- Phase IV (NDA): 88%

Although efforts that fail in the earlier stages of drug development will cost pharmaceutical companies less than those that fail after multiple phases of clinical trials, this huge failure rate also helps explain high drug prices. Drug developers need the revenue generation from their successful drugs to not only cover the cost of developing that drug but also help recoup the money invested into unsuccessful development efforts.

The risks associated with developing new drugs present an ongoing challenge to the pharmaceutical industry and individual pharmaceutical companies. Despite the overall profitability of large pharmaceutical companies, investing too much money into the development of drugs that fail could threaten a company’s solvency and its future. These challenges are particularly pronounced when it comes to the development of drugs for which the pharmaceutical company is anticipating lower demand and, as such, lower sales revenue.

Patent Protection Expiration

For the developers of novel drugs, patent protection expiration is a major challenge. In the competitive landscape of the pharmaceutical market, patent protection is what makes the costs and hassle of the drug development process financially worthwhile.

Because large pharmaceutical companies invest so much money and time into drug development, they naturally want to see a great return on this investment in pharmaceutical research. If other pharmaceutical companies can simply copy their formulations and immediately sell the same product without having to invest in drug research and development, the developer isn’t reaping the rewards of their investment and their hard work to bring the drug to the market. This possibility would, in turn, deter pharmaceutical companies from spending the money—and taking the risks— of developing new drugs in the future.

Upon receiving FDA approval to put the drug on the market, the pharmaceutical company that developed the drug also receives patent protection and/or an exclusivity period. For the duration of the patent—which, according to the FDA, currently lasts for 20 years from the date the application is originally filed—the pharmaceutical company has exclusive rights to sell the drug on the U.S. market.

Once the developer or sponsor no longer has exclusive rights to the drug, other pharmaceutical companies can produce and sell the medication as generic drugs. Generic drugs must possess the same active ingredients, strength of ingredients, quality, safety, dosage form and performance characteristics, the FDA reported, and they must be marketed for the same intended use.

Generic pharmaceuticals can reduce drug prices, saving money for both consumers and health insurance companies. In fact, some health insurance companies will require that patients use generic drugs when available unless otherwise specified by their doctors and/or require the patient to pay more for brand name drugs when generic drugs are available.

Despite the benefits of more affordable drug prices for consumers and health insurance companies, the end of exclusive rights to manufacture and sell a medicine is troubling for the drug developers who sink so much time and money into the research, development, and clinical testing process. Given the length of the drug approvals process, the time during which drug developers have exclusive rights to the new drugs and the FDA approval to actually sell the medication on the U.S. market is far less than 20 years for which the patent provides protection. For the developers of most name brand drugs, the length of the development process cuts this time in half.

Recalls

Another common issue drugmakers face is recalls. Both over-the-counter and prescription drugs may be recalled. In a drug recall, as in recalls of food products, the product is pulled from the market and consumers who are already in possession of it are urged not to use it.

Most drug recalls don’t represent a complete removal of the medication from the market. Instead, the recall applies only to specific batches of the drug that are affected by a particular problem.

The FDA classifies recalls into three categories. A Class I recall involves a drug that has been linked to “serious health problems or death.” A Class II recall has the potential to either “cause a temporary health problem” or “pose a slight threat” to a user’s health. Class III recalls are the least serious type of drug recall. Although the recalled medication is not in compliance with labeling or manufacturing requirements, it is “unlikely” to cause any significant harm.

The most common cause of United States drug recalls is incorrect labeling, according to healthcare education company StatPearls. Incorrect labeling may pose health and safety risks, particularly if it causes patients to take the wrong dose or exposes those with allergies or other contraindications to ingredients that may be harmful to them.

Other common reasons for drug recalls have an even greater potential to cause harm. Defective products may have more serious side effects than was previously believed or, at the very least, may not have the clinical effects required to make the benefits of taking the medication outweigh the risks. A batch of the drug with incorrect potency may likewise lack the dosage strength needed to achieve clinical effectiveness or, even more concerning, may expose the patient to dangerously high dosages of the medication. Contamination is another reason a drug manufacturer may recall a medication. Bacteria, fungi, heavy metals, other drugs, and other potentially hazardous contaminants have all prompted medications to be recalled.

Just how big a problem are drug recalls for the pharmaceutical industry? About once a month, “clinically important” recalls concerning drugs occur, according to StatPearls. Again, some recalls are small in scale, involving only a few lots of a product, while others are massive, involving millions of doses or lots of a drug.

However, even a single large recall could be a major issue. A Johnson & Johnson recall that led to the closing of a distribution site once cost the company $600 million, StatPearls reported. The consequences of a drug recall can go beyond financial losses directly arising out of the recall. A negative impact on public opinion of the product and company can contribute to revenue declines, especially in the cases of over-the-counter medications and medications for which generic versions or competitors’ products are suitable alternatives. Of course, not all of the consequences of an issue that leads to a drug recall are financial in nature. Some major recalls have, unfortunately, led to widespread and serious side effects or even claimed numerous lives.

Consumers often assume that the FDA, which regulates pharmaceutical products and announces recalls, has the power to recall a drug from the market. In fact, the federal agency doesn’t have the authority to directly remove drugs from the market, although it can do so for medical devices, StatPearls reported. The FDA must instead “request” that a drugmaker issue a recall.

Given the major challenges that a pharmaceutical company may face in the aftermath of a recall, you might wonder why a drugmaker would voluntarily agree to the FDA’s request to withdraw a medication from the market. This can happen but is “rare,” StatPearls reported. If a pharmaceutical company attempts to avoid the issues that arise out of a recall by refusing to comply with the FDA’s request to issue a voluntary recall, the agency can instead “force” a recall and issue an injunction to stop the pharmaceutical company from continuing to manufacture or distribute the medication under the authority conferred on it by the Food, Drug, and Cosmetic Act.

Lawsuits

A recall isn’t necessarily the end of a pharmaceutical company’s troubles pertaining to a defective drug. Pharmaceutical lawsuits are common and, for drugmakers, costly.

Pharmaceutical companies may face legal issues for a variety of reasons. When drugs are alleged to have caused serious physical harm, their manufacturers may face lawsuits on behalf of patients who blame their medical conditions and the resulting damages on the defective drug. In some instances, class action lawsuits may even be filed by patients and consumers who have no diagnosed medical complications or adverse events, seeking refunds because the plaintiffs say they would not have taken the medication if they were aware of alleged potential risks.

Patients and consumers aren’t the only ones who can sue pharmaceutical companies. The government may sue drugmakers for offenses like off-label promotion of their medications, failures to disclose safety information, making misleading claims about safety or effectiveness, paying kickbacks to medical providers, committing Medicare fraud, and more.

All told, a single lawsuit may cost a pharmaceutical company hundreds of millions of dollars or even billions of dollars in settlements or jury awards alone, not counting the burden of legal costs. Even for the largest and most profitable pharmaceutical companies, such a huge cost can pose major financial challenges.

Although drug lawsuits often accompany recalls, compounding the financial troubles a pharmaceutical company must navigate, this isn’t always the case. Individual patients claiming drug injuries can sue pharmaceutical companies even if no recall has yet been announced, although they need to present compelling evidence of harm to do so successfully. The government can sue for fraud, kickbacks, off-label promotion, and other wrongdoing, even if the medication itself is not recalled.

Conclusion

What have we learned from our detailed analysis of the size and growth of the pharmaceutical market? Like the human body in which pharmaceutical products are made to act, this trillion-dollar global industry is complex. It’s driven by cutting-edge research and development that can save lives and improve quality of life, but it’s also driven by the potential for profits and, in most cases, emphasizes sickness over wellness.

Pharmaceutical companies take big financial risks to develop new specialty drugs and drugs with mass market appeal, and the most successful companies in this industry achieve big financial rewards. Along with the high costs of drug development, complicated supply chain and manufacturing processes contribute to high drug prices, yet the data shows that most leading pharmaceutical companies spend more on marketing than on research and development—and the biggest players in this competitive industry are more profitable than major corporations outside big pharma.

With both the global pharmaceutical market and the U.S. market on track to experience significant growth, it’s reasonable to assume that the pharmaceutical industry as a whole is only going to get larger. Increased disease incidence is increasing the demand for pharmaceutical products, and new technologies are making possible medical interventions that were once unthinkable. A promising possibility is pharmaceutical products’ ability to expand their own market. A drug that prolongs the life and quality of life of patients with chronic diseases in essence creates more demand for itself by keeping its target audience alive—and using the medication—longer.

For those interested in working in the pharmaceutical industry, in technical roles like research scientist and non-technical roles like pharmaceutical sales representative, the growth of the pharmaceutical industry is undoubtedly good news. The job outlook for work in the pharmaceutical industry as a whole has only been fueled by the COVID-19 pandemic. The United States Bureau of Labor Statistics (BLS) predicted in 2021 that, in the aftermath of the pandemic, employment in the pharmaceutical and medicine manufacturing industry was likely to grow by 19% between 2019 and 2029.

The positive growth rate in the pharmaceutical industry is also good news for current and prospective investors and shareholders, because it means that—in spite of the risks inherent in the process of developing new drugs—these stakeholders are likely to see returns on their investments. The bright future of the pharmaceutical industry may also bolster related businesses, including retail pharmacies and companies involved in providing key ingredients, the manufacturing process, and distribution.

For patients and consumers, the financial health of the pharmaceutical industry is more nuanced. On the one hand, a thriving pharmaceutical industry is better equipped to undertake the cutting-edge research needed to develop treatments—in some cases, even complete cures—for medical conditions. The demand for specialty drugs that can save the lives of cancer patients, for example, is urgent. On the other hand, the poor perception of the United States pharmaceutical industry highlights consumer attitudes toward the high drug prices and frequent recalls and lawsuits pertaining to the pharmaceutical industry, and data like the comparably high profitability of pharmaceutical companies and their large investments in marketing would seem to support these perceptions.

As the pharmaceutical industry in the U.S. and around the world continues to grow, as numerous sources have predicted it will in the years to come, there are both positive and negative consequences. To give the bad news first, the largest pharmaceutical companies will likely continue to have a great deal of power and influence. Unless forced to do so by new regulations or legislation, they are unlikely to lower troublingly high drug prices. On the positive side, though, this projected growth positions the industry to make new breakthroughs that could improve the future of medicine and help people live longer, better lives.